The Discount On Bonds Payable Account Is

Holbox

Mar 19, 2025 · 6 min read

Table of Contents

The Discount on Bonds Payable Account: A Comprehensive Guide

The discount on bonds payable account is a crucial element in understanding corporate finance, particularly when a company issues bonds at a price below their face value. This comprehensive guide will delve into the intricacies of this account, explaining its nature, implications, and accounting treatment. We'll cover everything from the reasons for a bond discount to its amortization and impact on financial statements.

What is a Discount on Bonds Payable?

When a company issues bonds, it essentially borrows money from investors. The face value (or par value) of a bond is the amount the issuer promises to repay at maturity. However, the market price of a bond can fluctuate based on various factors, including prevailing interest rates. If the market interest rate is higher than the stated (coupon) interest rate on the bond, investors will demand a lower purchase price to compensate for the lower return. This lower purchase price creates a discount on bonds payable.

In simpler terms, a discount on bonds payable represents the difference between the face value of a bond and its selling price when the selling price is lower. This discount is essentially a reduction in the amount the company receives upfront, but it doesn't represent a loss. Instead, it reflects the cost of borrowing at a lower-than-market interest rate.

Why Do Bond Discounts Occur?

Several factors contribute to a discount on bonds payable:

-

Higher Market Interest Rates: This is the most common reason. If prevailing interest rates rise after a company sets its bond's coupon rate, the bond's fixed interest payments become less attractive to investors. They demand a lower price to compensate for the lower yield compared to other, newer bonds with higher rates.

-

Company Creditworthiness: A company with a lower credit rating (higher perceived risk of default) will typically issue bonds at a discount. Investors demand a higher return to offset the increased risk, resulting in a lower purchase price.

-

Market Conditions: General economic conditions and investor sentiment can affect bond prices. During times of economic uncertainty, investors may be more risk-averse, leading to lower bond prices and discounts.

-

Bond Features: Certain bond features, like call provisions (allowing the issuer to redeem the bond before maturity), can impact the price. A callable bond might sell at a discount if investors perceive the risk of early redemption.

Accounting for Discount on Bonds Payable

The discount on bonds payable is treated as a contra-liability account. This means it's subtracted from the bonds payable account on the balance sheet. It's not a direct expense but rather an adjustment to the carrying value of the bonds.

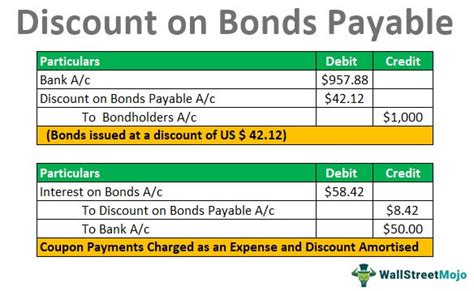

The initial entry when bonds are issued at a discount involves debiting cash for the proceeds received, debiting the discount on bonds payable account, and crediting the bonds payable account for the face value.

Example:

A company issues $1,000,000 in bonds with a stated interest rate of 5% and a maturity of 10 years. The bonds sell for $950,000.

The journal entry would be:

- Debit: Cash ($950,000)

- Debit: Discount on Bonds Payable ($50,000)

- Credit: Bonds Payable ($1,000,000)

Amortization of the Discount

The discount on bonds payable is not recognized as an expense immediately. Instead, it's systematically amortized (spread out) over the life of the bond. This process increases the carrying value of the bonds over time, until it reaches the face value at maturity. There are two primary methods for amortizing the discount:

-

Straight-Line Amortization: This method evenly distributes the discount over the bond's life. It's simpler to calculate but may not accurately reflect the time value of money.

-

Effective Interest Amortization: This method is more complex but provides a more accurate representation of the bond's effective interest rate. It calculates interest expense based on the carrying value of the bonds, leading to a fluctuating amount of amortization each period. This is the generally accepted accounting principle (GAAP) preferred method.

Straight-Line Amortization Example:

Using the previous example, the annual amortization using the straight-line method would be $5,000 ($50,000 discount / 10 years). Each year, the discount account would be credited by $5,000, and the interest expense would be debited by the sum of the stated interest expense and the amortization.

Effective Interest Amortization Example:

The effective interest rate is calculated based on the present value of the future cash flows (principal and interest payments) discounted at the market rate. The interest expense for the first year would be calculated by multiplying the carrying value of the bonds at the beginning of the year by the effective interest rate. The difference between the interest expense and the stated interest payment represents the amortization of the discount. This process repeats each year, with the carrying value increasing as the discount is amortized.

Impact on Financial Statements

The discount on bonds payable account appears on the balance sheet as a deduction from the bonds payable account. The amortization of the discount affects the income statement, increasing interest expense over the life of the bond. This increase in interest expense is a reflection of the higher effective interest rate paid due to the initial discount.

Analyzing Bonds with Discounts

Analyzing bonds with discounts requires a thorough understanding of the underlying factors leading to the discount. Investors and analysts need to consider:

- Credit Risk: A significant discount might signal concerns about the issuer's ability to repay the debt.

- Interest Rate Risk: Changes in market interest rates can significantly affect the value of bonds issued at a discount.

- Liquidity Risk: The ability to sell the bonds easily in the secondary market can be influenced by the discount.

Differences between Premium and Discount on Bonds Payable

It's important to differentiate between a discount and a premium on bonds payable. A premium occurs when bonds are issued above their face value, indicating that the stated interest rate exceeds the market interest rate. The premium is amortized over the life of the bond, reducing interest expense. A discount, conversely, increases interest expense.

Conclusion

Understanding the discount on bonds payable is essential for anyone involved in corporate finance, accounting, or investment analysis. The discount reflects the cost of borrowing at a rate lower than the market rate and is systematically amortized over the bond's life. Careful analysis of the discount is crucial for assessing the financial health of a company and the risks associated with its debt obligations. The choice of amortization method (straight-line or effective interest) affects the presentation of interest expense over time, but the effective interest method is generally preferred under GAAP due to its superior accuracy in reflecting the true cost of borrowing. Analyzing bonds considering these factors provides a more holistic understanding of the company's financial position and risk profile. Remember that this information is for educational purposes and should not be considered financial advice. Always consult with a financial professional for guidance on your specific circumstances.

Latest Posts

Latest Posts

-

Umatilla Bank And Trust Is Considering Giving

Mar 19, 2025

-

An Ordinary Annuity Is Best Defined As

Mar 19, 2025

-

A Flexible Budget Performance Report Compares

Mar 19, 2025

-

Standard Heat Of Formation For H2o

Mar 19, 2025

-

Complete The Synthesis Below By Selecting Or Drawing The Reagents

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about The Discount On Bonds Payable Account Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.