A Flexible Budget Performance Report Compares

Holbox

Mar 15, 2025 · 6 min read

Table of Contents

A Flexible Budget Performance Report: A Comprehensive Comparison

A flexible budget is a crucial tool for businesses looking to accurately assess their financial performance. Unlike a static budget, which remains fixed regardless of activity levels, a flexible budget adjusts to reflect actual sales volume or other activity measures. This adaptability provides a more realistic and insightful comparison between planned and actual results. This article will delve into a comprehensive comparison of flexible budget performance reports, exploring their advantages, disadvantages, limitations, and how to effectively use them for improved financial decision-making.

Understanding Flexible Budgets

Before diving into comparisons, let's establish a clear understanding of flexible budgets. A flexible budget is a dynamic financial plan that adjusts to changes in activity levels. It allows businesses to compare actual results to what should have been expected given the actual level of activity. This contrasts sharply with a static budget, which holds fixed regardless of sales, production, or other key performance indicators (KPIs).

For example, imagine a company budgeted for 10,000 units of production, but ended up producing 12,000 units. A static budget would still compare the actual results to the plan for 10,000 units, potentially misrepresenting performance. A flexible budget, however, would adjust the planned figures to reflect the 12,000 units produced, providing a far more accurate picture of efficiency and cost control.

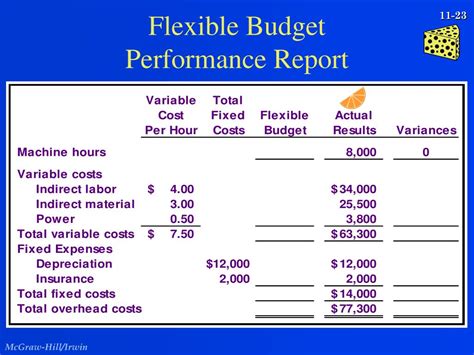

Key Components of a Flexible Budget

A flexible budget typically includes the following components:

- Sales Revenue: This is projected based on the actual sales volume achieved during the period.

- Variable Costs: These costs directly relate to production or sales volume and are adjusted based on the actual activity level. Examples include direct materials, direct labor, and sales commissions.

- Fixed Costs: These costs remain relatively constant regardless of activity levels. Examples include rent, salaries of administrative staff, and depreciation.

- Contribution Margin: This represents the difference between sales revenue and variable costs, showing the amount available to cover fixed costs and generate profit.

- Net Operating Income: This is the final profit figure after deducting all costs (both fixed and variable) from revenue.

Advantages of Using a Flexible Budget Performance Report

The primary advantage of using a flexible budget lies in its accuracy and improved insights. By adjusting to actual activity levels, it provides a fairer and more reliable assessment of management performance. Here's a breakdown of its benefits:

- More Realistic Performance Evaluation: It allows for a more accurate comparison of actual results to planned results, considering the impact of variations in sales volume or activity levels. This eliminates the distortion caused by using a static budget when actual activity deviates significantly from the planned activity.

- Improved Variance Analysis: Analyzing variances becomes more meaningful. Variances are the differences between planned and actual results. With a flexible budget, you can isolate variances due to changes in sales volume from variances due to cost inefficiencies or price changes.

- Better Cost Control: By highlighting variances at different activity levels, it encourages a more proactive approach to cost control. Managers can pinpoint areas where costs are exceeding expectations even after accounting for changes in sales volume.

- Enhanced Decision-Making: The information provided enables more informed decisions. For example, understanding the impact of varying sales volumes on profitability can help in setting realistic sales targets and pricing strategies.

- Motivation and Accountability: Providing a fairer performance evaluation can boost morale and accountability, as managers are judged based on performance relative to actual activity levels rather than an arbitrary, inflexible plan.

Limitations of Flexible Budgets

While flexible budgets offer significant advantages, it's crucial to acknowledge their limitations:

- Complexity: Preparing a flexible budget requires more effort and expertise than preparing a static budget. It involves developing cost formulas and making adjustments based on actual activity levels.

- Data Dependency: Accuracy depends heavily on the reliability of the data used in the budget. Inaccurate sales forecasts or cost estimations can lead to misleading results.

- Assumption of Linearity: Many flexible budgets assume a linear relationship between costs and activity levels. However, in reality, this relationship may not always be linear, especially at very high or very low activity levels.

- Oversimplification: Flexible budgets may simplify complex business processes and relationships, potentially leading to an incomplete understanding of actual performance.

- Time Constraints: Preparing a flexible budget after the period ends can take significant time, especially in companies with high transaction volumes. This can cause delays in decision-making processes.

Comparing Flexible Budget Performance Reports: A Case Study

Let's illustrate with a hypothetical case study. Suppose "ABC Company" manufactures widgets. Their static budget and flexible budget for a given period are as follows:

Static Budget (10,000 Units):

- Sales Revenue: $100,000

- Variable Costs: $60,000

- Fixed Costs: $20,000

- Net Operating Income: $20,000

Actual Results (12,000 Units):

- Sales Revenue: $115,000

- Variable Costs: $70,000

- Fixed Costs: $22,000

- Net Operating Income: $23,000

Flexible Budget (12,000 Units):

- Sales Revenue: $120,000 (assuming $10/unit selling price)

- Variable Costs: $72,000 (assuming $6/unit variable cost)

- Fixed Costs: $20,000

- Net Operating Income: $28,000

Comparison:

Comparing the actual results to the static budget ($23,000 vs. $20,000) suggests a positive performance. However, comparing the actual results to the flexible budget reveals a different story ($23,000 vs. $28,000). This indicates a shortfall of $5,000, highlighting that the company didn't perform as efficiently as expected given the increased production volume. This difference could be due to several reasons, including higher than expected variable costs per unit or higher fixed costs than budgeted. Further investigation is necessary to pinpoint the exact cause of this variance.

Analyzing Variances with a Flexible Budget

A flexible budget facilitates a more detailed variance analysis. Variances are classified into:

- Sales Price Variance: Difference between actual and budgeted selling prices, multiplied by actual sales volume.

- Sales Volume Variance: Difference between actual and budgeted sales volume, multiplied by the budgeted contribution margin per unit.

- Variable Cost Variance: Difference between actual and budgeted variable costs. This can be further broken down into variable cost price variances and variable cost efficiency variances.

- Fixed Cost Variance: Difference between actual and budgeted fixed costs.

By analyzing these variances, management can identify areas for improvement and implement corrective actions.

Improving the Effectiveness of Flexible Budgets

To maximize the effectiveness of flexible budgets, consider these strategies:

- Accurate Cost Estimation: Invest in robust cost accounting systems to ensure accurate cost estimation and forecasting.

- Regular Monitoring and Review: Regularly monitor actual results and compare them against the flexible budget. Conduct periodic reviews to identify trends and potential issues.

- Improved Communication: Ensure that all relevant personnel understand the budget, its purpose, and their roles in achieving the budgeted targets.

- Integration with Other Management Tools: Integrate the flexible budget with other management tools, such as performance dashboards and key performance indicators (KPIs).

- Use of Technology: Use budgeting software or spreadsheet applications to automate the process of creating and updating flexible budgets.

Conclusion

Flexible budget performance reports provide a significantly more accurate and insightful assessment of financial performance compared to static budgets. By adjusting to actual activity levels, they facilitate a more meaningful variance analysis, enabling better cost control, informed decision-making, and improved accountability. Although they have limitations regarding complexity and data dependency, the advantages outweigh these limitations for most businesses. Implementing a flexible budgeting system, coupled with thorough variance analysis and regular monitoring, is a crucial step towards efficient financial management and improved business performance. The key to success lies in utilizing the data effectively to identify areas for improvement and driving more informed strategic decisions.

Latest Posts

Latest Posts

-

Cash Flows From Financing Activities Do Not Include

Mar 17, 2025

-

A Positive Return On Investment For Education Happens When

Mar 17, 2025

-

What Is The Value Of I

Mar 17, 2025

-

The Accounts In The Ledger Of Monroe Entertainment Co

Mar 17, 2025

-

A Process Cost Accounting System Is Most Appropriate When

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about A Flexible Budget Performance Report Compares . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.