A Process Cost Accounting System Is Most Appropriate When

Holbox

Mar 17, 2025 · 7 min read

Table of Contents

A Process Cost Accounting System is Most Appropriate When...

Process cost accounting, a crucial tool for many manufacturing and service businesses, offers a unique approach to tracking costs. Unlike job order costing, which focuses on individual projects, process costing tracks costs across large volumes of homogeneous products or services produced through a series of processes. Understanding when this system shines is vital for businesses aiming to optimize their cost management strategies. This article delves deep into the scenarios where a process cost accounting system proves most appropriate, examining its advantages and limitations to provide a comprehensive understanding.

Understanding the Core Principles of Process Cost Accounting

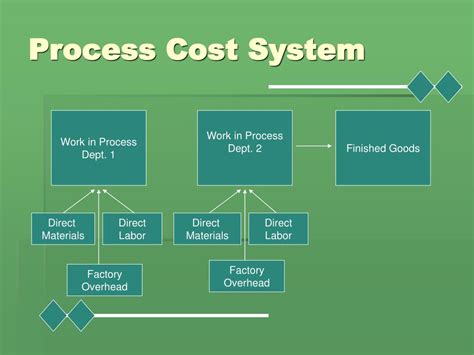

Before we dive into the appropriateness of process costing, let's briefly review its fundamentals. Process costing aggregates costs associated with a specific production process over a defined period (often a month). These costs are then allocated to the total number of units produced during that period, resulting in a per-unit cost. This method is particularly useful when:

-

Large volumes of identical or similar products are produced: This is a key characteristic. Think of food processing, chemical manufacturing, or even mass-produced clothing. The products within each process are largely indistinguishable.

-

Production involves multiple processes: The manufacturing or service delivery involves a series of steps or stages. Each stage adds value and incurs costs, all tracked and aggregated in the process costing system.

-

Continuous production flow: The production process is continuous or near-continuous rather than starting and stopping for individual jobs. Think assembly lines or continuous chemical reactions.

When Process Cost Accounting Reigns Supreme: Ideal Scenarios

Several scenarios strongly suggest that a process cost accounting system is the most appropriate choice:

1. Mass Production Environments: The Factory Floor

Process costing thrives in mass production settings. Imagine a large-scale manufacturing plant producing thousands of identical widgets daily. Tracking costs for each individual widget is impractical and inefficient. Process costing, however, allows for the aggregation of direct materials, direct labor, and manufacturing overhead for each production stage (e.g., molding, assembly, packaging), yielding a cost per widget. This provides valuable insights into the cost-effectiveness of each stage and the overall production process. Industries like:

- Food processing: Canning factories, beverage manufacturers.

- Chemical manufacturing: Production of plastics, fertilizers, pharmaceuticals.

- Textile manufacturing: Production of fabrics and clothing.

- Paper production: Manufacturing of paper and paper products.

all benefit significantly from the efficiency and clarity of process costing.

2. Continuous Flow Production: Optimizing Efficiency

Industries with continuous flow production benefit immensely from process costing. This approach accurately captures costs throughout the continuous production stream, allowing for precise identification of cost drivers and bottlenecks. For instance, a bottling plant continuously fills and caps bottles. Process costing effectively tracks the costs associated with each stage, allowing management to identify and address inefficiencies in the bottling, capping, or labeling processes. Examples include:

- Oil refineries: Refining crude oil into various petroleum products.

- Power generation: Generating electricity through various means (nuclear, hydro, etc.).

- Cement production: Manufacturing cement through a continuous process.

- Sugar refining: Processing raw sugar into refined sugar.

3. Homogeneous Products or Services: Simplifying Cost Allocation

When dealing with homogeneous products or services (products or services that are virtually identical), process costing simplifies the cost allocation process considerably. This is because the cost per unit is calculated based on the total cost divided by the total number of units. There is no need for complex job-specific cost tracking. Industries where this applies include:

- Dairy farming: Producing milk and dairy products.

- Mining: Extracting minerals and ores.

- Utilities: Providing water, electricity, and gas to consumers.

- Public transportation: Operating buses, trains, and subways.

4. Standardized Processes: Reducing Variability

When production processes are highly standardized and repeatable, process costing provides a stable and reliable cost accounting framework. The predictability of the process allows for accurate cost forecasting and budgeting. Any variations from the standard cost can be readily identified and investigated. This is crucial for industries where maintaining consistent quality and cost are paramount. Examples of industries that fit this profile include:

- Printing: Mass printing of books, brochures, or newspapers.

- Electronics manufacturing: Production of electronic components and devices.

- Pharmaceuticals: Manufacturing of generic drugs.

- Automotive parts manufacturing: Production of standardized automotive components.

When Process Cost Accounting Might Not Be the Best Fit: Limitations and Alternatives

While process costing offers many advantages, it's not a one-size-fits-all solution. There are situations where alternative costing methods, such as job order costing, are more appropriate.

1. Heterogeneous Products or Services: The Need for Job Order Costing

Process costing struggles when dealing with diverse products or services. If a company produces highly customized products or services, each requiring unique materials, labor, and overhead, then a job order costing system is far more suitable. This system tracks costs for each individual job or project, providing a more accurate cost breakdown.

2. Low-Volume Production: The Overhead Burden

In low-volume production environments, the overhead costs allocated to each unit under process costing can be significantly distorted. The overhead cost might be disproportionately high relative to direct costs, resulting in inaccurate unit cost calculations. Job order costing, with its project-specific cost tracking, offers more precision in such scenarios.

3. Unique and Non-Repeatable Projects: Beyond Standard Processes

Process costing is unsuitable for unique, non-repeatable projects. For example, constructing a building or developing a new software application involves unique processes and costs that cannot be easily aggregated and averaged. Job order costing is the ideal solution for such situations.

4. Significant Variations in Production Processes: A Lack of Standardization

If production processes are highly variable and lack standardization, it becomes challenging to accurately allocate costs under process costing. The inconsistencies make it difficult to establish a reliable cost per unit. Job order costing would offer a more accurate representation of costs in these volatile production environments.

Choosing the Right Cost Accounting System: A Critical Decision

The choice between process cost accounting and other methods depends heavily on the specific characteristics of the business and its production processes. Companies should carefully consider their production volume, product homogeneity, process standardization, and the need for detailed cost tracking when deciding on the most appropriate system. A thorough analysis of these factors will ensure that the chosen cost accounting system provides accurate, reliable, and actionable cost information for informed decision-making.

Refining Process Cost Accounting: Addressing Challenges and Optimizations

Even in ideal scenarios, process costing can encounter challenges. Addressing these proactively enhances the system's effectiveness:

1. Dealing with Spoilage and Waste: Accounting for Losses

Process costing must account for spoilage and waste. These losses impact the final number of units produced and should be appropriately factored into the per-unit cost calculation. Methods like incorporating spoilage costs into the cost of goods sold or analyzing root causes of waste are crucial.

2. Handling Work-in-Process (WIP) Inventory: Accurate Valuation

Accurate valuation of WIP inventory is vital. Various methods exist for assigning costs to WIP, such as weighted-average costing or FIFO (first-in, first-out). Choosing the appropriate method depends on the specific circumstances and the company's inventory management policies.

3. Continuous Improvement Through Cost Analysis: Identifying Bottlenecks

Process costing offers opportunities for continuous improvement. By analyzing costs at each stage of production, companies can identify bottlenecks and areas for cost reduction. This data-driven approach enables proactive improvements in efficiency and cost optimization.

4. Technological Integration: Streamlining Data Collection

Integrating process costing with relevant technologies, like enterprise resource planning (ERP) systems, streamlines data collection and analysis. This automation reduces manual effort, minimizes errors, and facilitates real-time cost monitoring and reporting.

Conclusion: Process Costing – A Powerful Tool When Applied Correctly

Process cost accounting, when applied appropriately, provides invaluable insights into production costs, enabling informed decision-making and continuous improvement. Understanding its strengths and limitations is crucial for selecting the right cost accounting system for your business. By carefully considering the factors outlined in this article and proactively addressing potential challenges, companies can leverage process costing to optimize their cost management strategies and achieve significant operational efficiencies. The right cost accounting system isn't just about numbers; it's about gaining a clear and actionable understanding of your business's financial health and future potential.

Latest Posts

Latest Posts

-

Where Is The Tissue Pictured Found

Mar 17, 2025

-

Per Navsup P 805 What Does This Indicator Show

Mar 17, 2025

-

Which Of The Following Can Be Translated Into Protein

Mar 17, 2025

-

The Deming Prize Was Established By The

Mar 17, 2025

-

100 Summer Vacation Words Answer Key Pdf

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about A Process Cost Accounting System Is Most Appropriate When . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.