The Accounts In The Ledger Of Monroe Entertainment Co

Holbox

Mar 17, 2025 · 6 min read

Table of Contents

The Accounts in the Ledger of Monroe Entertainment Co.: A Comprehensive Guide

Monroe Entertainment Co., a hypothetical entertainment company, utilizes a general ledger to record its financial transactions. This ledger provides a centralized and organized record of all the company's accounts, crucial for financial reporting, decision-making, and regulatory compliance. Understanding the types of accounts found in Monroe Entertainment Co.'s ledger is vital for anyone involved in its financial management. This article will delve deep into the various account types, providing examples relevant to the entertainment industry.

Key Account Categories in Monroe Entertainment Co.'s Ledger

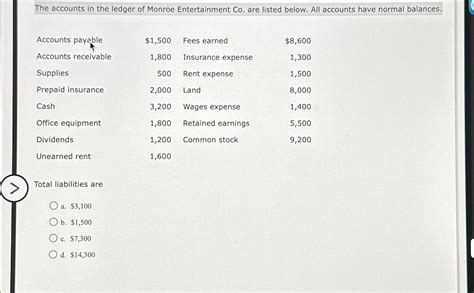

Monroe Entertainment Co.'s ledger, like any other company’s, is organized using the double-entry bookkeeping system. This means every transaction impacts at least two accounts, maintaining the fundamental accounting equation: Assets = Liabilities + Equity. The accounts within the ledger are categorized broadly into:

- Assets: Resources owned by Monroe Entertainment Co. that provide future economic benefits.

- Liabilities: Obligations of Monroe Entertainment Co. to outside parties.

- Equity: The owners' stake in Monroe Entertainment Co.

Let's examine each category in detail, providing specific examples relevant to Monroe Entertainment Co.'s operations:

Assets: The Resources of Monroe Entertainment Co.

Assets are categorized into current and non-current assets based on their liquidity (how quickly they can be converted into cash).

Current Assets:

These assets are expected to be converted into cash or used up within one year or the company's operating cycle, whichever is longer. Examples relevant to Monroe Entertainment Co. include:

- Cash: This includes cash on hand, in banks, and readily available cash equivalents. Monroe Entertainment Co. might have separate accounts for operating expenses, payroll, and marketing campaigns.

- Accounts Receivable: Money owed to Monroe Entertainment Co. by clients for services rendered or products delivered. This could be revenue from ticket sales (for concerts or events), licensing fees, or payments from streaming platforms. Managing accounts receivable effectively is crucial for maintaining cash flow. The ledger will track individual invoices and their payment status.

- Inventory: For Monroe Entertainment Co., this might include merchandise (t-shirts, CDs, DVDs) sold at concerts or online. It could also include unsold tickets for future events or props and costumes for film productions. Proper inventory management is key to avoiding losses due to obsolescence or damage.

- Prepaid Expenses: Costs paid in advance, such as insurance premiums, rent, advertising, or subscription fees for streaming services. These are assets because they represent future benefits. The ledger will track the prepaid amount and its amortization over time.

Non-Current Assets:

These assets are not expected to be converted into cash within one year. For Monroe Entertainment Co., this category includes:

- Property, Plant, and Equipment (PP&E): This includes land, buildings, recording studios, filming equipment, musical instruments, and vehicles. These assets are depreciated over their useful lives, meaning their value is systematically reduced in the ledger each year.

- Intangible Assets: These are non-physical assets with economic value. For Monroe Entertainment Co., this could include copyrights, trademarks (for the company name or artist names), patents for innovative technologies, and brand recognition. These assets are often amortized over their useful lives.

- Investments: Monroe Entertainment Co. might invest in other entertainment companies or financial instruments. These investments are recorded at their fair market value.

- Goodwill: This intangible asset arises when Monroe Entertainment Co. acquires another company for a price exceeding the fair market value of its identifiable net assets.

Liabilities: Monroe Entertainment Co.'s Obligations

Liabilities represent the company's financial obligations to external parties. These are also categorized as current and non-current:

Current Liabilities:

These liabilities are due within one year.

- Accounts Payable: Money owed to suppliers for goods and services purchased on credit. This could include payments for recording studio time, musicians' fees, marketing services, or costumes.

- Salaries Payable: Wages earned by employees but not yet paid. The ledger tracks the amount owed to each employee.

- Taxes Payable: Taxes owed to government agencies, such as income tax, sales tax, and property tax.

- Short-Term Loans: Loans due within one year. This could include lines of credit used to finance short-term projects.

- Unearned Revenue: Money received from customers for goods or services not yet provided. For instance, ticket sales for a future concert are considered unearned revenue until the concert takes place.

Non-Current Liabilities:

These liabilities are due in more than one year.

- Long-Term Loans: Loans due in more than one year. This might be a loan taken out to finance the construction of a new recording studio or the acquisition of another company.

- Deferred Tax Liabilities: This arises due to differences between the company's accounting treatment and tax treatment of certain items.

- Bonds Payable: Money raised by issuing bonds to investors.

Equity: The Owners' Stake in Monroe Entertainment Co.

Equity represents the residual interest in Monroe Entertainment Co.'s assets after deducting its liabilities. For a corporation, equity includes:

- Common Stock: Represents the ownership shares issued to investors.

- Retained Earnings: Accumulated profits reinvested in the business. This is increased by net income and decreased by dividends paid to shareholders.

Specific Accounts in Monroe Entertainment Co.'s Ledger: Detailed Examples

Let’s look at some specific account examples within each category, highlighting their relevance to the entertainment industry:

1. Concert Revenue: This account records the revenue generated from ticket sales, merchandise sales, and concessions at concerts. The ledger tracks each concert separately, detailing ticket prices, quantities sold, and total revenue.

2. Film Production Costs: This account tracks all expenses related to film production, including salaries for actors and crew, location rentals, equipment rentals, and post-production costs. The ledger will detail each cost item for better budgeting and expense control.

3. Royalties Payable: This account records the amounts owed to songwriters, composers, and other artists for the use of their creative works. The ledger tracks each royalty payment separately, ensuring accurate accounting and payment to artists.

4. Advertising Expense: This account records expenses related to marketing and advertising campaigns, including costs for television commercials, radio spots, online advertising, and print media. Tracking individual campaign expenses helps measure marketing ROI.

5. Depreciation Expense: This account records the systematic allocation of the cost of long-lived assets (like recording equipment) over their useful lives. The ledger shows the depreciation method used and the amount of depreciation expense for each asset.

6. Amortization Expense: This account records the systematic allocation of the cost of intangible assets (like copyrights) over their useful lives. The ledger tracks the amortization of each intangible asset.

7. Artist Management Fees: This account tracks fees paid to artist management companies for their services in managing artists' careers. The ledger records the fees paid to each management company.

Conclusion: The Importance of Accurate Ledger Maintenance

Maintaining an accurate and up-to-date general ledger is crucial for Monroe Entertainment Co.'s success. The ledger provides the foundation for accurate financial reporting, informed decision-making, and effective financial management. By meticulously tracking all transactions and categorizing them appropriately, Monroe Entertainment Co. can gain valuable insights into its financial performance, identify areas for improvement, and make strategic decisions that drive growth and profitability. Regular reconciliation of the ledger with bank statements and other supporting documentation is critical to ensure accuracy and prevent errors. The detailed information contained within the ledger allows for effective analysis, leading to improved financial planning and stronger overall business performance. Through careful and consistent record-keeping, Monroe Entertainment Co. can build a robust financial foundation for long-term success in the dynamic entertainment industry.

Latest Posts

Latest Posts

-

100 Summer Vacation Words Answer Key Pdf

Mar 17, 2025

-

Goal Displacement Satisficing And Groupthink Are

Mar 17, 2025

-

Where Should Glassware Be Stored After It Is Cleaned

Mar 17, 2025

-

A Favorable Labor Rate Variance Indicates That

Mar 17, 2025

-

Split The Worksheet Into Panes At Cell D16

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about The Accounts In The Ledger Of Monroe Entertainment Co . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.