Cash Flows From Financing Activities Do Not Include

Holbox

Mar 17, 2025 · 6 min read

Table of Contents

Cash Flows from Financing Activities: What They Don't Include

Understanding cash flows is crucial for assessing a company's financial health and future prospects. One key component of the statement of cash flows is cash flows from financing activities. While this section details how a company raises and repays capital, it's important to know what isn't included to avoid misinterpretations and ensure accurate financial analysis. This comprehensive guide will delve into the specifics of cash flows from financing activities, highlighting the transactions that are explicitly excluded.

What are Cash Flows from Financing Activities?

Before exploring exclusions, let's establish a firm understanding of what constitutes cash flows from financing activities. This section of the statement of cash flows focuses on the transactions a company undertakes to fund its operations and growth. These activities primarily involve dealings with external parties like investors and lenders. Think of it as a summary of how a company gets its money and how it pays it back. Positive cash flows from financing activities generally indicate a company's ability to secure funding, while negative flows might signal difficulties in raising capital or aggressive repayment strategies.

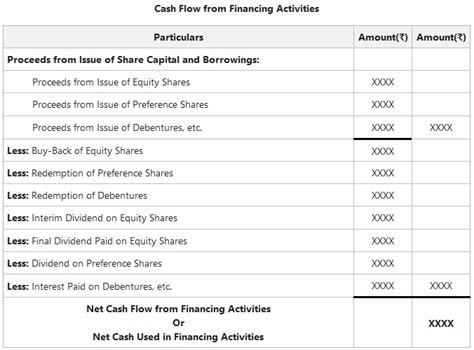

Key Activities Included:

- Issuance of debt: Proceeds from issuing bonds, loans, or other forms of debt financing.

- Repayment of debt: Principal payments on loans, bonds, and other debt obligations.

- Issuance of equity: Cash received from issuing new shares of stock.

- Repurchase of equity: Cash spent buying back the company's own shares.

- Dividends paid: Cash distributed to shareholders as dividends.

- Payments for lease financing: Cash payments related to capital leases.

Transactions NOT Included in Cash Flows from Financing Activities

Now, let's focus on the crucial aspect: what transactions are specifically excluded from cash flows from financing activities. Understanding these exclusions is critical for correctly interpreting the financial statement and making sound investment decisions.

1. Operating Activities: The Clear Divide

The most significant exclusion relates to activities categorized as operating activities. This is a fundamental distinction. Cash flows from operating activities pertain to the core business operations – the day-to-day activities that generate revenue. Examples include:

- Cash sales: Money received directly from customers for goods or services.

- Cash payments to suppliers: Money paid for inventory, raw materials, and other operating expenses.

- Cash collection from accounts receivable: Payments received from customers on credit.

- Cash payments for salaries and wages: Compensation paid to employees.

- Cash payments for taxes: Taxes paid to relevant government agencies.

- Interest received: Interest earned on short-term investments. (Note: While interest received is operating, interest paid is financing).

Confusing operating and financing activities can significantly distort the financial picture. For instance, interest paid on debt is a financing activity, while interest received on short-term investments is an operating activity. Keeping these categories distinct is paramount.

2. Investing Activities: A Separate Sphere

Similarly, activities classified as investing activities are also entirely separate from financing activities. Investing activities relate to the acquisition and disposal of long-term assets, such as:

- Purchase of property, plant, and equipment (PP&E): Acquiring buildings, machinery, and other capital assets.

- Sale of PP&E: Selling off existing assets.

- Acquisition of other businesses: Purchasing other companies.

- Investments in securities: Acquiring stocks or bonds of other companies.

- Proceeds from the sale of investments: Selling off previously acquired investments.

Confusing investing and financing activities could lead to inaccurate analysis of capital expenditures and investment strategies. For example, the purchase of a new factory is an investing activity, not a financing activity, even if the purchase was financed through debt.

3. Non-Cash Transactions: A Key Distinction

Non-cash transactions are a major source of potential confusion. The statement of cash flows focuses solely on cash transactions. Non-cash transactions, even if they significantly impact the company's financial position, are not reflected in the cash flow statement. These include:

- Issuance of stock for the acquisition of assets: If a company acquires another company by issuing its own stock rather than paying cash, this is a non-cash transaction and is not included in the cash flows from financing activities. It is typically reflected in the notes to the financial statements.

- Conversion of debt to equity: When a company converts debt into equity, this involves no cash exchange and therefore is not reported as a cash flow from financing activities.

- Share-based payments: Issuing shares of stock to employees as compensation, without a direct cash exchange.

4. Changes in Working Capital: An Operating Matter

Changes in working capital (current assets minus current liabilities) are generally considered part of operating activities, not financing activities. While changes in working capital can affect a company's cash position, they are not directly related to raising or repaying capital. Examples include:

- Increase in accounts receivable: This signifies an increase in credit sales, affecting operating cash flow, not financing.

- Decrease in accounts payable: Paying off suppliers more quickly affects operating cash flow.

5. Foreign Exchange Effects: A Separate Adjustment

Fluctuations in foreign exchange rates can impact a company's cash flows, but these effects are usually reported separately and not integrated into cash flows from financing activities. This is primarily due to the complexity of allocating exchange rate changes to specific activities.

Why Understanding Exclusions is Crucial

Accurate interpretation of the statement of cash flows, particularly the financing activities section, is essential for several reasons:

- Evaluating Financial Health: Understanding the sources and uses of financing helps assess a company's financial stability and its ability to meet its obligations.

- Assessing Debt Management: Analyzing the repayment of debt provides insights into a company's debt management strategies and its risk profile.

- Predicting Future Performance: By understanding the company's financing patterns, investors can better predict its future performance and growth potential.

- Comparing Companies: A clear understanding of what's included and excluded allows for more accurate comparisons between different companies' financial performance.

- Identifying Red Flags: Analyzing financing activities can help identify potential red flags, such as excessive reliance on debt or difficulties in raising capital.

Conclusion: A Clear Picture of Financing

The statement of cash flows, specifically the section on financing activities, offers a powerful lens into a company's financial health. However, a comprehensive understanding requires not only knowing what is included but also, crucially, what is excluded. By clearly differentiating financing activities from operating and investing activities, by recognizing non-cash transactions, and understanding the separate treatment of working capital changes and foreign exchange effects, analysts can obtain a much more accurate and nuanced picture of a company’s financial position and its capacity for future growth. This understanding is vital for investors, creditors, and other stakeholders seeking to make informed decisions based on a company's financial reporting. A clear grasp of these exclusions enhances the precision and reliability of financial analysis, leading to more confident and effective decision-making.

Latest Posts

Latest Posts

-

100 Summer Vacation Words Answer Key Pdf

Mar 17, 2025

-

Goal Displacement Satisficing And Groupthink Are

Mar 17, 2025

-

Where Should Glassware Be Stored After It Is Cleaned

Mar 17, 2025

-

A Favorable Labor Rate Variance Indicates That

Mar 17, 2025

-

Split The Worksheet Into Panes At Cell D16

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Cash Flows From Financing Activities Do Not Include . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.