An Ordinary Annuity Is Best Defined As

Holbox

Mar 15, 2025 · 5 min read

Table of Contents

An Ordinary Annuity: A Comprehensive Guide

An ordinary annuity is a series of equal payments made at fixed intervals over a specified period. Understanding annuities is crucial for various financial planning aspects, from retirement savings to loan amortization. This comprehensive guide will delve into the intricacies of ordinary annuities, covering their definition, calculation methods, applications, and comparison with other annuity types.

What is an Ordinary Annuity?

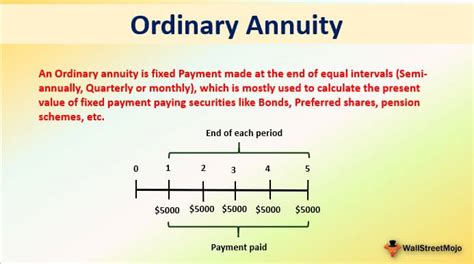

An ordinary annuity is best defined as a sequence of equal cash flows occurring at the end of each period. This is the key differentiator from other annuity types, such as annuities due. The regularity and predictability of these payments make them a valuable tool in financial modeling and planning. The "ordinary" designation simply means the payments are made at the end of the period, as opposed to the beginning. Think of it like receiving your monthly salary – it typically arrives at the end of the month, representing an ordinary annuity.

Key Characteristics of Ordinary Annuities:

- Equal Payments: Each payment is identical in amount.

- Fixed Intervals: Payments occur at regular intervals (e.g., monthly, quarterly, annually).

- End-of-Period Payments: This is the defining characteristic of an ordinary annuity.

- Finite Time Period: The annuity lasts for a predetermined number of periods.

Calculating the Future Value of an Ordinary Annuity (FV)

The future value (FV) of an ordinary annuity represents the total accumulated value of all payments, along with their accumulated interest, at the end of the annuity's term. This calculation is essential for understanding the growth potential of investments structured as ordinary annuities. The formula for calculating the FV of an ordinary annuity is:

FV = P * [((1 + r)^n - 1) / r]

Where:

- FV = Future Value

- P = Periodic Payment

- r = Interest rate per period

- n = Number of periods

Example: Suppose you invest $1,000 annually for 10 years at an interest rate of 5% per year. Using the formula:

FV = $1000 * [((1 + 0.05)^10 - 1) / 0.05] FV ≈ $12,577.89

This shows that your initial investment of $10,000 ($1,000 x 10 years) grows to approximately $12,577.89 due to the compounding effect of interest.

Calculating the Present Value of an Ordinary Annuity (PV)

The present value (PV) of an ordinary annuity represents the current worth of a future stream of equal payments, discounted back to the present using an appropriate interest rate. This is crucial for valuing future income streams, such as retirement pensions or lease payments. The formula for calculating the PV of an ordinary annuity is:

PV = P * [(1 - (1 + r)^-n) / r]

Where:

- PV = Present Value

- P = Periodic Payment

- r = Interest rate per period

- n = Number of periods

Example: Let's say you want to determine the present value of receiving $1,000 annually for 10 years, with a discount rate of 5% per year. Using the formula:

PV = $1000 * [(1 - (1 + 0.05)^-10) / 0.05] PV ≈ $7,721.73

This signifies that receiving $1,000 annually for the next 10 years is equivalent to receiving a lump sum of approximately $7,721.73 today.

Applications of Ordinary Annuities

Ordinary annuities have numerous applications in various financial scenarios:

1. Retirement Planning:

Many retirement savings plans, like 401(k)s and IRAs, function as ordinary annuities. Regular contributions grow over time, providing a substantial nest egg for retirement.

2. Loan Amortization:

Mortgage payments, car loans, and student loans are examples of ordinary annuities in reverse. The loan amount represents the present value, and the monthly payments are the periodic payments that gradually reduce the loan's principal.

3. Lease Payments:

Lease payments for equipment or property are structured as ordinary annuities. The payments made over the lease term represent the cost of using the asset.

4. Insurance Annuities:

Insurance companies offer annuities that provide a series of guaranteed payments, functioning as an ordinary annuity providing a steady income stream.

5. Investment Strategies:

Systematic investment plans (SIPs) operate as ordinary annuities, enabling investors to make regular contributions to investment funds.

Ordinary Annuity vs. Annuity Due

The primary difference between an ordinary annuity and an annuity due lies in the timing of the payments. As discussed, ordinary annuities have payments made at the end of each period. In contrast, an annuity due involves payments made at the beginning of each period.

This seemingly minor difference significantly impacts the future and present values. Because payments in an annuity due are made earlier, they have more time to earn interest, resulting in a higher future value and a higher present value compared to an ordinary annuity with the same payment amount, interest rate, and number of periods.

Factors Affecting Ordinary Annuity Calculations

Several factors influence the future and present values of ordinary annuities:

1. Interest Rate:

A higher interest rate leads to a greater future value and a lower present value. Conversely, a lower interest rate results in a lower future value and a higher present value.

2. Payment Amount:

Larger periodic payments translate into a higher future value and a higher present value.

3. Number of Periods:

A longer investment horizon (more periods) generally leads to a higher future value and a lower present value.

Advanced Concepts and Considerations

While the basic formulas provide a strong foundation for understanding ordinary annuities, advanced concepts and considerations should also be noted:

1. Inflation:

The impact of inflation should be considered when calculating the real value of future payments. Inflation erodes the purchasing power of money, making future payments less valuable in real terms.

2. Taxes:

Tax implications can significantly influence the net returns from annuities. Interest earned may be subject to taxation.

3. Risk:

Investment-based annuities carry varying degrees of investment risk depending on the underlying assets.

Conclusion: The Power of Ordinary Annuities in Financial Planning

Understanding ordinary annuities is essential for effective financial planning. Whether saving for retirement, managing debt, or making investment decisions, grasping the principles of ordinary annuities equips you with the tools to analyze and optimize your financial strategies. By using the formulas provided and considering the various factors involved, you can accurately assess the present and future values of ordinary annuities and make informed decisions about your financial future. Remember to consult with a financial advisor for personalized guidance tailored to your specific circumstances and risk tolerance. The concepts presented here serve as a solid foundation for your journey towards financial literacy and informed decision-making. The consistent and predictable nature of ordinary annuities makes them an invaluable tool for planning a secure financial future.

Latest Posts

Latest Posts

-

An Increase In The Quantity Supplied Suggests A

Mar 15, 2025

-

Libreoffice Is An Example Of Which Type Of Software

Mar 15, 2025

-

The Cash Conversion Cycle Is Computed As

Mar 15, 2025

-

What Are Three Ways You Could Use Hootsuite Streams

Mar 15, 2025

-

If A Patient With A Chest Injury Only Inhales

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about An Ordinary Annuity Is Best Defined As . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.