The Balance Sheet Should Be Prepared

Holbox

Mar 14, 2025 · 7 min read

Table of Contents

The Balance Sheet: Why It Should Be Prepared and How to Do It Right

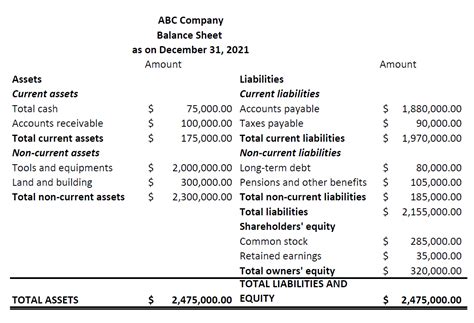

The balance sheet, a cornerstone of financial reporting, provides a snapshot of a company's financial health at a specific point in time. Understanding and preparing a balance sheet accurately is crucial for businesses of all sizes, from small startups to multinational corporations. This comprehensive guide will delve into the importance of preparing a balance sheet, its key components, and best practices for accurate and effective preparation.

Why is Preparing a Balance Sheet Essential?

A well-prepared balance sheet offers numerous benefits, making it an indispensable tool for both internal management and external stakeholders. Here's why its preparation is non-negotiable:

1. Assessing Financial Health: A Clear Picture of Assets, Liabilities, and Equity

The balance sheet fundamentally shows the relationship between a company's assets, liabilities, and equity. This triad provides a comprehensive overview of a company's financial position. Understanding this relationship allows for the assessment of solvency, liquidity, and overall financial stability.

- Assets: These are resources controlled by the company as a result of past events and from which future economic benefits are expected to flow to the entity. This includes cash, accounts receivable, inventory, property, plant, and equipment (PP&E), and intangible assets.

- Liabilities: These are present obligations of the entity arising from past events, the settlement of which is expected to result in an outflow of resources embodying economic benefits. Examples include accounts payable, loans payable, salaries payable, and deferred revenue.

- Equity: This represents the residual interest in the assets of the entity after deducting all its liabilities. For a corporation, this includes common stock, retained earnings, and other contributed capital.

The fundamental accounting equation, Assets = Liabilities + Equity, underpins the balance sheet. This equation must always balance; any discrepancy indicates an error that needs immediate rectification.

2. Making Informed Business Decisions: Guiding Strategic Planning

A carefully prepared balance sheet is a vital input for informed decision-making. Management uses this information to:

- Secure Funding: Lenders and investors rely heavily on balance sheet data to assess creditworthiness and investment potential. A strong balance sheet increases the likelihood of securing favorable loan terms or attracting investors.

- Strategic Planning: By analyzing trends in assets, liabilities, and equity, management can identify areas for improvement, optimize resource allocation, and develop effective strategic plans for growth and profitability.

- Performance Evaluation: The balance sheet provides a benchmark against which to compare performance over time and against industry competitors. Identifying trends and anomalies allows for proactive adjustments to business strategies.

- Mergers and Acquisitions: During mergers and acquisitions, the balance sheets of the involved companies are meticulously scrutinized to assess their financial health and determine fair valuations.

3. Meeting Regulatory and Compliance Requirements: Maintaining Transparency and Accountability

Many jurisdictions mandate the preparation and regular filing of balance sheets, particularly for publicly traded companies. Compliance with these regulations ensures transparency and accountability, fostering trust among stakeholders.

4. Enhancing Credibility and Attracting Investors: Building Trust and Confidence

A well-structured and accurately prepared balance sheet projects professionalism and competence, bolstering the company's credibility with investors, lenders, and other stakeholders. It demonstrates a commitment to financial transparency and sound management practices.

Key Components of a Balance Sheet: Understanding the Structure

The balance sheet typically follows a standardized format, although variations may exist depending on the accounting standards followed (e.g., Generally Accepted Accounting Principles (GAAP) in the US, International Financial Reporting Standards (IFRS) internationally). The key components include:

1. Assets: Categorizing and Valuing Company Resources

Assets are typically presented in order of liquidity, meaning assets that are most easily converted into cash are listed first. Common asset categories include:

-

Current Assets: These are assets expected to be converted into cash or used within one year or the operating cycle, whichever is longer. Examples include:

- Cash and Cash Equivalents: Includes cash on hand, checking accounts, and short-term, highly liquid investments.

- Accounts Receivable: Amounts owed to the company by customers for goods or services sold on credit.

- Inventory: Raw materials, work-in-progress, and finished goods held for sale.

- Prepaid Expenses: Expenses paid in advance, such as insurance or rent.

-

Non-Current Assets (Long-term Assets): These are assets expected to be used for more than one year. Examples include:

- Property, Plant, and Equipment (PP&E): Land, buildings, machinery, and equipment used in the company's operations. These are typically reported at their net book value (original cost less accumulated depreciation).

- Intangible Assets: Non-physical assets with economic value, such as patents, trademarks, and copyrights. These are often amortized over their useful lives.

- Long-term Investments: Investments in securities or other assets that are not expected to be liquidated within one year.

2. Liabilities: Acknowledging Obligations and Due Payments

Liabilities are also categorized based on their maturity date.

-

Current Liabilities: These are obligations due within one year or the operating cycle. Examples include:

- Accounts Payable: Amounts owed to suppliers for goods or services purchased on credit.

- Salaries Payable: Amounts owed to employees for wages earned but not yet paid.

- Short-term Loans Payable: Amounts owed on loans due within one year.

- Taxes Payable: Amounts owed to government agencies for taxes.

-

Non-Current Liabilities (Long-term Liabilities): These are obligations due beyond one year. Examples include:

- Long-term Loans Payable: Amounts owed on loans with maturities exceeding one year.

- Bonds Payable: Amounts owed on bonds issued by the company.

- Deferred Revenue: Amounts received from customers for goods or services not yet delivered or performed.

3. Equity: Reflecting Ownership and Investment

Equity represents the owners' stake in the company. For corporations, this typically includes:

- Common Stock: The par value of common shares issued.

- Retained Earnings: Accumulated profits that have not been distributed as dividends.

- Additional Paid-in Capital: Amounts received from shareholders in excess of the par value of common stock.

- Treasury Stock: Shares of the company's own stock that have been repurchased.

Best Practices for Preparing a Balance Sheet: Ensuring Accuracy and Reliability

Preparing a reliable balance sheet requires careful attention to detail and adherence to accounting principles. Here are some best practices:

1. Utilize Reliable Accounting Software: Streamlining the Process

Accounting software significantly streamlines the process of balance sheet preparation. These programs automate many tasks, reducing errors and saving time.

2. Employ Double-Entry Bookkeeping: Maintaining Balance and Accuracy

The double-entry bookkeeping system ensures that the accounting equation always balances. Every transaction affects at least two accounts, maintaining the equality of assets, liabilities, and equity.

3. Maintain Accurate Records: Supporting Documentation and Timely Updates

Accurate and up-to-date records are crucial for preparing a reliable balance sheet. All transactions should be properly documented and recorded in a timely manner.

4. Conduct Regular Reconciliation: Identifying and Correcting Discrepancies

Regular reconciliation of bank statements, accounts receivable, and accounts payable helps identify and correct discrepancies, ensuring the accuracy of the balance sheet data.

5. Follow Accounting Standards: Ensuring Consistency and Comparability

Adherence to relevant accounting standards (GAAP or IFRS) ensures consistency and comparability across different periods and companies.

6. Seek Professional Assistance When Needed: Expert Guidance for Complex Situations

For complex situations or if you lack accounting expertise, seeking professional assistance from a qualified accountant or auditor is advisable.

Analyzing the Balance Sheet: Interpreting Key Ratios and Indicators

Once prepared, the balance sheet needs to be analyzed to extract meaningful insights. Key ratios and indicators include:

- Current Ratio: (Current Assets / Current Liabilities) Indicates a company's ability to meet its short-term obligations.

- Quick Ratio: ((Current Assets - Inventory) / Current Liabilities) A more stringent measure of short-term liquidity, excluding inventory.

- Debt-to-Equity Ratio: (Total Liabilities / Total Equity) Measures the proportion of financing from debt versus equity.

- Working Capital: (Current Assets - Current Liabilities) Shows the company's ability to fund day-to-day operations.

By carefully analyzing these ratios and indicators in conjunction with other financial statements (income statement and cash flow statement), a comprehensive understanding of a company's financial performance and health can be achieved.

Conclusion: The Balance Sheet as a Vital Tool for Financial Management

The preparation of a balance sheet is not merely a regulatory requirement; it is a fundamental aspect of sound financial management. By diligently preparing and analyzing this crucial financial statement, businesses can gain valuable insights into their financial health, make informed decisions, and build a strong foundation for sustainable growth and success. Understanding the balance sheet's components, adhering to best practices, and interpreting key ratios are essential steps in leveraging this powerful tool for effective financial management. A well-prepared balance sheet, coupled with careful analysis, is an invaluable asset for any business, enabling strategic planning, attracting investors, and fostering overall financial stability.

Latest Posts

Latest Posts

-

Laker Company Reported The Following January

Mar 17, 2025

-

Quantitative Analysis Of Vinegar Via Titration

Mar 17, 2025

-

The Interest Rate A Company Pays On 1 Year 5 Year

Mar 17, 2025

-

The Shape Of An Atomic Orbital Is Associated With

Mar 17, 2025

-

Parallelism In Writing Can Reflect Which Of The Following

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about The Balance Sheet Should Be Prepared . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.