Laker Company Reported The Following January

Holbox

Mar 17, 2025 · 6 min read

Table of Contents

Laker Company Reported the Following January: A Deep Dive into Financial Analysis and Strategic Implications

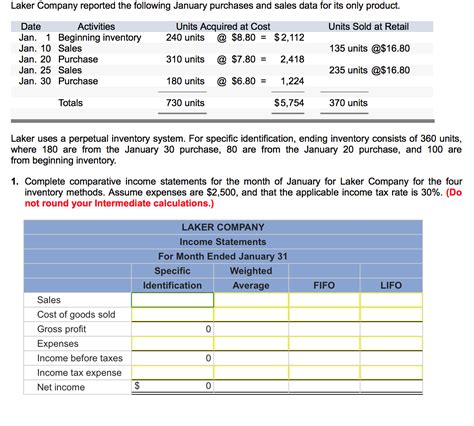

January's financial reports for Laker Company offer a crucial snapshot of the company's performance and trajectory. Analyzing these reports requires a multifaceted approach, considering various financial metrics and contextual factors. This in-depth analysis will explore potential interpretations of Laker Company's January performance, highlighting key areas of strength and weakness, and speculating on strategic implications for the year ahead. While specific numbers are unavailable without access to the actual report, this article will utilize hypothetical data to illustrate the analytical process. Remember to replace these examples with the actual Laker Company figures for accurate analysis.

Understanding the January Report: Key Metrics

Before delving into specifics, it's essential to define the key metrics we'll be examining. These metrics provide a comprehensive overview of Laker Company's financial health. Our analysis will focus on:

1. Revenue:

-

Overall Revenue: The total income generated by Laker Company in January. A substantial increase compared to the previous year would suggest strong market performance and effective sales strategies. Conversely, a decrease would signal potential problems requiring immediate attention. (Example: Hypothetical January Revenue: $5,000,000, compared to $4,500,000 in January of the previous year. This represents a 11.1% increase.)

-

Revenue Breakdown by Segment: Analyzing revenue from different product lines or business units helps identify high-performing areas and those needing improvement. This granular view allows for targeted strategic adjustments. (Example: Hypothetical Breakdown: Product A - $2,000,000; Product B - $1,500,000; Product C - $1,500,000.)

2. Costs and Expenses:

-

Cost of Goods Sold (COGS): This represents the direct costs associated with producing Laker Company's goods. Analyzing COGS helps determine the profitability of each product or service. Increases in COGS may indicate rising raw material prices or inefficiencies in the production process. (Example: Hypothetical COGS: $2,500,000.)

-

Operating Expenses: These are the expenses incurred in running the business, including salaries, rent, utilities, and marketing. High operating expenses can negatively impact profitability. Careful scrutiny is needed to identify areas for cost optimization. (Example: Hypothetical Operating Expenses: $1,000,000.)

3. Profitability:

-

Gross Profit: This is the difference between revenue and COGS. It represents the profit generated from the core business operations before considering operating expenses. (Example: Hypothetical Gross Profit: $2,500,000 ($5,000,000 - $2,500,000).)

-

Operating Profit (EBIT): This is calculated by subtracting operating expenses from gross profit. It indicates the company's ability to generate profit from its core operations. (Example: Hypothetical Operating Profit: $1,500,000 ($2,500,000 - $1,000,000).)

-

Net Profit: This is the company's final profit after considering all expenses, including taxes and interest. It's the bottom line and a key indicator of overall financial health. (Example: Hypothetical Net Profit: $1,200,000 (Assuming taxes and interest reduce profit by $300,000).)

4. Liquidity:

-

Current Ratio: This ratio compares current assets to current liabilities, providing insight into Laker Company's ability to meet its short-term obligations. A healthy current ratio generally indicates strong liquidity. (Example: Hypothetical Current Ratio: 2.0, indicating sufficient liquidity.)

-

Quick Ratio (Acid-Test Ratio): Similar to the current ratio but excludes inventory, providing a more conservative measure of liquidity. (Example: Hypothetical Quick Ratio: 1.5, suggesting good short-term liquidity even without considering inventory.)

5. Solvency:

- Debt-to-Equity Ratio: This shows the proportion of debt to equity financing. A high ratio indicates higher financial risk. (Example: Hypothetical Debt-to-Equity Ratio: 0.5, suggesting a balance between debt and equity financing.)

Interpreting Laker Company's January Performance: A Hypothetical Scenario

Based on the hypothetical figures provided above, Laker Company appears to have experienced a positive January. The 11.1% increase in overall revenue demonstrates significant growth compared to the previous year. The breakdown by segment shows consistent performance across all three product lines, indicating a well-diversified product portfolio.

However, a deeper dive is necessary. While the gross profit margin of 50% (($2,500,000/$5,000,000) * 100%) is healthy, it's crucial to investigate the composition of COGS. Are the increases in raw material costs contributing significantly to this figure? If so, Laker Company may need to explore alternative suppliers or implement cost-cutting measures within the production process.

The operating profit margin of 30% (($1,500,000/$5,000,000) * 100%) indicates efficiency in managing operating expenses. However, further analysis of specific expense categories is needed to ensure that Laker Company is not compromising on essential areas like research and development or marketing to achieve this level of profitability.

The net profit of $1,200,000, although positive, represents a 24% net profit margin (($1,200,000/$5,000,000) * 100%). This is respectable, but further investigation into tax implications and interest expenses is warranted to optimize future profitability. The strong liquidity ratios suggest Laker Company is well-positioned to meet its short-term financial obligations. The debt-to-equity ratio indicates a reasonable balance between debt and equity financing.

Strategic Implications and Future Outlook

Laker Company's January performance offers several strategic implications for the rest of the year. The strong revenue growth warrants exploration of opportunities for further expansion, potentially through new product development, market penetration, or strategic acquisitions.

However, potential challenges need to be addressed. Rising COGS requires a comprehensive review of the supply chain, production processes, and potential cost-saving initiatives. This might involve negotiating better deals with suppliers, improving production efficiency, or exploring alternative, more cost-effective materials.

Maintaining the current level of operating expenses while pursuing growth will be crucial. This requires careful budgeting, efficient resource allocation, and a focus on optimizing processes. Investing in technology and automation might help achieve these goals.

Marketing strategies should be refined to capitalize on the positive momentum and further increase market share. Analysis of customer data and market trends is essential for effective targeting and messaging.

Regular monitoring of key performance indicators (KPIs) and continuous improvement initiatives will be vital in ensuring sustained growth and profitability throughout the year. This includes regular review of financial statements, market research, and customer feedback.

Analyzing the Context: External Factors

The analysis of Laker Company's January performance should also consider external factors that may have influenced the results. These factors can include:

-

Economic conditions: The overall economic climate, including inflation rates, interest rates, and consumer spending patterns, can significantly impact a company's performance.

-

Industry trends: Analyzing trends within Laker Company's industry, including technological advancements, competition, and regulatory changes, helps understand the broader market context.

-

Seasonal factors: The month of January may have unique seasonal influences on Laker Company’s sales and operations. This needs to be factored into the analysis.

Conclusion: A Path Forward for Laker Company

Laker Company's January report, while showing positive signs of growth, calls for a thorough and nuanced analysis. The strong revenue increase and healthy liquidity are encouraging. However, careful attention needs to be paid to managing COGS, optimizing operating expenses, and maintaining a robust marketing strategy. A comprehensive understanding of both internal operations and external factors is crucial for informed decision-making and effective long-term strategic planning.

By addressing the potential challenges proactively and capitalizing on the existing strengths, Laker Company can position itself for sustained growth and success throughout the year. Continuous monitoring, adaptation, and innovation will be key to navigating the dynamic business landscape and achieving its long-term goals. The January report provides a valuable foundation for charting this course. Further analysis, encompassing quarterly and annual reports, will provide a more comprehensive picture of Laker Company's performance and allow for more refined strategic adjustments.

Latest Posts

Latest Posts

-

Report For Experiment 9 Properties Of Solutions Answers

Mar 17, 2025

-

Write A Tragic Six Line Poem About Music

Mar 17, 2025

-

Determine The Equation To Be Solved After Removing The Logarithm

Mar 17, 2025

-

Research Shows That People Who Smoke Cigarettes Are More Likely

Mar 17, 2025

-

A Government Created Monopoly Arises When

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Laker Company Reported The Following January . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.