The Interest Rate A Company Pays On 1-year 5-year

Holbox

Mar 17, 2025 · 7 min read

Table of Contents

The Interest Rate a Company Pays on 1-Year vs. 5-Year Debt: A Comprehensive Guide

Understanding the interest rate a company pays on its debt is crucial for investors, lenders, and the company itself. Interest rates aren't static; they fluctuate based on numerous factors, and the timeframe of the debt – whether it's a short-term 1-year loan or a longer-term 5-year loan – significantly impacts the rate. This comprehensive guide explores the intricacies of these interest rates, delving into the reasons behind the differences and the implications for businesses and investors.

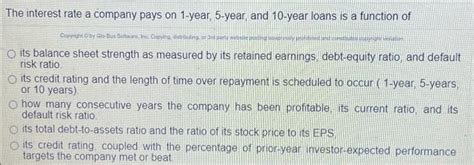

Factors Influencing Interest Rates on Corporate Debt

Several key factors influence the interest rate a company pays on its debt, regardless of the loan's term. These factors interact in complex ways, making it challenging to predict exact rates, but understanding them is vital for informed decision-making.

1. Creditworthiness (Credit Rating): The Cornerstone of Interest Rates

A company's creditworthiness, often represented by its credit rating from agencies like Moody's, S&P, and Fitch, is arguably the most significant factor. A higher credit rating (e.g., AAA) indicates lower risk for lenders, translating to lower interest rates. Conversely, companies with lower credit ratings (e.g., BB or below) are considered riskier, leading to higher interest rates to compensate lenders for the increased probability of default. This risk premium is often substantial, significantly increasing borrowing costs for financially weaker companies.

Key takeaway: The better a company's credit rating, the lower the interest rate it will likely pay on both 1-year and 5-year debt.

2. Market Interest Rates: The Benchmark for Borrowing Costs

Prevailing market interest rates, often influenced by central bank policies and broader economic conditions, provide a benchmark for corporate borrowing costs. When market interest rates rise (e.g., due to inflation or increased demand for funds), borrowing becomes more expensive for companies, irrespective of their credit rating. Conversely, falling market rates make borrowing cheaper. These market rates serve as a floor, with individual company rates adjusted upward or downward based on their creditworthiness.

Key takeaway: General market conditions heavily influence the base interest rate a company will pay, affecting both short-term and long-term debt.

3. Loan Type and Structure: Customization Impacts Costs

The specific type and structure of the loan significantly impact interest rates. Secured loans (backed by collateral) typically command lower rates than unsecured loans due to reduced lender risk. Similarly, loans with covenants (restrictions on the borrower's activities) might offer slightly lower rates as they provide additional protection to the lender. The complexity of the loan structure, including fees and other charges, can also influence the overall cost of borrowing.

Key takeaway: The finer details of the loan agreement significantly affect the final interest rate charged.

4. Maturity: The Time Factor in Interest Rate Determination

The maturity of the debt, whether 1 year or 5 years, is a crucial determinant of the interest rate. Generally, longer-term loans (like 5-year loans) carry higher interest rates than shorter-term loans (like 1-year loans). This is due to several factors:

- Increased Uncertainty: Lenders face greater uncertainty over the longer period, including potential changes in the borrower's financial health, market interest rates, and overall economic conditions.

- Inflation Risk: Inflation erodes the purchasing power of money over time. Lenders demand higher interest rates on longer-term loans to compensate for the potential impact of inflation.

- Liquidity Risk: Longer-term loans tie up lenders' capital for a more extended period, reducing their liquidity. They demand higher returns to offset this risk.

Key takeaway: The longer the loan term, the higher the interest rate is typically charged to compensate for increased risk and uncertainty.

1-Year vs. 5-Year Debt: A Direct Comparison

The differences between 1-year and 5-year debt extend beyond their maturity. Let's analyze the key distinctions:

Interest Rate Differences: Short-Term vs. Long-Term

As previously discussed, 5-year debt generally commands a higher interest rate than 1-year debt. This difference reflects the increased risks and uncertainties associated with the longer timeframe. The exact spread between the two rates varies depending on market conditions and the borrower's creditworthiness. However, the 5-year rate will typically be higher to compensate for the longer period of exposure to risk.

Risk Profile: Managing Uncertainty

1-year debt offers a lower risk profile for both the lender and the borrower. For lenders, the shorter timeframe reduces exposure to potential changes in the borrower's financial position and market interest rates. For borrowers, it allows for greater flexibility as they can refinance or repay the debt sooner based on their changing financial circumstances. 5-year debt locks in the interest rate for a longer duration, reducing the risk of interest rate fluctuations but increasing the exposure to financial changes during the extended period.

Flexibility and Refinance Options: Adapting to Changing Needs

1-year debt provides greater flexibility. At the end of the year, the borrower can refinance at the prevailing market rates, potentially securing a lower rate if market conditions are favorable. This flexibility is beneficial in dynamic economic environments. 5-year debt limits this flexibility. While refinancing is possible, it's subject to market conditions and the borrower's creditworthiness at the time of refinancing. Prepayment penalties might also apply, adding costs to early repayment.

Liquidity: Accessing Funds and Managing Cash Flow

1-year debt enhances a company's short-term liquidity. The shorter maturity period means the company doesn't need to manage the repayment of a large sum for a longer period. This is beneficial for businesses that need to maintain strong short-term cash flow. 5-year debt ties up the company's funds for a longer period, potentially affecting its liquidity and short-term cash flow management strategies.

Strategic Implications: Aligning with Business Goals

The choice between 1-year and 5-year debt depends on the company's specific needs and financial strategy. Companies with predictable cash flows and a long-term horizon might prefer 5-year debt to lock in interest rates for a longer period. Conversely, companies operating in volatile sectors or with uncertain future cash flows might prefer the greater flexibility of 1-year debt. Matching the debt maturity with the anticipated life of the assets financed is also a crucial consideration.

Analyzing Interest Rate Trends and Predictions

Predicting future interest rates is challenging due to their complex interplay with various economic and market factors. However, by monitoring key indicators, companies and investors can make more informed decisions.

Monitoring Key Economic Indicators

Tracking key economic indicators, such as inflation rates, GDP growth, and unemployment figures, provides insights into the potential direction of interest rates. High inflation, strong economic growth, and low unemployment often lead to increased interest rates.

Analyzing Central Bank Policies

Central bank policies, such as interest rate adjustments and quantitative easing programs, directly influence market interest rates. Understanding the central bank's goals and actions is vital for anticipating future interest rate movements.

Studying Market Sentiment and Investor Behavior

Market sentiment and investor behavior play a significant role in shaping interest rates. Increased risk aversion among investors can lead to higher interest rates as lenders demand higher returns to compensate for perceived risks.

Utilizing Forecasting Models and Expert Opinions

Sophisticated forecasting models and expert opinions from financial analysts can offer insights into potential future interest rate scenarios. However, it's crucial to remember that these are predictions, not guarantees.

Conclusion: A Strategic Approach to Debt Management

Choosing between 1-year and 5-year debt requires a thorough understanding of a company's financial position, risk tolerance, and strategic goals. The decision should not be based solely on the interest rate but should consider the broader implications of each option in terms of flexibility, risk management, and cash flow. By carefully analyzing the factors that influence interest rates and anticipating future market trends, companies can make informed decisions that optimize their debt management strategies and contribute to their overall financial health. Remember to consult with financial professionals for personalized guidance tailored to your specific circumstances.

Latest Posts

Latest Posts

-

Tagout Systems Tend To Have All These Limitations Except

Mar 17, 2025

-

From The Book Pre Lab Unit 1 Activity 1 Question 2

Mar 17, 2025

-

Which Component Of The Personality Uses Defense Mechanisms And Why

Mar 17, 2025

-

Knowledge Check 01 Match The Term And The Definition

Mar 17, 2025

-

Banks Typically Come Under Financial Stress Because Of

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about The Interest Rate A Company Pays On 1-year 5-year . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.