If The Canadian Dollar Is Strengthening Then

Holbox

Mar 21, 2025 · 7 min read

Table of Contents

- If The Canadian Dollar Is Strengthening Then

- Table of Contents

- If the Canadian Dollar is Strengthening: Implications and Opportunities

- Understanding a Strengthening Canadian Dollar

- 1. Increased Demand for Canadian Goods and Services:

- 2. Higher Interest Rates in Canada:

- 3. Increased Foreign Investment in Canada:

- 4. Global Economic Factors:

- 5. Government Policies:

- Implications of a Strengthening Canadian Dollar

- 1. Impact on Canadian Exporters:

- 2. Impact on Canadian Importers:

- 3. Impact on Canadian Consumers:

- 4. Impact on the Canadian Tourism Industry:

- 5. Impact on the Canadian Stock Market:

- Opportunities Presented by a Strengthening Canadian Dollar

- 1. Increased Foreign Investment:

- 2. Lower Inflation:

- 3. Enhanced Purchasing Power:

- 4. Reduced Debt Burden:

- 5. Strategic Investments:

- Navigating a Strengthening Canadian Dollar: Strategies for Businesses and Individuals

- For Businesses:

- For Individuals:

- Conclusion: The Dynamic Nature of the Canadian Dollar

- Latest Posts

- Latest Posts

- Related Post

If the Canadian Dollar is Strengthening: Implications and Opportunities

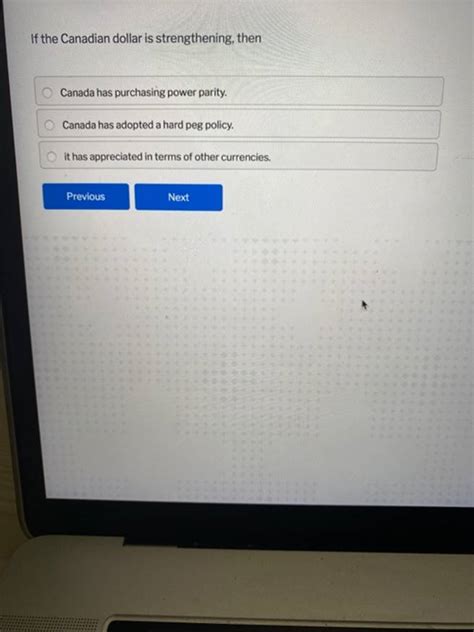

The Canadian dollar, also known as the loonie, is a floating currency, meaning its value fluctuates based on supply and demand in the global foreign exchange market. When the Canadian dollar strengthens, it means it's appreciating in value relative to other currencies, such as the US dollar, the Euro, or the British pound. This seemingly simple shift has wide-ranging implications for individuals, businesses, and the Canadian economy as a whole. Understanding these implications is crucial for navigating the financial landscape and capitalizing on potential opportunities.

Understanding a Strengthening Canadian Dollar

A strengthening Canadian dollar occurs when more people and entities are buying Canadian dollars than selling them. This increased demand drives up the price, making it more expensive to buy Canadian dollars with other currencies. Several factors can contribute to a strengthening loonie:

1. Increased Demand for Canadian Goods and Services:

A booming Canadian economy, with robust exports of commodities like oil, gas, lumber, and agricultural products, creates higher demand for the Canadian dollar. International buyers need to purchase Canadian dollars to pay for these goods and services, thus boosting its value.

2. Higher Interest Rates in Canada:

When the Bank of Canada raises interest rates, it makes Canadian investments more attractive to foreign investors seeking higher returns. This influx of foreign capital increases demand for the Canadian dollar, leading to appreciation.

3. Increased Foreign Investment in Canada:

Foreign direct investment (FDI) and portfolio investment in Canadian assets, such as stocks and bonds, also fuel demand for the Canadian dollar. Investors need to exchange their currencies for Canadian dollars to make these investments.

4. Global Economic Factors:

Global economic events can significantly impact the Canadian dollar. For instance, a weakening US dollar often leads to a strengthening Canadian dollar, as the loonie is often viewed as a safe-haven asset during times of global uncertainty. Conversely, a strong global economy might drive demand for Canadian commodities, strengthening the loonie.

5. Government Policies:

Government policies, such as fiscal and monetary policies, can influence the value of the Canadian dollar. Stable and predictable government policies generally foster confidence in the Canadian economy, leading to a stronger currency.

Implications of a Strengthening Canadian Dollar

A stronger Canadian dollar has both positive and negative effects, depending on the perspective and the specific sector of the economy.

1. Impact on Canadian Exporters:

For Canadian businesses that export goods and services, a strengthening loonie is generally bad news. Their products become more expensive for international buyers, reducing competitiveness and potentially harming sales and profits. This is particularly true for businesses that primarily export to countries with weaker currencies. They might need to absorb the cost increase, lowering their profit margins, or adjust pricing strategies to remain competitive. This can lead to job losses in export-oriented industries.

2. Impact on Canadian Importers:

Conversely, Canadian importers benefit from a stronger Canadian dollar. Importing goods and services becomes cheaper, making them more affordable for Canadian consumers and businesses. This increased affordability can boost consumer spending and business investment. This benefit is particularly relevant for industries that heavily rely on imported raw materials or intermediate goods. The lower cost of imports can contribute to improved profit margins and increased competitiveness in the domestic market.

3. Impact on Canadian Consumers:

For Canadian consumers, a stronger dollar translates into lower prices for imported goods. This means cheaper electronics, clothing, and other consumer products, potentially boosting consumer purchasing power and overall living standards. However, the impact on consumers is not universally positive. While some enjoy lower prices on imports, the positive effects might be offset by job losses in the export sector and potential wage stagnation.

4. Impact on the Canadian Tourism Industry:

A stronger Canadian dollar makes it more expensive for foreign tourists to visit Canada. This can lead to a decrease in the number of foreign tourists and a decline in tourism revenue. Conversely, it might encourage more Canadians to travel internationally, impacting the domestic travel industry and its overall revenue.

5. Impact on the Canadian Stock Market:

A strengthening Canadian dollar can affect the Canadian stock market in various ways. Companies heavily reliant on exports might experience a decline in stock prices due to reduced profitability. Conversely, companies that import raw materials or intermediate goods could see an increase in stock prices due to improved profitability.

Opportunities Presented by a Strengthening Canadian Dollar

While a strengthening loonie presents challenges, it also opens up several opportunities:

1. Increased Foreign Investment:

A stronger currency can attract more foreign investment, as it signals a stable and robust economy. This influx of capital can further boost economic growth and create new job opportunities. Foreign investors find Canadian assets more attractive when the currency is strong, offering a hedge against currency fluctuations and the potential for higher returns.

2. Lower Inflation:

The lower cost of imported goods due to a stronger dollar can help keep inflation in check. This stability benefits consumers and businesses by maintaining predictable price levels, which is crucial for long-term planning and investment decisions.

3. Enhanced Purchasing Power:

Canadians enjoy enhanced purchasing power when the dollar strengthens, as they can purchase more imported goods and services for the same amount of money. This translates into improved living standards and increased consumer confidence, which in turn can stimulate economic activity.

4. Reduced Debt Burden:

A stronger Canadian dollar can reduce the debt burden for Canadian companies that have borrowed money in foreign currencies. Repaying these loans becomes cheaper as the value of the Canadian dollar increases relative to the currencies they borrowed in. This allows companies to allocate more funds towards growth and expansion.

5. Strategic Investments:

The strengthening Canadian dollar presents opportunities for strategic investments, both domestically and internationally. Investors can take advantage of favourable exchange rates to invest in foreign markets or acquire businesses abroad, potentially generating higher returns.

Navigating a Strengthening Canadian Dollar: Strategies for Businesses and Individuals

Both businesses and individuals need to adapt their strategies to navigate the impact of a strengthening Canadian dollar.

For Businesses:

- Diversify Export Markets: Reduce dependence on markets with weaker currencies by expanding into regions with stronger currencies or developing new products tailored to different markets.

- Increase Efficiency and Productivity: Improve operational efficiency to offset the impact of higher production costs.

- Explore New Revenue Streams: Develop new products or services that are less susceptible to currency fluctuations.

- Hedge Against Currency Risk: Use financial instruments like forward contracts or options to mitigate potential losses due to currency fluctuations.

- Invest in Technology and Automation: Reduce labor costs through automation and improve productivity to maintain competitiveness.

For Individuals:

- Strategic Spending: Take advantage of lower prices on imported goods but remain mindful of potential price increases on domestically produced goods.

- Travel Planning: Consider travelling internationally while the Canadian dollar is strong, as it translates to lower travel costs.

- Investment Diversification: Diversify investments to mitigate risks associated with currency fluctuations.

- Currency Exchange Strategies: Be mindful of exchange rates when exchanging currency for travel or other purposes.

- Monitor Economic Indicators: Stay informed about economic news and trends to anticipate potential changes in the currency exchange rate.

Conclusion: The Dynamic Nature of the Canadian Dollar

The strengthening Canadian dollar presents a complex scenario with both challenges and opportunities. Understanding the underlying factors that influence its value, along with the implications for various sectors of the economy, is crucial for making informed decisions. By adapting strategies, mitigating risks, and capitalizing on opportunities, businesses and individuals can navigate this dynamic environment effectively. The ongoing fluctuations of the Canadian dollar highlight the importance of monitoring economic trends and adjusting strategies accordingly to ensure long-term financial health and success. The interplay between global economics, domestic policies, and market forces will continue to shape the value of the loonie, making continuous adaptation a key to thriving in the Canadian and global financial landscape.

Latest Posts

Latest Posts

-

Determine The T Value In Each Of The Cases

Mar 29, 2025

-

What Are The Primary Effects Of Cost Push Inflation

Mar 29, 2025

-

Which Of These Is Not A Cost Of Quality

Mar 29, 2025

-

Figure A And Figure B Represent Examples Of

Mar 29, 2025

-

Reduced Competition Through Merging Of Companies Will Raise Social Welfare

Mar 29, 2025

Related Post

Thank you for visiting our website which covers about If The Canadian Dollar Is Strengthening Then . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.