Reduced Competition Through Merging Of Companies Will Raise Social Welfare

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

- Reduced Competition Through Merging Of Companies Will Raise Social Welfare

- Table of Contents

- Reduced Competition Through Merging of Companies Will Raise Social Welfare: A Critical Analysis

- The Traditional Antitrust Perspective: Why Less Competition Often Means Higher Prices

- Exceptions to the Rule: When Mergers Can Benefit Social Welfare

- 1. Synergies and Economies of Scale Leading to Lower Prices

- 2. Solving Coordination Problems and Network Effects

- 3. Preventing Market Failure and Avoiding Bankruptcy

- 4. Enhancing Innovation Through Resource Consolidation

- 5. Addressing Systemic Risk and Protecting Financial Stability

- Analyzing the Welfare Impact: A Case-by-Case Approach

- The Role of Regulatory Authorities

- Conclusion: A Nuanced Perspective on Mergers and Social Welfare

- Latest Posts

- Latest Posts

- Related Post

Reduced Competition Through Merging of Companies Will Raise Social Welfare: A Critical Analysis

The assertion that reduced competition through mergers and acquisitions (M&A) can raise social welfare is a complex and controversial one. While intuitively, increased competition often leads to better outcomes for consumers, the reality is far more nuanced. This article will delve into the arguments supporting this seemingly paradoxical claim, examining various scenarios where mergers, despite reducing competition, can ultimately benefit society. It's crucial to understand that this is not a blanket endorsement of all mergers, but rather a critical analysis of specific situations where such outcomes are possible.

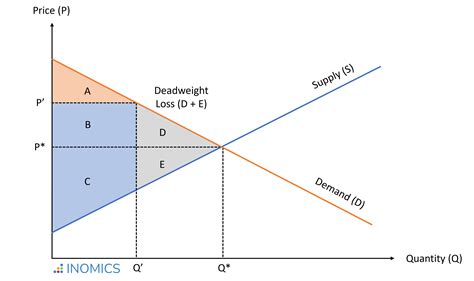

The Traditional Antitrust Perspective: Why Less Competition Often Means Higher Prices

Before exploring the exceptions, it's essential to acknowledge the traditional antitrust perspective. Generally, reduced competition through mergers is viewed negatively. The standard economic model suggests that fewer competing firms lead to:

- Higher Prices: With fewer firms in the market, the remaining entities have more market power. This allows them to restrict supply and raise prices above competitive levels, harming consumers.

- Reduced Innovation: A lack of competition can stifle innovation. Firms with less pressure to compete may be less incentivized to invest in research and development, leading to stagnant product offerings and technological advancements.

- Lower Quality: Similar to innovation, competition drives firms to improve product quality to attract consumers. Reduced competition can lead to complacency and a decline in quality.

- Reduced Consumer Choice: Fewer firms mean fewer product options for consumers. This can limit consumer choice and restrict access to diverse goods and services.

Exceptions to the Rule: When Mergers Can Benefit Social Welfare

Despite the generally negative view of reduced competition, certain situations can justify mergers even if they lead to a less competitive market. These situations often involve:

1. Synergies and Economies of Scale Leading to Lower Prices

One key argument for mergers is the potential for synergies and economies of scale. Merging companies can achieve cost reductions through:

- Elimination of Redundancies: Combining operations can eliminate redundant departments, facilities, and personnel, leading to significant cost savings.

- Improved Efficiency: Merging can streamline operations, improve efficiency, and optimize resource allocation.

- Increased Bargaining Power with Suppliers: A larger, merged entity often has greater bargaining power with suppliers, enabling it to negotiate lower input prices.

These cost reductions can lead to lower prices for consumers, even with reduced competition. This is particularly true in industries with high fixed costs, where larger scale operations are significantly more efficient. For example, the merger of two struggling airlines might lead to cost reductions that allow them to offer lower fares, benefiting passengers even though the number of airlines has decreased.

2. Solving Coordination Problems and Network Effects

In certain industries, coordination problems can impede efficiency and consumer welfare. For instance, imagine two competing telecommunication companies with separate but overlapping networks. Merging these companies can eliminate the need for interoperability agreements, leading to improved network coverage, seamless connectivity, and potentially lower costs for consumers. This synergistic effect from improved network coverage can outweigh the negative effects of reduced competition. This illustrates the importance of considering network effects, where the value of a product or service increases with the number of users.

3. Preventing Market Failure and Avoiding Bankruptcy

Sometimes, a merger is necessary to prevent market failure or the bankruptcy of a struggling firm. If a company is on the brink of collapse, a merger with a healthier entity might be the only way to save jobs, preserve valuable assets, and avoid disruption to the market. This is particularly relevant in industries with high barriers to entry, where new competitors struggle to emerge. The survival of one company, even at the cost of reduced competition in the short term, can safeguard against a complete collapse of the market and benefit the broader economy.

4. Enhancing Innovation Through Resource Consolidation

While reduced competition is often associated with decreased innovation, in some instances, a merger can actually increase innovation by consolidating resources and expertise. By bringing together different research teams and technological capabilities, a merged entity might be better positioned to develop breakthrough technologies and introduce innovative products. This is particularly relevant in research-intensive industries such as pharmaceuticals or biotechnology, where significant investment is needed to develop new products.

5. Addressing Systemic Risk and Protecting Financial Stability

In the financial sector, mergers can play a crucial role in addressing systemic risk and protecting financial stability. The merger of two financially troubled banks, for example, might prevent a broader financial crisis by preventing a domino effect of failures. While this might lead to reduced competition in the banking sector, the potential benefits of avoiding a widespread financial meltdown often outweigh the concerns about reduced competition. This is particularly relevant during times of economic instability.

Analyzing the Welfare Impact: A Case-by-Case Approach

Determining whether a specific merger will raise or lower social welfare requires a careful analysis of several factors:

- Market Structure: The level of competition in the market before and after the merger is crucial. A merger in a highly concentrated market is more likely to have negative consequences than a merger in a highly competitive market.

- Synergies and Efficiency Gains: The potential for cost reductions, increased efficiency, and innovation must be assessed.

- Consumer Surplus: The impact of the merger on consumer prices and choice must be considered.

- Dynamic Effects: The long-term effects of the merger on innovation, competition, and market structure need to be evaluated.

- Entry Barriers: The ease with which new firms can enter the market after the merger is a critical factor. High barriers to entry make it less likely that the merger's anti-competitive effects will be mitigated by new competition.

The Role of Regulatory Authorities

Regulatory authorities play a vital role in assessing the potential impact of mergers and acquisitions. Their task is to evaluate the potential benefits and harms of a merger and to ensure that mergers do not unduly restrict competition. This involves careful analysis of market structure, potential synergies, and the overall impact on consumer welfare. In situations where the potential benefits outweigh the harms, regulatory authorities may approve the merger, even if it reduces competition in the short term. This requires a nuanced understanding of market dynamics and the ability to forecast the long-term effects of a merger.

Conclusion: A Nuanced Perspective on Mergers and Social Welfare

The relationship between mergers, competition, and social welfare is not straightforward. While reduced competition often leads to negative outcomes, there are exceptions where mergers can enhance social welfare by generating synergies, improving efficiency, preventing market failures, or fostering innovation. The ultimate impact of a merger depends on a variety of factors, and a careful case-by-case analysis is essential to determine whether a particular merger will benefit or harm society. The role of regulatory authorities in evaluating these complex issues and making informed decisions is paramount to ensure that mergers serve the interests of consumers and the broader economy. Therefore, a blanket condemnation of all mergers that reduce competition is overly simplistic and fails to account for the significant nuances in this intricate area of economic policy. The focus should always be on maximizing social welfare, a task that requires a profound understanding of market dynamics and a willingness to consider the potential benefits alongside the potential drawbacks of reduced competition.

Latest Posts

Latest Posts

-

Recent Improvements In Have Increased The Pace Of Globalization

Apr 01, 2025

-

When Using Goal Setting Theory To Motivate Employees Managers Should

Apr 01, 2025

-

Issues And Ethics In The Helping Professions

Apr 01, 2025

-

Serological Testing Is Based On The Fact That

Apr 01, 2025

-

Draw The Product Of The Following Reaction

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about Reduced Competition Through Merging Of Companies Will Raise Social Welfare . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.