What Are The Primary Effects Of Cost Push Inflation

Holbox

Mar 29, 2025 · 6 min read

Table of Contents

- What Are The Primary Effects Of Cost Push Inflation

- Table of Contents

- What Are the Primary Effects of Cost-Push Inflation?

- The Root Causes of Cost-Push Inflation

- 1. Increased Wages:

- 2. Rising Raw Material Prices:

- 3. Supply Chain Bottlenecks:

- 4. Increased Taxes and Regulations:

- 5. Exchange Rate Fluctuations:

- Primary Effects of Cost-Push Inflation: A Detailed Analysis

- 1. Reduced Economic Output:

- 2. Increased Unemployment:

- 3. Reduced Consumer Purchasing Power:

- 4. Reduced Profit Margins for Businesses:

- 5. Menu Costs and Shoe-Leather Costs:

- 6. Uncertainty and Investment Decline:

- 7. Wage-Price Spiral:

- 8. Impact on International Competitiveness:

- 9. Redistributive Effects:

- 10. Impact on Government Policy:

- Mitigating the Effects of Cost-Push Inflation

- Conclusion: Navigating the Complexities of Cost-Push Inflation

- Latest Posts

- Latest Posts

- Related Post

What Are the Primary Effects of Cost-Push Inflation?

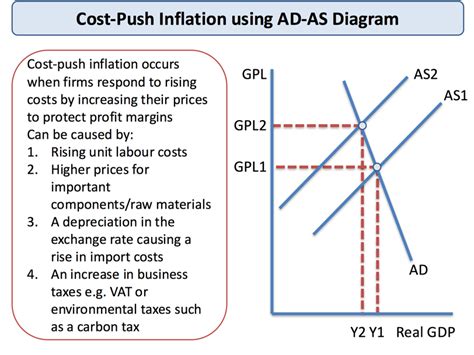

Cost-push inflation, a significant economic phenomenon, occurs when rising production costs compel businesses to increase prices for their goods and services. Unlike demand-pull inflation, which stems from excessive consumer demand, cost-push inflation is driven by factors internal to the production process. Understanding its primary effects is crucial for policymakers, businesses, and individuals alike. This article will delve deep into the multifaceted consequences of cost-push inflation, examining its impact on various sectors of the economy.

The Root Causes of Cost-Push Inflation

Before exploring the effects, it's vital to grasp the underlying causes of cost-push inflation. These can be broadly categorized as:

1. Increased Wages:

Wage increases, particularly if they outpace productivity gains, are a major driver. Strong labor unions negotiating substantial pay hikes can significantly boost production costs. This is especially true in industries with limited automation where labor forms a considerable proportion of overall expenses. Minimum wage increases, while aiming to improve worker welfare, can also contribute to cost-push inflation if businesses pass on the added labor costs to consumers through higher prices.

2. Rising Raw Material Prices:

Fluctuations in commodity markets profoundly impact production costs. Increases in the prices of oil, metals, agricultural products, and other raw materials directly translate into higher manufacturing and transportation costs. Geopolitical events, supply chain disruptions, natural disasters, and even speculative trading can all trigger sharp increases in raw material prices, fueling cost-push inflation.

3. Supply Chain Bottlenecks:

Disruptions to supply chains, whether due to pandemics, natural disasters, geopolitical instability, or logistical challenges, can lead to shortages of essential inputs. This scarcity drives up prices, forcing businesses to raise their prices to maintain profit margins, thereby contributing to cost-push inflation.

4. Increased Taxes and Regulations:

Government policies can also indirectly contribute to cost-push inflation. Higher taxes on businesses, particularly indirect taxes like sales tax or excise duties, increase production costs. Similarly, stringent environmental regulations, while crucial for sustainability, can add compliance costs which are often passed onto consumers.

5. Exchange Rate Fluctuations:

For countries heavily reliant on imports, depreciation of the domestic currency can inflate the cost of imported raw materials and intermediate goods. This increase in import costs gets embedded in the overall price level, thus contributing to cost-push inflation.

Primary Effects of Cost-Push Inflation: A Detailed Analysis

The ripple effects of cost-push inflation are widespread and significant, impacting various aspects of the economy:

1. Reduced Economic Output:

Cost-push inflation often leads to a reduction in real GDP. Higher production costs squeeze profit margins, discouraging businesses from expanding production and potentially leading to job losses. Consumers, facing higher prices, reduce their purchasing power, further dampening demand and overall economic activity. This creates a negative feedback loop, hindering economic growth.

2. Increased Unemployment:

As businesses grapple with higher costs and reduced demand, they might resort to layoffs or hiring freezes to manage expenses. This leads to increased unemployment, particularly in sectors most affected by the rising input costs. This unemployment can be further exacerbated by reduced consumer spending, causing a decline in demand across several sectors.

3. Reduced Consumer Purchasing Power:

Higher prices for goods and services directly translate into reduced purchasing power for consumers. This means consumers can afford fewer goods and services than before, impacting their standard of living. This decrease in consumer spending can lead to a further slowdown in economic activity, creating a vicious cycle of declining output and rising prices.

4. Reduced Profit Margins for Businesses:

Initially, businesses might attempt to absorb increased costs by reducing their profit margins. However, this is often unsustainable in the long run. Sustained cost-push inflation eventually erodes profitability, compelling businesses to raise prices further to maintain their profit levels, creating a self-reinforcing inflationary spiral.

5. Menu Costs and Shoe-Leather Costs:

Cost-push inflation generates significant menu costs—the costs businesses incur to update their prices. This includes printing new menus, changing price tags, and updating online catalogs. Similarly, shoe-leather costs refer to the time and effort individuals spend searching for the best prices due to heightened inflation, reducing overall economic efficiency.

6. Uncertainty and Investment Decline:

The unpredictability of cost-push inflation creates economic uncertainty, making it difficult for businesses to plan for the future. This uncertainty discourages investment in new projects and expansion, further hampering economic growth and job creation. Businesses hesitant to invest due to unstable pricing environments can stagnate productivity and impede innovation.

7. Wage-Price Spiral:

Cost-push inflation can trigger a wage-price spiral. As prices rise, workers demand higher wages to maintain their purchasing power. These higher wages, in turn, push up production costs, leading to further price increases, creating a vicious cycle of rising prices and wages. This spiral can be particularly challenging to break once it takes hold, resulting in persistent inflation.

8. Impact on International Competitiveness:

For countries experiencing cost-push inflation, the increase in domestic prices can negatively affect their international competitiveness. Their exports become more expensive relative to those of countries with lower inflation, potentially leading to a decline in exports and a worsening trade balance. This can especially hurt countries heavily reliant on exports for economic growth.

9. Redistributive Effects:

Cost-push inflation has significant redistributive effects. It disproportionately impacts fixed-income earners, retirees, and those on low incomes, as their incomes do not adjust as quickly as prices. This can lead to increased income inequality and social unrest. Creditors also suffer as the real value of their loans declines due to higher inflation.

10. Impact on Government Policy:

Governments face a difficult policy challenge when dealing with cost-push inflation. Monetary policy tools, such as raising interest rates, can be effective but may also lead to a recession. Fiscal policy measures, such as subsidies or tax cuts, can help alleviate the impact on businesses and consumers, but might also exacerbate inflationary pressures. Finding the right balance between combating inflation and supporting economic growth requires careful policy navigation.

Mitigating the Effects of Cost-Push Inflation

Addressing cost-push inflation requires a multifaceted approach involving both government intervention and private sector adjustments:

-

Supply-side policies: Governments can implement policies to boost productivity and increase supply, thus alleviating pressure on prices. This includes investments in infrastructure, education, and technology. Deregulation in certain sectors can also improve efficiency and reduce costs.

-

Wage moderation: Encouraging wage restraint through negotiations or productivity-linked wage increases can prevent wages from becoming a significant driver of inflation.

-

Competition policy: Promoting competition among businesses can prevent excessive price increases by encouraging companies to keep their prices in check.

-

International cooperation: Coordinating policies with other countries can help manage global commodity prices and supply chain disruptions.

-

Managing expectations: Central banks can play a role in managing inflationary expectations through clear communication about their monetary policy objectives. This can help prevent self-fulfilling prophecies of rising inflation.

Conclusion: Navigating the Complexities of Cost-Push Inflation

Cost-push inflation poses a substantial threat to economic stability and prosperity. Its primary effects – reduced output, unemployment, decreased purchasing power, and increased inequality – highlight the need for proactive and well-coordinated policy responses. Understanding the root causes and the intricate ways in which cost-push inflation impacts the economy is essential for businesses, policymakers, and individuals to navigate the challenges and mitigate the negative consequences. The effectiveness of policy responses depends greatly on anticipating the specific inflationary pressures and tailoring solutions to the unique characteristics of each economic scenario. The long-term economic health and social well-being of a nation are significantly influenced by its ability to successfully manage and mitigate the adverse effects of cost-push inflation.

Latest Posts

Latest Posts

-

Use Or To Compare The Following Numbers

Apr 01, 2025

-

The Roi Formula Typically Uses Blank

Apr 01, 2025

-

5x 15 20x 10

Apr 01, 2025

-

To Avoid Fatigue When Should Team Roles Alternate Providing Compressions

Apr 01, 2025

-

When Handling Dod Legacy Marked Material

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about What Are The Primary Effects Of Cost Push Inflation . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.