For Compnaies Using A Cost Method Other Than Lifo

Holbox

Mar 24, 2025 · 6 min read

Table of Contents

- For Compnaies Using A Cost Method Other Than Lifo

- Table of Contents

- Beyond LIFO: Cost Accounting Methods for Companies

- Understanding Inventory Costing Methods: A Foundation

- Deep Dive into Cost Accounting Methods Other Than LIFO:

- 1. First-In, First-Out (FIFO) Method: A Detailed Look

- 2. Weighted-Average Cost Method: Balancing the Scales

- 3. Specific Identification Method: Precision and Detail

- Choosing the Right Method: Factors to Consider

- The Impact on Financial Statements: A Comparative Analysis

- Beyond the Basics: Advanced Considerations

- Conclusion: Navigating the Cost Method Landscape

- Latest Posts

- Latest Posts

- Related Post

Beyond LIFO: Cost Accounting Methods for Companies

Last-In, First-Out (LIFO) is a well-known inventory costing method, particularly popular during inflationary periods due to its tax advantages. However, LIFO isn't suitable for all businesses, and many companies opt for alternative cost accounting methods. This comprehensive guide explores various cost methods other than LIFO, delving into their intricacies, advantages, disadvantages, and suitability for different businesses. Choosing the right method is crucial for accurate financial reporting, effective inventory management, and informed business decisions.

Understanding Inventory Costing Methods: A Foundation

Before diving into specific methods, it's essential to understand the fundamental principles of inventory costing. Inventory costing methods determine the value of goods sold and the value of ending inventory. This impacts several key financial statements, including the income statement (Cost of Goods Sold) and the balance sheet (Inventory). The choice of method significantly influences profitability, taxes, and overall financial picture. The primary methods, besides LIFO, are:

- First-In, First-Out (FIFO): This method assumes that the oldest inventory items are sold first. This often mirrors the actual flow of goods in many businesses.

- Weighted-Average Cost: This method calculates a weighted-average cost for all inventory items during a period. It averages the cost of goods available for sale and divides it by the number of units available.

- Specific Identification: This method directly tracks the cost of each individual item. It's commonly used for businesses dealing with high-value, easily identifiable items like cars or jewelry.

Deep Dive into Cost Accounting Methods Other Than LIFO:

1. First-In, First-Out (FIFO) Method: A Detailed Look

How it Works: FIFO assumes that the oldest inventory items are sold first. The cost of goods sold (COGS) is calculated using the cost of the oldest inventory, while the ending inventory reflects the cost of the newest inventory.

Advantages of FIFO:

- Simplicity: Relatively easy to understand and implement.

- Relevance: Often closely reflects the actual physical flow of goods.

- Accurate Valuation: Provides a more accurate valuation of ending inventory, particularly in stable price environments.

- Lower Tax Liability (during deflation): During periods of deflation, FIFO can lead to a lower tax liability because the cost of goods sold will be higher, reducing net income.

Disadvantages of FIFO:

- Higher Tax Liability (during inflation): During periods of inflation, FIFO results in a lower cost of goods sold, leading to higher net income and thus higher taxes.

- Doesn't Always Reflect Reality: In some businesses, the actual flow of goods might not strictly adhere to a FIFO sequence.

2. Weighted-Average Cost Method: Balancing the Scales

How it Works: The weighted-average cost method calculates a weighted-average cost for all units available for sale during a period. This average cost is then applied to both the cost of goods sold and the ending inventory.

Advantages of Weighted-Average Cost:

- Simplicity: Easier to implement compared to FIFO or specific identification, especially for businesses with large inventory volumes.

- Smoothing: Smooths out price fluctuations, providing a more stable cost of goods sold.

- Reduced Administrative Burden: Requires less record-keeping than FIFO or specific identification.

Disadvantages of Weighted-Average Cost:

- Less Accurate: Doesn't always reflect the true cost of goods sold or ending inventory.

- Not Suitable for Perishable Goods: Not ideal for businesses dealing with highly perishable goods where the cost can vary significantly over time.

3. Specific Identification Method: Precision and Detail

How it Works: This method directly traces the cost of each individual item sold. It requires meticulous record-keeping to track each item's cost from purchase to sale.

Advantages of Specific Identification:

- Accuracy: Provides the most accurate cost of goods sold and ending inventory.

- Ideal for High-Value Items: Especially suitable for businesses dealing with unique or high-value items where precise cost tracking is crucial.

Disadvantages of Specific Identification:

- High Administrative Costs: Requires significant administrative effort and record-keeping.

- Complexity: More complex to implement and maintain than other methods.

- Potential for Manipulation: Provides opportunities for manipulation if not properly controlled.

Choosing the Right Method: Factors to Consider

Selecting the appropriate inventory costing method is a critical decision with significant implications for financial reporting and tax liabilities. Several factors must be carefully considered:

-

Nature of Inventory: The type of inventory plays a crucial role. Businesses with easily identifiable, high-value items might prefer specific identification, while those with homogenous, low-value items might find weighted-average more practical.

-

Industry Practices: Certain industries might favor specific methods due to regulatory requirements or industry standards.

-

Tax Implications: Understanding the tax implications of each method is crucial, especially during periods of inflation or deflation.

-

Cost of Implementation: Consider the cost of implementing and maintaining each method. Specific identification, for example, demands significant administrative resources.

-

Materiality: For businesses with large inventory turnover, the impact of choosing one method over another might be insignificant. In such cases, simpler methods may be preferred.

The Impact on Financial Statements: A Comparative Analysis

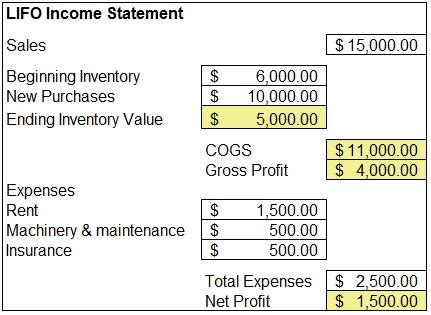

The choice of inventory costing method directly impacts a company's financial statements. Let's compare how FIFO and weighted-average methods affect key financial metrics:

| Metric | FIFO | Weighted-Average |

|---|---|---|

| Cost of Goods Sold | Lower during inflation, higher during deflation | Average cost, less susceptible to fluctuations |

| Gross Profit | Higher during inflation, lower during deflation | Less volatile |

| Net Income | Higher during inflation, lower during deflation | Less volatile |

| Ending Inventory | Reflects current market prices | Reflects an average of past and current prices |

Beyond the Basics: Advanced Considerations

-

Software and Automation: Inventory management software can significantly streamline the process of tracking inventory costs and calculating COGS, regardless of the chosen method.

-

Internal Controls: Robust internal controls are crucial to ensure accuracy and prevent manipulation, regardless of the inventory costing method. Regular audits and reconciliation procedures are vital.

-

Periodic vs. Perpetual Inventory Systems: The choice between periodic and perpetual inventory systems also impacts how the inventory costing method is applied. Perpetual systems continuously update inventory records, allowing for real-time tracking of costs. Periodic systems update inventory records only at the end of a period.

Conclusion: Navigating the Cost Method Landscape

Selecting the optimal inventory costing method requires careful consideration of several factors. While LIFO offers tax advantages in certain situations, other methods, such as FIFO, weighted-average, and specific identification, offer their own strengths and weaknesses. A thorough understanding of each method's implications on financial reporting, tax liabilities, and overall business strategy is critical. Businesses should consult with accounting professionals to determine the method best suited to their specific needs and circumstances. Remember to regularly review and adapt your chosen method as your business evolves and market conditions change. The key is selecting a method that ensures accurate financial reporting while aligning with your business objectives.

Latest Posts

Latest Posts

-

The Herfindahl Index For A Pure Monopolist Is

Mar 27, 2025

-

Table 1 Earthquake Triangulation Via Three Seismograph Stations

Mar 27, 2025

-

Simulation To Produce An Aggregate Plan

Mar 27, 2025

-

Significant Noncash Transactions Would Not Include

Mar 27, 2025

-

Apple Is Regularly Targeted By Law Officials Because They

Mar 27, 2025

Related Post

Thank you for visiting our website which covers about For Compnaies Using A Cost Method Other Than Lifo . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.