The Herfindahl Index For A Pure Monopolist Is

Holbox

Mar 27, 2025 · 5 min read

Table of Contents

- The Herfindahl Index For A Pure Monopolist Is

- Table of Contents

- The Herfindahl Index for a Pure Monopolist: A Deep Dive

- Understanding the Herfindahl-Hirschman Index (HHI)

- The HHI for a Pure Monopolist: A Singular Case

- Limitations of HHI in a Monopoly Context

- 1. Lack of Granularity:

- 2. Ignores Non-Market Factors:

- 3. Static Nature:

- Beyond the HHI: Analyzing Monopolies

- Antitrust Implications and the HHI

- Conclusion: The HHI's Limited, Yet Valuable Role

- Latest Posts

- Latest Posts

- Related Post

The Herfindahl Index for a Pure Monopolist: A Deep Dive

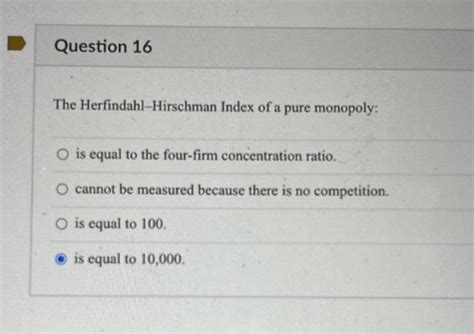

The Herfindahl-Hirschman Index (HHI) is a common measure of market concentration, providing insights into the competitive landscape of an industry. While often used to assess the competitiveness of markets with multiple firms, its application to a pure monopolist presents a unique scenario. This article delves into the implications of calculating the HHI for a pure monopolist, exploring its limitations and providing a nuanced understanding of its role in antitrust analysis and market structure evaluation.

Understanding the Herfindahl-Hirschman Index (HHI)

The HHI is calculated by squaring the market share of each firm in an industry and then summing the results. The formula is:

HHI = Σ (Market Shareᵢ)²

where:

- Market Shareᵢ represents the market share of firm i.

A higher HHI indicates greater market concentration. Generally, the following classifications are used:

- HHI below 1500: Represents a largely unconcentrated market.

- HHI between 1500 and 2500: Suggests a moderately concentrated market.

- HHI above 2500: Indicates a highly concentrated market.

The HHI for a Pure Monopolist: A Singular Case

In a pure monopoly, a single firm controls the entire market. This means one firm holds 100% of the market share. Therefore, the calculation of the HHI becomes strikingly simple:

HHI = (100%)² = 100,000

This exceptionally high HHI value unequivocally demonstrates the complete lack of competition. This result aligns perfectly with the definition of a pure monopoly—a market structure dominated by a single seller.

Limitations of HHI in a Monopoly Context

While the HHI effectively highlights the monopolistic nature of the market, it presents several limitations when applied to this extreme scenario:

1. Lack of Granularity:

The HHI's strength lies in its ability to differentiate between varying degrees of competition among multiple firms. In a pure monopoly, however, this granularity is lost. The index simply confirms the already obvious: the presence of a single, dominant player. It doesn't offer any further insights into the subtleties of market power or the potential for future competition.

2. Ignores Non-Market Factors:

The HHI focuses solely on market share. It fails to account for other crucial factors that might influence market dynamics, even in a monopolistic setting. These factors include:

- Potential Entry: The HHI doesn't inherently assess the ease or difficulty of new firms entering the market. Even a monopolist might face potential competition if entry barriers are low.

- Technological Innovation: A monopolist might be challenged by technological advancements that disrupt the market, rendering the current HHI value irrelevant in the future.

- Government Regulation: Regulatory interventions, such as price controls or antitrust actions, can significantly impact the monopolist's market power, a factor not directly captured by the HHI.

- Substitute Goods: The availability of substitute goods and services can constrain a monopolist's ability to exert its market power, a factor not reflected in the simple HHI calculation.

3. Static Nature:

The HHI is a snapshot in time. It doesn't capture the dynamic nature of markets. Market share can fluctuate due to various internal and external factors. A high HHI today might not reflect the market's structure tomorrow. This is particularly relevant in rapidly evolving industries.

Beyond the HHI: Analyzing Monopolies

While the HHI provides a clear indication of a monopolistic market, it's crucial to employ more comprehensive analytical tools to fully understand the implications of this market structure. These tools include:

- Market Definition: Precisely defining the relevant market is crucial. A seemingly high market share might be misleading if the market definition is too narrow. A broader market definition might reveal more potential competitors.

- Barriers to Entry: Analyzing the barriers to entry—such as high capital costs, stringent regulations, or proprietary technology—helps assess the long-term sustainability of the monopoly.

- Pricing Behavior: Examining the pricing strategies employed by the monopolist can reveal the extent of its market power. Monopolies often engage in price discrimination or limit pricing to maintain their dominance.

- Consumer Welfare Analysis: Assessing the impact of the monopoly on consumer welfare is crucial. Monopolies often lead to higher prices, reduced output, and lower consumer surplus.

- Dynamic Analysis: A dynamic analysis, considering factors such as technological innovation, potential entry, and changes in consumer preferences, provides a more complete picture of the market's evolution.

Antitrust Implications and the HHI

The HHI plays a significant role in antitrust policy. While a pure monopoly would immediately raise antitrust concerns, the HHI's use is more nuanced in cases involving oligopolistic markets (markets dominated by a few firms). Antitrust agencies often use the HHI, in conjunction with other factors, to assess the potential for anti-competitive behavior, such as mergers and acquisitions.

Conclusion: The HHI's Limited, Yet Valuable Role

The Herfindahl-Hirschman Index provides a straightforward method for identifying a pure monopoly – an HHI of 100,000 clearly signifies complete market control by a single firm. However, its usefulness is limited when dealing with this extreme case. While the HHI readily identifies the existence of a monopoly, it doesn't offer nuanced insights into the underlying dynamics of the market. A deeper understanding necessitates a comprehensive analysis, going beyond the HHI to examine market definition, entry barriers, pricing strategies, consumer welfare, and dynamic market forces. This multifaceted approach allows for a richer understanding of the implications of a monopolistic market structure and informs effective policy interventions. Therefore, the HHI's value lies not in its capacity for deep analysis of a monopoly, but rather its role as a quick identifier of a situation requiring more thorough investigation. It serves as a warning flag, prompting a deeper dive into the intricacies of market power and its impact on competition and consumer welfare. Using the HHI as a single indicator for a monopoly would be an oversimplification, necessitating a more detailed and context-specific investigation.

Latest Posts

Latest Posts

-

Match Each Erythrocyte Disorder To Its Cause Or Definition

Mar 31, 2025

-

Label The Veins Of The Head And Neck

Mar 31, 2025

-

When Derivatively Classifying Information Where Can You Find A Listing

Mar 31, 2025

-

True Or False Professional And Technical Communication Is Research Oriented

Mar 31, 2025

-

Express The Force As A Cartesian Vector

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about The Herfindahl Index For A Pure Monopolist Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.