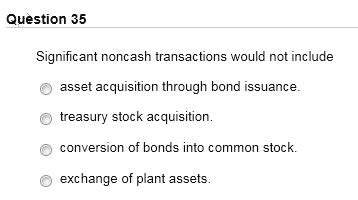

Significant Noncash Transactions Would Not Include

Holbox

Mar 27, 2025 · 5 min read

Table of Contents

- Significant Noncash Transactions Would Not Include

- Table of Contents

- Significant Noncash Transactions Would Not Include: A Comprehensive Guide

- Defining "Significant" Noncash Transactions

- Non-Significant Noncash Transactions: What They Typically Aren't

- 1. Routine Operational Transactions

- 2. Transactions with Insignificant Financial Impact

- 3. Transactions Involving Intangible Assets with Low Value

- 4. Transactions with Minimal Risk Exposure

- Considerations for Determining Significance

- Examples of Transactions that Would Be Considered Significant

- Conclusion: Navigating the Complexity of Noncash Transactions

- Latest Posts

- Latest Posts

- Related Post

Significant Noncash Transactions Would Not Include: A Comprehensive Guide

Noncash transactions are increasingly prevalent in today's digital economy, transforming how businesses operate and individuals manage their finances. Understanding what constitutes a significant noncash transaction, and what falls outside this definition, is crucial for various reasons, including financial reporting, regulatory compliance, and fraud prevention. This article delves deep into the nuances of significant noncash transactions, exploring what they typically do not include, along with practical examples and considerations.

Defining "Significant" Noncash Transactions

Before we explore what wouldn't be considered significant, let's establish a baseline definition. The significance of a noncash transaction is usually determined relative to a company's overall financial position and activities. While there's no universally agreed-upon threshold, a transaction is generally considered significant if it materially affects the financial statements, alters the company's risk profile, or has a substantial impact on key performance indicators (KPIs). This assessment often involves both quantitative and qualitative factors.

Quantitative factors might include:

- Transaction Value: A large monetary value relative to the company's assets, revenues, or expenses.

- Volume: A high number of transactions within a specific period.

- Impact on Ratios: A significant change in key financial ratios (e.g., liquidity, solvency, profitability).

Qualitative factors might consider:

- Strategic Importance: The transaction's impact on the company's long-term strategic goals.

- Risk Exposure: The level of risk associated with the transaction (e.g., credit risk, operational risk).

- Compliance Implications: Potential impact on regulatory compliance.

Non-Significant Noncash Transactions: What They Typically Aren't

Now, let's examine types of noncash transactions that generally wouldn't be considered significant. It's vital to remember that context is key – a transaction deemed insignificant for a large multinational corporation might be highly significant for a small business.

1. Routine Operational Transactions

Many everyday business transactions are noncash but fall far below the significance threshold. These include:

- Small-value credit card and debit card payments: Everyday purchases with relatively small transaction amounts are typically not considered significant. This includes payments for office supplies, employee meals, or minor equipment repairs.

- Electronic Funds Transfers (EFTs) for salaries and wages: While EFTs represent a considerable volume of transactions, the individual payments, unless exceptionally large, generally don't qualify as significant.

- Utility bill payments via online banking: Regular payments for utilities such as electricity, water, and gas, made through automated systems, are rarely deemed significant.

- Inter-company transfers of funds: Transfers of funds between different divisions or subsidiaries of the same company are often not considered significant, especially if they represent routine operational activity.

2. Transactions with Insignificant Financial Impact

These transactions have a negligible impact on the company's overall financial health:

- Accruals and deferrals: Accounting adjustments for expenses incurred but not yet paid, or revenues received but not yet earned, are routine accounting practices that rarely qualify as significant noncash transactions.

- Adjustments for bad debts: Writing off small amounts of uncollectible accounts receivable does not typically trigger significance concerns.

- Minor stock splits or dividends: Small stock splits or dividend payments, proportionally distributed among shareholders, have a limited impact on the overall financial position of the company.

3. Transactions Involving Intangible Assets with Low Value

While transactions involving intangible assets can be significant, those related to assets of low value are usually not:

- Transfer of in-house developed software: Moving internally developed software between departments is usually considered an internal resource allocation and not a significant noncash event.

- Licensing of minor intellectual property: Licensing of low-value intellectual property rights does not typically necessitate separate disclosure as a significant noncash transaction.

4. Transactions with Minimal Risk Exposure

Certain noncash transactions carry minimal risk and therefore might not be considered significant:

- Non-material debt restructurings: Minor adjustments to loan terms, like extending payment deadlines by a short period, are usually not significant.

- Internal resource allocation: Transfers of resources or assets within a company, such as the transfer of equipment between departments, are generally not considered significant unless the value is exceptionally high.

Considerations for Determining Significance

The determination of significance is highly context-dependent. Several critical factors must be considered:

- Company Size and Industry: A transaction deemed insignificant for a large corporation might be significant for a small business. Industry standards and benchmarks can also influence this determination.

- Materiality Threshold: Companies often set their own materiality thresholds, which help guide the assessment of whether a transaction is significant or not. This threshold will vary depending on the company's specific circumstances.

- Regulatory Requirements: Specific industries are subject to stricter reporting and disclosure requirements. For example, banks and financial institutions have more stringent guidelines.

- Internal Controls: Strong internal control systems are essential for accurate identification and reporting of significant noncash transactions.

Examples of Transactions that Would Be Considered Significant

To further clarify the concept, let's look at transactions that would generally be classified as significant noncash transactions:

- Mergers and Acquisitions: The combining of two or more companies is a fundamentally transformative event, significantly impacting the financial statements and business operations.

- Significant Asset Sales or Exchanges: Disposing of a substantial portion of a company's assets, such as a major factory or production facility, would be considered a significant event.

- Debt Restructuring: Major changes in debt agreements, including significant modifications to loan terms, interest rates, or principal repayments.

- Large-Scale Investments: Substantial investments in new facilities, equipment, or technology often have a significant impact on a company’s financial position and future operations.

- Issuance of Stock or Bonds: Raising capital through issuing new stock or bonds can significantly alter the company's capital structure and financial statements.

- Significant Write-downs or Impairments: Writing down the value of a substantial asset (due to impairment or obsolescence) can significantly impact the company's financial position.

Conclusion: Navigating the Complexity of Noncash Transactions

The identification and classification of significant noncash transactions are complex processes requiring careful consideration of numerous factors. While routine, small-value transactions are generally not significant, larger transactions with a material impact on the financial statements or company operations must be carefully documented and disclosed. Understanding the nuances of what constitutes a significant noncash transaction is vital for financial reporting accuracy, regulatory compliance, and effective risk management. This comprehensive understanding helps businesses make informed decisions, maintain financial stability, and adhere to legal and accounting standards. Seeking expert advice from accounting professionals is recommended for businesses facing complex situations or uncertain scenarios.

Latest Posts

Latest Posts

-

Monopolistic Competition Resembles Pure Competition Because

Mar 31, 2025

-

Identify The Expected Major Product Of The Following Reaction

Mar 31, 2025

-

Object A Is Released From Rest At Height H

Mar 31, 2025

-

Which One Of The Following Is A Source Of Cash

Mar 31, 2025

-

The Contribution Margin Equals Sales Minus All

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Significant Noncash Transactions Would Not Include . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.