Compute The Cost Of Direct Labor Used For The Period

Holbox

Mar 19, 2025 · 6 min read

Table of Contents

Computing the Cost of Direct Labor Used for the Period: A Comprehensive Guide

Accurately calculating the cost of direct labor is crucial for any manufacturing or production-based business. Understanding this cost is vital for setting prices, managing profitability, and making informed business decisions. This comprehensive guide will walk you through the process of computing the cost of direct labor used for a specific period, covering various aspects and potential complexities.

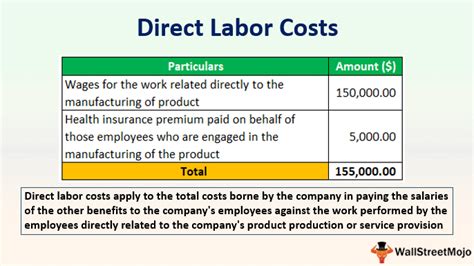

Understanding Direct Labor Costs

Direct labor refers to the wages and salaries paid to employees directly involved in the production process. This contrasts with indirect labor, which includes the salaries of employees who support production but don't directly participate in it (e.g., supervisors, maintenance personnel). Accurately classifying labor is essential for accurate cost accounting.

Key characteristics of direct labor:

- Directly traceable: The labor cost can be directly attributed to specific products or services.

- Manufacturing-related: The work performed is directly involved in the transformation of raw materials into finished goods.

- Easily quantifiable: The time spent and wages paid are readily measurable.

Components of Direct Labor Cost

The cost of direct labor typically includes more than just the employee's base hourly or salary rate. A comprehensive calculation must consider several components:

1. Gross Wages and Salaries

This is the most straightforward component, representing the total amount paid to employees for their work during the period. It includes:

- Hourly wages: The basic pay rate multiplied by the number of hours worked.

- Salaries: Fixed annual or monthly compensation paid to employees.

- Overtime pay: Compensation paid at a higher rate for hours worked beyond regular working hours. This is often 1.5 or 2 times the regular rate.

- Bonuses and commissions: Incentive payments tied to performance or output. These are often included if directly related to production volume.

2. Employee Benefits

Employee benefits represent a significant portion of the total labor cost. These include:

- Payroll taxes: Employer contributions to Social Security, Medicare, and unemployment insurance. These are mandatory in most jurisdictions.

- Health insurance: Employer contributions towards employee health insurance premiums.

- Retirement plan contributions: Employer matching contributions to employee retirement accounts (e.g., 401k).

- Paid time off: Wages paid to employees during vacation, sick leave, and other absences. This represents an indirect cost, but critical in total labor expenses.

- Workers' compensation insurance: Premiums paid to cover workplace injuries and illnesses.

3. Other Direct Labor Costs

Depending on the industry and specific circumstances, other costs might be considered part of direct labor:

- Training costs: Expenses related to training employees on specific production techniques.

- Safety equipment: Costs of providing safety gear and apparel directly used by production workers.

- Relocation expenses (for specific hires): Costs associated with relocating employees to work at the production facility. This cost is usually only accounted for specific situations or for specific highly skilled employees whose movement is critical to production.

Calculating Direct Labor Cost: A Step-by-Step Approach

Let's illustrate the calculation with a hypothetical example:

Scenario: A manufacturing company employs 10 direct labor workers for the month of October. Each worker earns an hourly wage of $20 and works 160 hours per month. The company also pays 7.65% for payroll taxes, 10% for health insurance, and 5% for retirement contributions. In October, two workers received $500 bonuses for exceeding production targets.

Step 1: Calculate Gross Wages

- Total regular hours worked: 10 workers * 160 hours/worker = 1600 hours

- Total regular wages: 1600 hours * $20/hour = $32,000

- Total bonuses: 2 workers * $500/worker = $1000

- Total gross wages: $32,000 + $1000 = $33,000

Step 2: Calculate Employee Benefits

- Payroll taxes: $33,000 * 7.65% = $2524.50

- Health insurance: $33,000 * 10% = $3300

- Retirement contributions: $33,000 * 5% = $1650

- Total employee benefits: $2524.50 + $3300 + $1650 = $7474.50

Step 3: Calculate Total Direct Labor Cost

- Total direct labor cost: $33,000 (gross wages) + $7474.50 (employee benefits) = $40,474.50

Accounting for Variations and Complexities

The example above presents a simplified calculation. Real-world scenarios often involve additional complexities:

Variable Labor Rates

Employees might have different hourly rates based on experience, skill level, or job classification. The calculation needs to account for these variations by summing the wages paid to each employee separately.

Non-Uniform Work Schedules

Employees may not work a consistent number of hours each week or month. Accurate tracking of hours worked is crucial for calculating accurate direct labor costs. Timekeeping systems and project management software can be instrumental here.

Outsourcing and Contract Labor

If the company utilizes outsourced labor or independent contractors, the cost calculation will differ. The costs involved might include payments to contractors, plus any fees paid to staffing agencies.

Labor Burden Rates

Some companies use labor burden rates to simplify the calculation. A labor burden rate includes all associated costs (wages, benefits, payroll taxes) expressed as a percentage of the gross wages. This simplifies the calculation but requires careful monitoring and adjustments to reflect changes in benefits costs.

Inventory Valuation Methods

The method used to value inventory (e.g., FIFO, LIFO) can affect how direct labor costs are allocated to the cost of goods sold (COGS) and ending inventory. This is particularly relevant when using cost accounting methods like absorption costing.

The Importance of Accurate Direct Labor Costing

Accurate direct labor costing is essential for several reasons:

- Pricing decisions: Accurate cost data is crucial for setting competitive and profitable product prices. Underestimating direct labor costs can lead to losses.

- Inventory valuation: Correctly valuing inventory is critical for financial reporting and tax purposes.

- Cost control: Tracking direct labor costs helps identify areas for potential cost savings and efficiency improvements.

- Performance evaluation: Comparing actual direct labor costs against budgets and standards provides insights into operational efficiency.

- Production planning: Accurate cost projections are essential for effective production planning and resource allocation.

Advanced Techniques and Software

For larger organizations, more sophisticated methods and software solutions are often used to manage and track direct labor costs. These might include:

- Enterprise resource planning (ERP) systems: Integrate various business functions, including labor cost management.

- Time and attendance systems: Provide accurate records of employee hours worked.

- Cost accounting software: Specialised software packages designed for detailed cost tracking and analysis.

Conclusion

Calculating the cost of direct labor used for a specific period is a multifaceted process. A thorough understanding of the components involved, from gross wages and salaries to employee benefits and other associated expenses, is vital for accurate calculation. By diligently tracking and analyzing direct labor costs, businesses can make better decisions regarding pricing, resource allocation, and overall profitability. Regular review and adjustments to the calculation methodology are also essential to maintain accuracy in the face of changing circumstances and regulations. Ultimately, mastering the art of accurate direct labor costing is a cornerstone of sound financial management for any manufacturing or production-based enterprise.

Latest Posts

Latest Posts

-

At A Team Meeting The Restaurant Manager

Mar 19, 2025

-

All Of The Following Are Heart Valves Except

Mar 19, 2025

-

Draw The Correct Organic Product Of The Oxidation Reaction Shown

Mar 19, 2025

-

Budget Compare Actual Results To Budgeted Results

Mar 19, 2025

-

Find As A Function Of If

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about Compute The Cost Of Direct Labor Used For The Period . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.