Budget Compare Actual Results To Budgeted Results.

Holbox

Mar 13, 2025 · 7 min read

Table of Contents

Budget vs. Actual: A Deep Dive into Comparing Your Budget to Reality

Budgeting is crucial for any successful business, regardless of size or industry. It provides a roadmap for financial planning, allowing you to allocate resources effectively and track progress towards your financial goals. However, a budget is only truly valuable when you actively compare it to your actual results. This process reveals areas where you're exceeding expectations, identifying opportunities for improvement, and highlighting potential problems that need immediate attention. This comprehensive guide will delve into the intricacies of comparing your budget to your actual results, offering practical strategies and insightful analysis to help you harness the full power of your budgeting process.

Understanding the Importance of Budget vs. Actual Analysis

Before we dive into the mechanics of comparison, let's reiterate the profound significance of this exercise. Simply creating a budget isn't enough; you must regularly analyze the differences between your planned expenditures and your actual spending. This process, often referred to as variance analysis, provides valuable insights into:

Identifying Areas of Strength:

By comparing your budget to your actual results, you can pinpoint areas where you're performing exceptionally well. Perhaps your sales team exceeded revenue projections, or you implemented cost-cutting measures that yielded significant savings. Recognizing these successes allows you to replicate them in the future and build upon your strengths.

Highlighting Areas for Improvement:

Conversely, variance analysis also reveals areas where you're falling short of your targets. Maybe your marketing campaign didn't generate the expected leads, or your operational expenses were higher than anticipated. This identification of weaknesses is the first step towards implementing corrective actions and improving your financial performance.

Proactive Problem Solving:

Early detection of significant variances allows you to address potential problems before they escalate into major crises. For instance, a consistent overspending in a particular area might indicate an underlying inefficiency that needs to be addressed promptly.

Improved Future Budgeting:

The insights gained from comparing your budget to your actuals provide invaluable data for refining your future budgets. By understanding past performance, you can create more realistic and accurate projections, enhancing the overall effectiveness of your financial planning.

Enhanced Accountability:

Regular budget vs. actual analysis promotes accountability within your organization. By tracking performance against established targets, you can identify areas where individuals or departments need additional support or training.

The Mechanics of Comparing Budget to Actual Results

The process of comparing budget to actual results involves several key steps:

1. Gather Data:

The first step is to collect all the necessary data. This includes your original budget, along with all your actual financial statements, including income statements, balance sheets, and cash flow statements. Ensure data accuracy is paramount; errors at this stage will skew your entire analysis.

2. Choose a Time Period:

Decide on the time period for your comparison. This could be monthly, quarterly, or annually, depending on your reporting frequency and the level of detail required. Comparing data across shorter timeframes allows for quicker identification and correction of discrepancies.

3. Develop a Comparison Format:

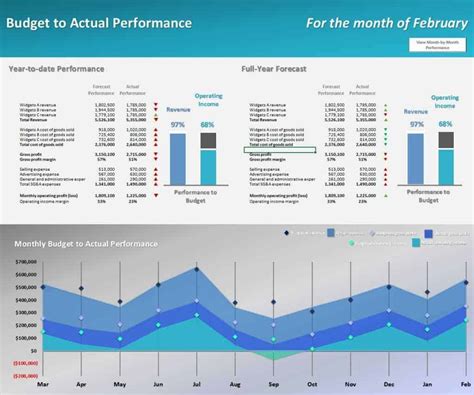

Create a clear and concise format to compare your budget to your actuals. This often involves a spreadsheet or dedicated budgeting software that allows you to easily visualize the differences between planned and actual figures. Consider including columns for:

- Budget: The original budgeted amount.

- Actual: The actual amount spent or earned.

- Variance: The difference between the budget and the actual (Actual – Budget).

- Variance Percentage: The variance expressed as a percentage of the budget [(Actual – Budget) / Budget] * 100.

4. Analyze Variances:

Once you have the data organized, analyze the variances. Focus on understanding why the variances occurred. Were they due to unforeseen circumstances, inaccurate budgeting, or operational inefficiencies? Investigate significant variances thoroughly to uncover the root causes.

5. Categorize Variances:

Categorize your variances to facilitate analysis and identification of patterns. For example, you can categorize variances by department, product line, or expense type. This will help you pinpoint areas requiring immediate attention and strategically allocate resources for improvement.

6. Report and Communicate Findings:

Once you’ve completed your analysis, report your findings to relevant stakeholders. Use clear and concise language, supported by visual aids like charts and graphs, to effectively communicate your results and recommendations. Transparency is crucial to ensure everyone understands the financial performance and potential areas for improvement.

Types of Variances and Their Interpretation

Understanding the different types of variances is critical to effective budget vs. actual analysis. Here are some common types:

Favorable Variance:

A favorable variance occurs when actual results exceed budgeted expectations. For example, higher-than-anticipated sales revenue or lower-than-budgeted expenses are favorable variances.

Unfavorable Variance:

An unfavorable variance occurs when actual results fall short of budgeted expectations. For example, lower-than-anticipated sales revenue or higher-than-budgeted expenses are unfavorable variances.

Sales Price Variance:

This variance measures the difference between the actual selling price and the budgeted selling price, multiplied by the actual number of units sold. A positive variance indicates that the selling price was higher than anticipated, while a negative variance suggests the opposite.

Sales Volume Variance:

This variance measures the difference between the actual sales volume and the budgeted sales volume, multiplied by the budgeted selling price. A positive variance indicates higher sales volume than expected, and a negative variance shows lower sales than anticipated.

Purchase Price Variance:

This variance measures the difference between the actual purchase price and the budgeted purchase price, multiplied by the actual quantity purchased. It's crucial for managing inventory costs and identifying potential savings through better supplier negotiations.

Material Usage Variance:

This variance measures the difference between the actual quantity of materials used and the budgeted quantity, multiplied by the budgeted material price. It highlights inefficiencies in production processes and potential areas for waste reduction.

Labor Rate Variance:

This variance measures the difference between the actual labor rate and the budgeted labor rate, multiplied by the actual labor hours worked. It helps in evaluating wage negotiations and potential areas for cost optimization.

Labor Efficiency Variance:

This variance measures the difference between the actual labor hours worked and the budgeted labor hours, multiplied by the budgeted labor rate. It highlights inefficiencies in labor utilization and potential areas for process improvement.

Advanced Techniques for Budget vs. Actual Analysis

Beyond the basic comparison, several advanced techniques can enhance the depth and effectiveness of your analysis:

Trend Analysis:

Analyzing variances over time can reveal patterns and trends that may not be apparent from a single period's comparison. Tracking variances month-over-month or year-over-year can identify recurring issues or emerging trends.

Benchmarking:

Comparing your budget vs. actual results to industry benchmarks or competitors' performance can provide valuable context and identify areas where you need to improve. This comparative analysis helps assess your relative performance and sets realistic goals for future periods.

Root Cause Analysis:

Employing root cause analysis techniques, such as the "5 Whys" method, can help you delve deeper into the reasons behind significant variances, uncovering underlying issues that require systemic solutions.

Scenario Planning:

Developing different scenarios based on varying assumptions can help you proactively address potential challenges and opportunities. For example, you can analyze the impact of different economic conditions or market changes on your budget and actual results.

Utilizing Technology for Efficient Comparison

Leveraging technology can significantly streamline the budget vs. actual comparison process. Budgeting software and financial management systems automate data collection, calculation, and reporting, freeing up your time to focus on analysis and strategic decision-making. These systems often provide sophisticated visualization tools, enabling clear and concise communication of your findings.

Conclusion: Turning Insights into Action

Comparing your budget to your actual results is not simply a bookkeeping exercise; it's a critical management tool. By diligently tracking variances, understanding their root causes, and implementing corrective actions, you can transform financial data into actionable insights that drive improved performance and sustainable growth. The process allows for continuous improvement, leading to more accurate forecasting, effective resource allocation, and ultimately, a healthier financial future for your business. Remember that consistent and proactive budget vs. actual analysis is a key ingredient in building a financially robust and successful enterprise.

Latest Posts

Latest Posts

-

A Departmental Contribution To Overhead Report Is Based On

Mar 13, 2025

-

Which Of The Following Is True About The

Mar 13, 2025

-

Logisctix Company Had The Following Tiems

Mar 13, 2025

-

When Does The Engage Stage Of The Inbound Methodology Begin

Mar 13, 2025

-

What Intoxications Signs Was John Showing

Mar 13, 2025

Related Post

Thank you for visiting our website which covers about Budget Compare Actual Results To Budgeted Results. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.