A Departmental Contribution To Overhead Report Is Based On

Holbox

Mar 15, 2025 · 7 min read

Table of Contents

- A Departmental Contribution To Overhead Report Is Based On

- Table of Contents

- A Departmental Contribution to Overhead Report is Based On: A Deep Dive into Allocation Methods

- The Nature of Overhead Costs

- Common Methods for Allocating Overhead Costs

- 1. Direct Labor Hours: A Classic Approach

- 2. Machine Hours: For Manufacturing Environments

- 3. Square Footage: Space as a Cost Driver

- 4. Revenue: A Sales-Driven Approach

- 5. Activity-Based Costing (ABC): A More Sophisticated Method

- Choosing the Right Allocation Method

- Analyzing the Departmental Contribution to Overhead Report

- Using the Report for Improved Decision Making

- Beyond the Numbers: Qualitative Considerations

- Conclusion: A Powerful Management Tool

- Latest Posts

- Latest Posts

- Related Post

A Departmental Contribution to Overhead Report is Based On: A Deep Dive into Allocation Methods

Understanding how a department contributes to overhead costs is crucial for effective cost management and resource allocation. A departmental contribution to overhead report doesn't simply list expenses; it dissects the complex relationship between departmental activities and indirect costs. This report is a powerful tool for identifying areas of inefficiency, optimizing resource utilization, and ultimately, improving profitability. This in-depth guide explores the various bases upon which a departmental contribution to overhead is calculated, providing a clear understanding of the methodologies and their implications.

The Nature of Overhead Costs

Before delving into allocation methods, it's essential to define overhead costs. These are indirect costs that are difficult or impossible to directly trace to a specific product, service, or department. They are the costs of running the business as a whole, supporting multiple departments and activities. Examples include:

- Rent: The cost of the building housing multiple departments.

- Utilities: Electricity, water, and heating bills.

- Administrative Salaries: Salaries of staff not directly involved in production or service delivery.

- Depreciation: The decline in value of assets like machinery and equipment.

- Insurance: Premiums for various business insurance policies.

- Maintenance and Repairs: Costs associated with keeping equipment and facilities operational.

These costs are not directly attributable to a single department, making allocation crucial for accurate cost accounting and performance evaluation.

Common Methods for Allocating Overhead Costs

Several methods exist for allocating overhead costs to departments. The choice of method depends on factors like the nature of the business, the complexity of its operations, and the level of accuracy desired. Some of the most common methods include:

1. Direct Labor Hours: A Classic Approach

This is a straightforward method where overhead costs are allocated based on the number of direct labor hours worked by each department. Departments with higher direct labor hours receive a larger share of the overhead costs.

Advantages:

- Simplicity: Easy to understand and implement.

- Relevance: Directly relates overhead costs to the level of labor-intensive activity.

Disadvantages:

- Inaccuracy: Doesn't account for differences in the complexity of tasks or the skill levels of employees. A department with highly skilled, high-paid employees might have fewer hours but contribute significantly more to overall value.

- Inapplicable to Automated Processes: In businesses with high levels of automation, direct labor hours may not be a relevant measure of overhead contribution.

Example: If Department A uses 1000 direct labor hours and Department B uses 500, and total overhead is $15,000, Department A would be allocated $10,000 and Department B $5,000.

2. Machine Hours: For Manufacturing Environments

In manufacturing settings, machine hours are a better indicator of overhead consumption. The allocation is based on the number of machine hours used by each department. Departments using more machine time are allocated a higher share of the overhead.

Advantages:

- Relevance in Manufacturing: Accurately reflects the contribution of departments heavily reliant on machinery.

- Simplicity: Relatively straightforward to calculate.

Disadvantages:

- Limited Applicability: Less suitable for service-based businesses or those with less reliance on machinery.

- Ignores Other Factors: Doesn't account for other factors that contribute to overhead, such as administrative support.

Example: If Department C uses 2000 machine hours and Department D uses 1000, and total overhead is $15,000, Department C would be allocated $10,000 and Department D $5,000.

3. Square Footage: Space as a Cost Driver

This method allocates overhead based on the floor space occupied by each department. Larger departments, occupying more square footage, are allocated a higher share of the overhead.

Advantages:

- Direct Relationship: Directly relates overhead costs like rent, utilities, and maintenance to space usage.

- Simplicity: Easy to measure and calculate.

Disadvantages:

- Ignores Intensity of Use: Doesn't account for the intensity of usage of the space. A small department might be highly productive despite occupying less space.

- Limited Applicability: Not suitable for businesses where space isn't a significant driver of overhead costs.

Example: If Department E occupies 1000 sq ft and Department F occupies 500 sq ft, and total overhead related to space is $7,500, Department E would be allocated $5,000 and Department F $2,500.

4. Revenue: A Sales-Driven Approach

In some cases, overhead is allocated based on each department's revenue contribution. Departments generating more revenue are allocated a larger share of the overhead.

Advantages:

- Simple and Intuitive: Easily understood by management and stakeholders.

- Links Overhead to Revenue: Highlights the relationship between overhead and revenue generation.

Disadvantages:

- Potential for Inaccuracy: May not accurately reflect the actual contribution to overhead costs. A highly profitable department might be inefficient internally and consume more overhead.

- Discourages Cost Control: Departments might focus solely on revenue generation without regard for cost control.

Example: If Department G generates $100,000 in revenue and Department H generates $50,000, and total overhead is $15,000, Department G would be allocated $10,000 and Department H $5,000.

5. Activity-Based Costing (ABC): A More Sophisticated Method

ABC is a more sophisticated method that allocates overhead based on the activities that consume resources. It identifies the various activities within the organization and assigns overhead costs to these activities based on their consumption of resources. These costs are then allocated to departments based on their consumption of these activities.

Advantages:

- Accuracy: Provides a more accurate reflection of the actual consumption of overhead resources.

- Improved Cost Control: Allows for a deeper understanding of cost drivers, enabling better cost control.

Disadvantages:

- Complexity: More complex and time-consuming to implement.

- Cost: Requires significant resources for implementation and maintenance.

Example: ABC might allocate costs based on the number of purchase orders processed, the number of customer service calls handled, or the number of machine setups required.

Choosing the Right Allocation Method

The selection of an appropriate allocation method is crucial for producing a reliable departmental contribution to overhead report. The ideal method depends on several factors:

- Industry: Manufacturing businesses might prefer machine hours or activity-based costing, while service businesses might favor direct labor hours or revenue.

- Company Size and Structure: Larger, more complex organizations might benefit from activity-based costing, while smaller organizations might find simpler methods more suitable.

- Data Availability: The chosen method must be feasible given the available data.

- Management Objectives: The report's intended use should guide the choice of method.

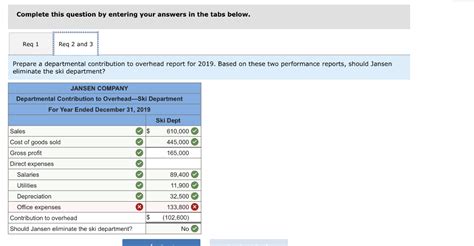

Analyzing the Departmental Contribution to Overhead Report

Once the overhead costs are allocated, the report should provide a clear picture of each department's contribution. This includes:

- Overhead Cost per Department: The total overhead cost allocated to each department.

- Overhead Cost per Unit (if applicable): The overhead cost per unit of output for each department.

- Overhead Rate: The overhead cost per unit of the allocation base (e.g., direct labor hour, machine hour, square footage).

- Comparison with Previous Periods: Tracking trends over time can reveal areas requiring attention.

Using the Report for Improved Decision Making

The departmental contribution to overhead report is not merely a static document; it's a dynamic tool for strategic decision-making. Analysis of the report can lead to:

- Identifying Inefficient Departments: Departments with disproportionately high overhead costs relative to their output may require further investigation and improvement initiatives.

- Optimizing Resource Allocation: The report can highlight areas where resources can be reallocated more efficiently.

- Improving Cost Control: By understanding the drivers of overhead costs, the organization can implement targeted cost-reduction strategies.

- Setting Performance Targets: The report can be used to set realistic and achievable performance targets for each department.

- Supporting Pricing Decisions: Understanding departmental overhead costs can inform pricing strategies.

Beyond the Numbers: Qualitative Considerations

While quantitative data is critical, the report shouldn't be interpreted solely through numbers. Qualitative factors should also be considered:

- Departmental Responsibilities: Some departments might have responsibilities that inherently lead to higher overhead costs, such as research and development or customer service.

- Long-Term Investments: Investments in new equipment or technology might initially increase overhead but ultimately lead to long-term cost savings.

- Strategic Importance: The importance of a department's contribution to the overall strategic goals of the organization should be considered.

Conclusion: A Powerful Management Tool

The departmental contribution to overhead report is a vital tool for effective cost management and resource allocation. By understanding the various allocation methods and their implications, businesses can develop a more accurate and insightful picture of their cost structure. Analyzing this report, considering both quantitative and qualitative factors, empowers organizations to make data-driven decisions, optimize operations, and improve profitability. Continuous monitoring and improvement of the reporting process ensure its ongoing value as a key component of sound financial management.

Latest Posts

Latest Posts

-

How Tall Is 130 Cm In Feet

May 21, 2025

-

How Much Is 83 Kg In Stones

May 21, 2025

-

183 Cm To Inches And Feet

May 21, 2025

-

22 Lbs Is How Many Kg

May 21, 2025

-

122 Cm To Feet And Inches

May 21, 2025

Related Post

Thank you for visiting our website which covers about A Departmental Contribution To Overhead Report Is Based On . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.