An Advantage Of Issuing Bonds Is That ______.

Holbox

Mar 14, 2025 · 6 min read

Table of Contents

An Advantage of Issuing Bonds Is That… Increased Capital Access for Growth and Expansion

Issuing bonds offers a compelling advantage to businesses and governments alike: access to significant capital without diluting ownership. This crucial benefit fuels growth, expansion, and strategic initiatives that might otherwise be unattainable through alternative financing methods. Let's delve deeper into this key advantage, exploring its nuances and demonstrating its impact on various entities.

Understanding Bond Issuance: A Quick Overview

Before we dive into the advantages, let's briefly define what a bond is. A bond is essentially a loan that an investor makes to a borrower (typically a corporation or government). The borrower agrees to repay the principal amount (the face value of the bond) at a specified maturity date, along with periodic interest payments (coupon payments). These bonds are then traded on the open market, offering investors liquidity and the ability to buy and sell them.

The process of issuing bonds involves several steps, including determining the bond's features (maturity date, interest rate, face value), securing a credit rating, and marketing the bonds to potential investors through underwriters. The complexity varies depending on the size and type of bond issuance.

Increased Capital Access: The Core Advantage

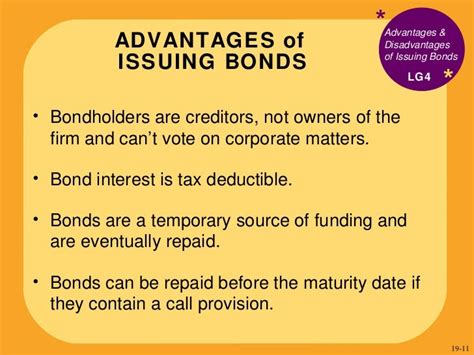

The primary advantage of issuing bonds lies in their ability to provide substantial capital infusions. Unlike equity financing (selling stock), issuing bonds does not dilute the ownership stake of existing shareholders. This is particularly crucial for businesses that want to maintain control and avoid relinquishing equity to external investors. The funds raised through bond issuance can be used for a variety of purposes, including:

- Business Expansion: Opening new facilities, expanding into new markets, or acquiring other companies.

- Infrastructure Development: For governments, bond issuance finances essential infrastructure projects like roads, bridges, schools, and hospitals.

- Debt Refinancing: Replacing existing high-interest debt with lower-cost bonds, improving the company’s financial health.

- Research and Development: Investing in innovative technologies and products to maintain a competitive edge.

- Working Capital Management: Improving cash flow and liquidity to support daily operations.

- Acquisitions and Mergers: Securing the capital needed to pursue strategic acquisitions and mergers.

Comparing Bond Issuance with Other Financing Options

Let's compare bond issuance with other common financing methods to better understand its unique strengths:

1. Equity Financing: This involves selling shares of the company's stock to investors, diluting ownership and potentially impacting control. While equity financing provides capital, it comes with the cost of sharing future profits and potentially losing control.

2. Bank Loans: Banks offer loans, but they often have stricter lending requirements and may not provide the same level of capital as bond issuance. Loan terms can also be less flexible.

3. Venture Capital: While venture capital can provide significant funding, it often demands significant equity stakes and a degree of influence over the company's operations. This can be a major disadvantage for companies seeking to retain full control.

4. Private Equity: Similar to venture capital, private equity involves significant equity investment and typically comes with conditions and managerial oversight that may not be desirable for all companies.

In contrast, bond issuance offers a relatively flexible and less intrusive method of raising capital, allowing companies and governments to retain control while accessing significant funding.

Different Types of Bonds and Their Applications

The versatility of bond issuance is further enhanced by the existence of various types of bonds, each designed to meet specific needs:

- Corporate Bonds: Issued by corporations to fund various business activities. These are often rated by credit rating agencies, which helps investors assess their risk.

- Municipal Bonds: Issued by state and local governments to finance public projects. These bonds often offer tax advantages to investors.

- Government Bonds (Treasuries): Issued by national governments, these are considered among the safest investments due to the government's backing.

- Zero-Coupon Bonds: These bonds don't pay periodic interest but are sold at a discount and mature at their face value.

- Convertible Bonds: These bonds can be converted into the issuer's stock under certain conditions, offering investors the potential for higher returns.

The choice of bond type depends on the issuer's financial situation, the intended use of funds, and the desired risk profile.

The Role of Credit Ratings and Investor Confidence

A crucial aspect of successful bond issuance is obtaining a favorable credit rating from reputable agencies like Moody's, Standard & Poor's, and Fitch. These ratings reflect the creditworthiness of the issuer and influence the interest rate the issuer will have to pay. A higher credit rating signals lower risk to investors and results in lower interest rates, making the bonds more attractive.

Investor confidence is paramount. A strong reputation, transparent financial reporting, and a well-defined business plan are essential for attracting investors and securing favorable terms for the bond issuance.

Managing the Risks Associated with Bond Issuance

While bond issuance offers significant advantages, it's essential to acknowledge the associated risks:

- Interest Rate Risk: Changes in interest rates can impact the value of bonds, particularly for long-term bonds.

- Credit Risk: The risk that the issuer might default on its obligations to repay the principal and interest.

- Inflation Risk: Unexpected inflation can erode the purchasing power of the bond's payments.

- Reinvestment Risk: The risk that reinvestment of coupon payments might yield lower returns in a declining interest rate environment.

- Liquidity Risk: The risk that bonds might be difficult to sell quickly at a favorable price.

Effective risk management strategies are crucial, including careful consideration of maturity dates, interest rate hedging, and maintaining a strong financial position.

Long-Term Strategic Implications of Bond Issuance

Bond issuance is not merely a short-term financing solution; it's a strategic decision with long-term implications. Successful bond issuance can:

- Enhance Financial Flexibility: Provides access to capital for future opportunities and unexpected challenges.

- Improve Creditworthiness: Successful repayment of bond obligations strengthens the issuer’s credit rating, making future financing easier and cheaper.

- Attract Investors: A well-structured bond issuance can attract a wider range of investors, expanding the issuer’s investor base.

- Support Sustainable Growth: Provides the capital needed for investments that foster sustainable growth and long-term competitiveness.

Conclusion: Harnessing the Power of Bond Issuance

The advantage of issuing bonds is undeniable: it provides access to substantial capital without diluting ownership. This allows businesses and governments to pursue ambitious growth strategies, fund critical infrastructure projects, and enhance their financial resilience. While risks are associated with bond issuance, careful planning, effective risk management, and a strong financial foundation can mitigate these risks and unlock the significant benefits that bond financing offers. Understanding the nuances of bond issuance, selecting the appropriate bond type, and building strong investor relationships are key to successfully leveraging this powerful financing tool for long-term success. Through thoughtful execution, bond issuance can be a transformative strategy for achieving sustainable growth and achieving long-term strategic objectives.

Latest Posts

Latest Posts

-

Laker Company Reported The Following January

Mar 17, 2025

-

Quantitative Analysis Of Vinegar Via Titration

Mar 17, 2025

-

The Interest Rate A Company Pays On 1 Year 5 Year

Mar 17, 2025

-

The Shape Of An Atomic Orbital Is Associated With

Mar 17, 2025

-

Parallelism In Writing Can Reflect Which Of The Following

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about An Advantage Of Issuing Bonds Is That ______. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.