A Rise In The General Level Of Prices.

Holbox

Mar 16, 2025 · 6 min read

Table of Contents

A Rise in the General Level of Prices: Understanding Inflation

A rise in the general level of prices of goods and services in an economy over a period of time is known as inflation. It's a phenomenon that affects every aspect of our lives, from the cost of groceries to the price of a house. Understanding inflation, its causes, and its consequences is crucial for individuals, businesses, and policymakers alike. This comprehensive guide delves deep into the complexities of inflation, exploring its various types, causes, effects, and potential solutions.

Understanding the Mechanics of Inflation

Inflation isn't simply about a few prices rising; it's a broad-based increase across the economy. This increase is usually measured using price indices, like the Consumer Price Index (CPI) and the Producer Price Index (PPI). The CPI tracks the average change in prices paid by urban consumers for a basket of consumer goods and services, while the PPI measures the average change in prices received by domestic producers for their output.

How is inflation measured?

Inflation is typically expressed as a percentage rate. For instance, 2% inflation means the general price level has increased by 2% compared to the previous period (usually a year). The calculation involves comparing the price index of the current period with the price index of the previous period.

Different Types of Inflation

Inflation isn't a monolithic entity; it manifests in several forms, each with its own characteristics and implications:

-

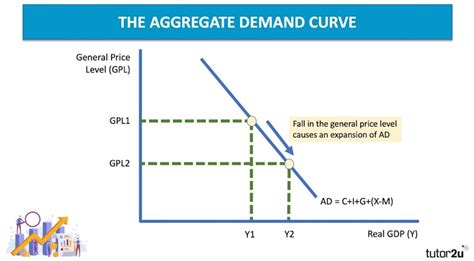

Demand-Pull Inflation: This occurs when aggregate demand in an economy outstrips aggregate supply. Think of it as too much money chasing too few goods. Increased consumer spending, government spending, or investment can all contribute to demand-pull inflation. This type of inflation is often associated with periods of strong economic growth.

-

Cost-Push Inflation: This arises when the cost of production increases, forcing businesses to raise prices to maintain their profit margins. Factors contributing to cost-push inflation include rising wages, increased raw material prices (e.g., oil), and higher taxes. Unlike demand-pull inflation, cost-push inflation can occur even during periods of slow economic growth.

-

Built-in Inflation: Also known as wage-price spiral, this type of inflation occurs when rising prices lead to demands for higher wages, which in turn lead to further price increases, creating a self-perpetuating cycle. Labor unions play a significant role in this type of inflation.

-

Hyperinflation: This is an extreme and rapid form of inflation, characterized by extraordinarily high and accelerating rates of price increases. Hyperinflation erodes the value of currency dramatically, leading to severe economic and social disruption. It's often associated with political and economic instability.

-

Creeping Inflation: This refers to a slow and steady increase in the price level, typically at a rate of less than 3% per year. It's generally considered manageable and less disruptive than other types of inflation.

-

Galloping Inflation: This is a rapid increase in the price level, usually exceeding 10% per year. It significantly erodes purchasing power and can destabilize the economy.

Causes of Inflation

Several factors contribute to inflation. Understanding these underlying causes is essential for developing effective countermeasures.

Monetary Factors

-

Excessive Money Supply: When the money supply grows faster than the economy's output, the value of money decreases, leading to inflation. This is often linked to expansionary monetary policies by central banks.

-

Low Interest Rates: Low interest rates can stimulate borrowing and spending, increasing aggregate demand and potentially fueling inflation.

Fiscal Factors

-

Government Spending: Increased government spending without a corresponding increase in tax revenue can lead to a budget deficit, which can be financed by borrowing, potentially increasing the money supply and contributing to inflation.

-

Tax Cuts: Significant tax cuts can boost disposable income, leading to increased consumer spending and potentially inflationary pressures.

Supply-Side Factors

-

Supply Shocks: Unexpected events like natural disasters, pandemics, or wars can disrupt supply chains, leading to shortages and price increases. The recent global supply chain disruptions are a prime example.

-

Rising Input Costs: Increased prices of raw materials, energy, or labor can push up production costs, forcing businesses to raise prices.

-

Monopolies and Oligopolies: Firms with significant market power can use their influence to raise prices, contributing to inflation.

Effects of Inflation

Inflation, while sometimes considered a mild symptom of a healthy economy, can have significant negative consequences if left unchecked.

Eroding Purchasing Power

The most direct impact of inflation is the erosion of purchasing power. As prices rise, each unit of currency buys fewer goods and services. This means consumers can afford less with the same amount of money, reducing their standard of living.

Uncertainty and Investment

High inflation creates uncertainty for businesses and investors. This uncertainty can lead to reduced investment, as businesses hesitate to commit capital in an unpredictable environment.

Distorted Resource Allocation

Inflation can distort resource allocation, as businesses may prioritize producing goods with the highest price increases, even if those goods are not essential. This can lead to inefficiencies in the economy.

Social Unrest

High and persistent inflation can lead to social unrest, as people struggle to cope with rising prices. This can manifest in protests, strikes, and other forms of social disruption.

International Competitiveness

High inflation can harm a country's international competitiveness, as its exports become more expensive relative to those of other countries. This can lead to a decline in exports and a trade deficit.

Inflation vs. Deflation: A Crucial Distinction

While inflation represents a rise in prices, deflation represents a decrease in prices. While deflation might seem positive, it can have severe consequences. Deflation can discourage spending as consumers delay purchases expecting further price drops, leading to decreased demand and economic slowdown.

Combating Inflation: Monetary and Fiscal Policies

Central banks and governments employ various measures to combat inflation.

Monetary Policy Tools

-

Interest Rate Hikes: Increasing interest rates makes borrowing more expensive, reducing consumer spending and investment, thus cooling down the economy and reducing inflationary pressure.

-

Reserve Requirements: Increasing the reserve requirement (the amount of money banks must hold in reserve) reduces the money supply, curbing inflation.

-

Open Market Operations: Selling government bonds reduces the money supply, while buying bonds increases the money supply. Central banks use these operations to manage the money supply and influence interest rates.

Fiscal Policy Tools

-

Tax Increases: Increasing taxes reduces disposable income, decreasing consumer spending and lowering demand-pull inflation.

-

Government Spending Cuts: Reducing government spending decreases aggregate demand, helping to curb inflation.

-

Supply-Side Policies: Policies aimed at increasing productivity, such as investments in infrastructure, education, and technology, can increase aggregate supply, reducing the pressure on prices.

Conclusion: Navigating the Inflationary Landscape

Inflation is a complex economic phenomenon with far-reaching consequences. Understanding its causes, types, and effects is essential for individuals, businesses, and policymakers. Effective strategies for managing inflation involve a combination of monetary and fiscal policies, tailored to the specific circumstances of the economy. While moderate inflation can be a sign of a healthy economy, high and persistent inflation can be detrimental, necessitating proactive intervention to maintain economic stability and protect the purchasing power of citizens. Staying informed about inflationary trends and the actions taken by policymakers is crucial for navigating this ever-changing economic landscape. Continuous monitoring of economic indicators and understanding the interplay between various economic forces are key to mitigating the risks and harnessing the opportunities presented by fluctuations in the price level.

Latest Posts

Latest Posts

-

Laker Company Reported The Following January

Mar 17, 2025

-

Quantitative Analysis Of Vinegar Via Titration

Mar 17, 2025

-

The Interest Rate A Company Pays On 1 Year 5 Year

Mar 17, 2025

-

The Shape Of An Atomic Orbital Is Associated With

Mar 17, 2025

-

Parallelism In Writing Can Reflect Which Of The Following

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about A Rise In The General Level Of Prices. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.