A Flexible Budget May Be Prepared

Holbox

Mar 19, 2025 · 6 min read

Table of Contents

A Flexible Budget: Your Key to Financial Freedom and Control

A flexible budget, also known as a variable budget, is a powerful financial tool that empowers individuals and businesses to adapt to changing circumstances while maintaining firm control over their finances. Unlike a static budget, which remains unchanged throughout the budgeting period, a flexible budget dynamically adjusts to fluctuations in revenue and expenses. This adaptability is crucial in navigating the uncertainties of modern life, whether it's unexpected car repairs, fluctuating sales in a business, or sudden changes in personal income. This comprehensive guide will delve into the intricacies of creating and managing a flexible budget, demonstrating its transformative power in achieving financial stability and prosperity.

Understanding the Fundamentals of a Flexible Budget

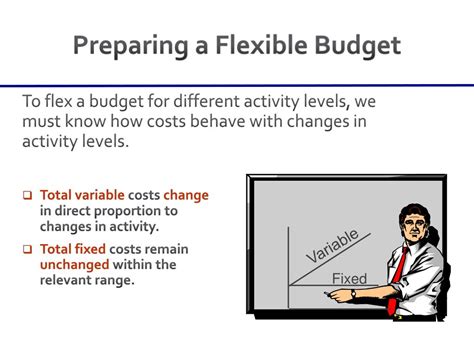

At its core, a flexible budget is built upon the concept of variable costs and fixed costs. Understanding this distinction is paramount in crafting an effective flexible budget.

Fixed Costs: The Unwavering Essentials

Fixed costs are expenses that remain relatively constant regardless of changes in activity levels. These are the bedrock of your budget, the non-negotiable expenses that you must account for consistently. Examples include:

- Rent or Mortgage Payments: Your housing costs typically remain consistent each month.

- Loan Repayments: Scheduled payments on loans, like student loans or car loans, are fixed obligations.

- Insurance Premiums: Health insurance, car insurance, and homeowner's insurance usually have a set monthly premium.

- Subscription Services: Recurring subscriptions to streaming services, software, or gym memberships are considered fixed costs.

Variable Costs: The Fluctuating Factors

Variable costs, on the other hand, fluctuate depending on your activity level or consumption. These are the areas where you can exert the most control and where the flexibility of your budget comes into play. Examples include:

- Groceries: Your grocery bill can vary widely depending on your meal planning and shopping habits.

- Utilities: Electricity, gas, and water bills can fluctuate based on your consumption.

- Transportation: Gas costs, public transportation fares, and mileage expenses can vary greatly.

- Entertainment: Spending on dining out, movies, concerts, and other forms of entertainment is highly variable.

- Clothing: Clothing purchases can fluctuate depending on seasonal needs and personal choices.

Crafting Your Flexible Budget: A Step-by-Step Guide

Building a flexible budget requires careful planning and honest self-assessment. Here's a step-by-step guide to help you create a budget tailored to your specific needs:

1. Track Your Spending: The Foundation of Financial Awareness

Before you can create a budget, you need to understand where your money is going. Track your spending meticulously for at least one month, recording every transaction, no matter how small. Utilize budgeting apps, spreadsheets, or even a simple notebook to diligently record your expenses. Categorize your spending based on the fixed and variable cost distinctions outlined above. This detailed analysis will provide invaluable insight into your spending habits and help you identify areas for potential savings.

2. Project Your Income: Anticipating the Revenue Stream

Accurately project your income for the upcoming budgeting period. If you have a stable, consistent income, this is relatively straightforward. However, if your income fluctuates, consider averaging your income over the past few months or using historical data to make a reasonable projection. Be realistic and don't overestimate your income to avoid disappointment later.

3. Allocate Funds to Fixed Costs: Prioritizing the Essentials

Allocate funds for your fixed costs first. These are your non-negotiable expenses that must be covered regardless of your variable spending. By addressing these first, you establish a solid financial foundation for the rest of your budget.

4. Assign Funds to Variable Costs: The Flexible Element

This is where the flexibility of your budget comes into play. Rather than assigning fixed amounts to your variable costs, allocate a range or percentage of your income to each category. This allows you to adjust your spending within those limits based on your needs and circumstances. For example, instead of budgeting $500 for groceries, allocate a range of $400-$500, allowing for flexibility depending on sales, special occasions, or unexpected expenses.

5. Build an Emergency Fund: Cushioning Against Unexpected Events

A crucial element of a flexible budget is an emergency fund. This fund acts as a safety net, providing financial cushioning against unexpected events like medical emergencies, car repairs, or job loss. Aim to save at least 3-6 months' worth of living expenses in your emergency fund. This will give you the financial freedom to adapt to unforeseen circumstances without derailing your budget.

6. Regularly Review and Adjust: Adapting to Change

The beauty of a flexible budget lies in its adaptability. Regularly review your budget, ideally monthly, to compare your actual spending against your planned spending. Adjust your variable cost allocations as needed based on your changing circumstances. This continuous monitoring and adjustment is crucial for maintaining financial control and ensuring your budget remains relevant and effective.

Advanced Techniques for Flexible Budgeting Mastery

Beyond the fundamental principles, several advanced techniques can enhance the effectiveness of your flexible budget:

1. Zero-Based Budgeting: Maximizing Resource Allocation

Zero-based budgeting is a powerful approach where you allocate every dollar of your income to a specific expense category. This ensures that all your income is accounted for and minimizes the risk of overspending. While it requires more detailed planning initially, the increased control and awareness it provides can be immensely beneficial.

2. Envelope System: Physical Budgeting for Visual Control

The envelope system involves dividing your cash into envelopes, each allocated to a specific expense category. Once the cash in an envelope is depleted, you're done spending in that category for the period. This physical approach provides a tangible representation of your budget and can enhance spending awareness.

3. 50/30/20 Rule: A Simple Yet Effective Framework

The 50/30/20 rule suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. While not strictly a flexible budget, it provides a solid framework for distributing your income, which can be adapted and personalized to suit your specific financial goals.

4. Goal Setting: Defining Financial Aspirations

Integrate your financial goals into your flexible budget. Whether it's saving for a down payment on a house, paying off debt, or investing for retirement, incorporating these goals into your budget will provide motivation and direction, reinforcing your commitment to financial discipline.

The Advantages of a Flexible Budget: Empowering Financial Control

The benefits of adopting a flexible budget are significant and far-reaching:

- Improved Financial Awareness: The process of creating and managing a flexible budget fosters greater awareness of your spending habits and financial situation.

- Enhanced Financial Control: The adaptability of a flexible budget allows you to adjust your spending in response to changing circumstances, maintaining control even during unexpected financial challenges.

- Reduced Financial Stress: Knowing you have a plan to manage your finances can significantly reduce financial stress and anxiety.

- Increased Savings Potential: The careful allocation of resources and continuous monitoring of expenses can lead to increased savings over time.

- Achieving Financial Goals: A flexible budget provides a structured approach to saving for specific goals, making them more attainable.

Conclusion: Embracing Financial Flexibility for a Secure Future

A flexible budget is more than just a financial tool; it's a pathway to financial freedom and security. By embracing its adaptability and employing the strategies outlined in this guide, you can take control of your finances, navigate financial uncertainties with confidence, and achieve your financial goals. Remember, consistent effort and regular review are crucial for maximizing the effectiveness of your flexible budget and securing a prosperous financial future. Embrace the flexibility, adapt to change, and enjoy the journey towards financial well-being.

Latest Posts

Latest Posts

-

Umatilla Bank And Trust Is Considering Giving

Mar 19, 2025

-

An Ordinary Annuity Is Best Defined As

Mar 19, 2025

-

A Flexible Budget Performance Report Compares

Mar 19, 2025

-

Standard Heat Of Formation For H2o

Mar 19, 2025

-

Complete The Synthesis Below By Selecting Or Drawing The Reagents

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about A Flexible Budget May Be Prepared . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.