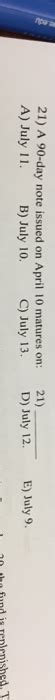

A 90 Day Note Issued On April 10 Matures On

Holbox

Mar 17, 2025 · 5 min read

Table of Contents

A 90-Day Note Issued on April 10th: Maturity Date Calculation and Implications

Understanding the maturity date of a promissory note is crucial for both the lender and the borrower. This article will delve into the calculation of the maturity date for a 90-day note issued on April 10th, exploring various scenarios and the implications of accurate date determination. We'll cover common methods of calculation, potential complications, and the importance of precise record-keeping in financial transactions.

Understanding Promissory Notes

A promissory note is a legally binding written promise made by one party (the maker or payer) to pay a specific sum of money to another party (the payee) on a specified date (the maturity date). These notes are commonly used in short-term lending, business transactions, and personal loans. The terms of the note, including the principal amount, interest rate (if any), and maturity date, are clearly outlined in the document.

Calculating the Maturity Date: The Standard Approach

The most straightforward method for calculating the maturity date of a 90-day note issued on April 10th involves simply adding 90 days to the issuance date. However, this process isn't always as simple as it seems, as it requires consideration of the number of days in each month.

Let's break down the calculation:

- April 10th to April 30th: 20 days remaining in April.

- May: 31 days in May.

- June: 30 days in June.

- Remaining days: 90 - 20 - 31 - 30 = 9 days in July.

Therefore, a 90-day note issued on April 10th matures on July 9th.

Dealing with Leap Years

The calculation above assumes a non-leap year. If the issuance date fell within a leap year (a year divisible by 4, except for years divisible by 100 unless also divisible by 400), the calculation would remain the same, unless the maturity date extends into February of the following year. Then you would need to account for the extra day in February.

Practical Implications of the Maturity Date

The accuracy of the maturity date is paramount for several reasons:

-

Interest Accrual: If the note carries interest, the precise maturity date determines the exact period for which interest accrues. An incorrect calculation could lead to discrepancies in the total amount due.

-

Legal Obligations: The maturity date signifies the legally binding deadline for repayment. Failure to repay on or before the maturity date can have significant legal consequences, including potential lawsuits and damage to creditworthiness.

-

Financial Planning: Both the lender and the borrower need accurate maturity date information for effective financial planning. The lender can anticipate the inflow of funds, and the borrower can plan their budget accordingly.

-

Accounting and Record-Keeping: Accurate record-keeping is essential for tax purposes and for maintaining a clear financial history. Miscalculating the maturity date can lead to accounting errors and potential tax penalties.

Complications and Variations in Calculation Methods

While the simple addition method works well in most cases, certain complexities can arise:

-

Day Count Conventions: Some financial instruments use specific day count conventions, such as the 30/360 method, where each month is treated as having 30 days, and the year as having 360 days. This method simplifies calculations but might not accurately reflect the actual number of days.

-

Weekend and Holiday Considerations: The maturity date might need adjustment if it falls on a weekend or a public holiday, depending on the terms of the note and local laws. Typically, the maturity date is shifted to the next business day.

-

Grace Periods: Some notes include a grace period, extending the repayment deadline by a few days. This grace period needs to be factored into the repayment schedule.

-

Early Repayment: The borrower might choose to repay the loan before the maturity date. In such cases, the lender will need to calculate the amount due, considering any applicable prepayment penalties.

The Importance of Precise Documentation and Legal Counsel

To avoid disputes and ensure a smooth financial transaction, both the lender and the borrower should meticulously document all aspects of the promissory note, including:

- Clear and unambiguous language: The note should use precise language to avoid any ambiguity regarding the terms, including the principal amount, interest rate, and, most importantly, the maturity date.

- Detailed calculation: The calculation of the maturity date should be clearly documented, showing all steps involved.

- Signatures: Both parties must sign the note, acknowledging their understanding and agreement to the terms.

- Legal review: It's advisable to seek legal counsel to ensure the promissory note complies with all applicable laws and regulations.

Software and Tools for Maturity Date Calculation

Various software applications and online calculators can assist in calculating maturity dates for promissory notes. These tools often incorporate day count conventions and automatically adjust for weekends and holidays. However, it's always advisable to independently verify the results to ensure accuracy.

Beyond the Basics: Considering Interest and Compound Interest

The maturity date calculation is just one element of a promissory note. Understanding the interest calculation is equally critical. If the note accrues simple interest, the interest is calculated only on the principal amount. Compound interest, on the other hand, involves calculating interest not just on the principal but also on the accumulated interest. The frequency of compounding (daily, monthly, annually) significantly impacts the total amount due at maturity.

Conclusion: Accuracy is Key

Calculating the maturity date of a 90-day note issued on April 10th, while seemingly straightforward, necessitates a careful consideration of several factors. Understanding the standard calculation method, potential complexities like leap years and day count conventions, and the legal implications of an inaccurate date is vital for both the lender and the borrower. Precise documentation, legal review, and potentially using specialized software can all contribute to ensuring accuracy and preventing potential disputes. Ultimately, accuracy in determining the maturity date is crucial for maintaining sound financial practices and minimizing potential risks. The goal is a clear, transparent, and legally sound transaction that benefits all parties involved.

Latest Posts

Latest Posts

-

Strategic Implementation Is Thought To Be

Mar 17, 2025

-

Laker Company Reported The Following January

Mar 17, 2025

-

Quantitative Analysis Of Vinegar Via Titration

Mar 17, 2025

-

The Interest Rate A Company Pays On 1 Year 5 Year

Mar 17, 2025

-

The Shape Of An Atomic Orbital Is Associated With

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about A 90 Day Note Issued On April 10 Matures On . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.