Which Of The Following Statements Regarding Merchandise Inventory Is False

Holbox

Mar 17, 2025 · 7 min read

Table of Contents

Which of the Following Statements Regarding Merchandise Inventory is False? A Deep Dive into Inventory Accounting

Inventory management is a cornerstone of successful business operations, particularly for companies that deal with tangible goods. Understanding inventory accounting is crucial for accurate financial reporting, efficient operations, and ultimately, profitability. This article delves into common statements regarding merchandise inventory, dissecting the truth and falsehoods to provide a comprehensive understanding of this crucial area of accounting. We'll examine several assertions, identifying the false statement and explaining why, while simultaneously clarifying the accurate principles of inventory accounting.

Common Statements Regarding Merchandise Inventory: Fact vs. Fiction

Let's explore several common statements about merchandise inventory, determining which are true and which are false. This will provide a solid foundation for understanding inventory accounting principles.

Statement 1: The cost of goods sold (COGS) is directly related to the value of the ending inventory.

Truth: This statement is TRUE. The cost of goods available for sale is the sum of beginning inventory and purchases during a period. This total cost is then allocated between the cost of goods sold (COGS) and the ending inventory. The relationship is inverse: a higher COGS typically implies a lower ending inventory, and vice versa. This relationship is fundamental to the accounting equation and inventory valuation methods.

Statement 2: Inventory is always valued at its historical cost.

Truth: This statement is FALSE. While historical cost (the original purchase price) is a common method, it's not the only method. Depending on the circumstances and the industry, inventory can be valued using different methods, including:

- First-In, First-Out (FIFO): This method assumes that the oldest inventory items are sold first. This often reflects the actual flow of goods in many businesses.

- Last-In, First-Out (LIFO): This method assumes that the newest inventory items are sold first. LIFO is allowed under U.S. GAAP but is prohibited under IFRS. It can lead to lower taxes during periods of inflation but may not accurately reflect the actual flow of goods.

- Weighted-Average Cost: This method calculates the average cost of all inventory items available for sale and uses this average cost to value both COGS and ending inventory. This method smooths out price fluctuations.

- Lower of Cost or Market (LCM): This method dictates that inventory should be reported at the lower of its historical cost or its current market value. This is a crucial principle for conservatism in accounting.

The choice of inventory valuation method significantly impacts the reported COGS and net income, highlighting the importance of understanding the implications of each method.

Statement 3: Obsolete inventory should be written down to its net realizable value.

Truth: This statement is TRUE. Obsolete inventory—items that are no longer saleable due to technological advancements, changes in consumer preferences, or damage—must be written down to its net realizable value (NRV). NRV is the estimated selling price less any costs of completion, disposal, and transportation. This write-down reflects the principle of conservatism in accounting and ensures that the financial statements present a fair representation of the company's financial position.

Statement 4: The inventory turnover ratio is a measure of how efficiently a company manages its inventory.

Truth: This statement is TRUE. The inventory turnover ratio is calculated by dividing the cost of goods sold by the average inventory. A higher turnover ratio generally indicates that a company is efficiently managing its inventory, selling its goods quickly, and minimizing the risk of obsolescence or spoilage. A lower ratio might suggest slow-moving inventory, potential for losses, or inefficient inventory management practices.

Statement 5: Inventory is always recorded at its retail price.

Truth: This statement is FALSE. Inventory is not typically recorded at its retail price in the financial statements. It is generally recorded at its cost, using one of the methods discussed above (FIFO, LIFO, Weighted-Average, LCM). Retail price is used in some inventory estimation techniques, but the official financial reporting uses cost-based valuation. Using retail price directly would misrepresent the actual cost of goods and inflate the value of the inventory.

Statement 6: Periodic inventory systems require a physical count of inventory at the end of each accounting period.

Truth: This statement is TRUE. A periodic inventory system doesn't track inventory continuously. Instead, it relies on a physical count of inventory at the end of the accounting period to determine the ending inventory and calculate the cost of goods sold. This contrasts with a perpetual inventory system, which continuously tracks inventory levels through a computerized system.

Statement 7: Perpetual inventory systems eliminate the need for physical inventory counts.

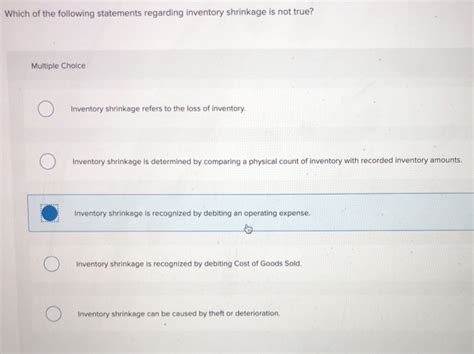

Truth: This statement is FALSE. While perpetual inventory systems provide real-time tracking of inventory, periodic physical counts are still essential. These counts verify the accuracy of the perpetual system, detect discrepancies, account for shrinkage (theft, damage, obsolescence), and ensure the reliability of the inventory data. Regular physical counts are crucial for maintaining accurate inventory records, even with a perpetual system in place.

The False Statement and its Implications

From the above analysis, Statement 2 ("Inventory is always valued at its historical cost") and Statement 7 ("Perpetual inventory systems eliminate the need for physical inventory counts") are demonstrably false. While historical cost is a common and accepted method, it's not the only one; other valuation methods are necessary depending on the circumstances. Similarly, perpetual inventory systems, while improving inventory tracking, still necessitate periodic physical inventory counts for accuracy and control.

The implications of using incorrect inventory valuation methods or neglecting physical counts are significant:

-

Inaccurate Financial Statements: Incorrect inventory valuation leads to inaccurate calculation of COGS and ending inventory, directly affecting the reported net income and balance sheet. This misrepresentation of financial performance can mislead investors, creditors, and other stakeholders.

-

Poor Inventory Management: Overestimating or underestimating inventory levels can lead to stockouts (lost sales) or excess inventory (storage costs, obsolescence risk). Accurate inventory management is crucial for maximizing profitability.

-

Tax Implications: Incorrect inventory valuation can affect tax calculations, potentially leading to penalties or legal issues.

-

Operational Inefficiencies: Inaccurate inventory data prevents informed decision-making regarding purchasing, production planning, and sales forecasting.

-

Damaged Business Reputation: Consistent inaccuracies in financial reporting can damage a company's credibility and reputation, impacting its ability to attract investors and secure financing.

Best Practices for Merchandise Inventory Management

Effective merchandise inventory management requires a holistic approach encompassing various aspects:

-

Accurate Inventory Tracking: Implement a robust inventory management system, whether perpetual or periodic, using barcode scanners, RFID tags, or other technologies to ensure accurate data capture.

-

Regular Physical Counts: Conduct cycle counts regularly (frequent smaller counts instead of one large annual count) to detect discrepancies early and minimize losses. This is essential regardless of the inventory system used.

-

Inventory Valuation Method Selection: Choose an inventory valuation method that aligns with the nature of the business, industry best practices, and applicable accounting standards. Consistency in applying the chosen method is crucial.

-

Efficient Storage and Handling: Implement efficient storage practices and handling procedures to minimize damage, loss, and obsolescence.

-

Demand Forecasting: Utilize data analysis and forecasting techniques to anticipate future demand and optimize inventory levels.

-

Regular Inventory Reviews: Conduct regular reviews of inventory levels, identifying slow-moving or obsolete items to take corrective actions, such as price reductions or write-downs.

Conclusion

Understanding the nuances of merchandise inventory accounting is paramount for successful business operations. By clarifying the true and false statements regarding inventory, we've highlighted the critical importance of accurate inventory valuation, the limitations of various methods, and the absolute necessity of regular physical counts. Adhering to best practices in inventory management—from tracking and valuation to storage and forecasting—is crucial for optimizing efficiency, minimizing costs, and presenting accurate financial information to stakeholders. Ignoring these principles can have significant and potentially detrimental consequences for a company's financial health and overall success.

Latest Posts

Latest Posts

-

Fresh Meat Should Be And Elastic When Pressed

Mar 17, 2025

-

A Preference Decision In Capital Budgeting

Mar 17, 2025

-

If A Company Recognizes Accrued Salary Expense

Mar 17, 2025

-

Utma Accounts Are Opened Under The Tax Id Of The

Mar 17, 2025

-

In Which Situations Can Simplifying Jobs Be Most Beneficial

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Statements Regarding Merchandise Inventory Is False . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.