A Preference Decision In Capital Budgeting

Holbox

Mar 17, 2025 · 6 min read

Table of Contents

A Preference Decision in Capital Budgeting: Navigating Complex Choices

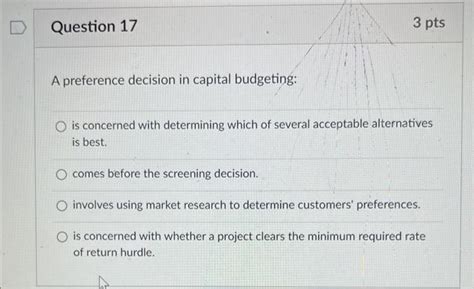

Capital budgeting, the process of planning and evaluating significant investments in long-term assets, is a cornerstone of financial management. While many capital budgeting techniques focus on identifying projects with positive net present values (NPVs) or internal rates of return (IRRs) exceeding the cost of capital, a critical aspect often overlooked is the preference decision. This involves choosing between multiple projects that are all financially viable, but which offer different returns, risks, and strategic implications. This article delves deep into the complexities of preference decisions in capital budgeting, exploring various techniques and considerations to guide effective decision-making.

Understanding the Preference Decision Problem

The preference decision arises when a firm faces resource constraints – typically budget limitations – and must select from a set of mutually exclusive projects, all of which offer acceptable returns. Simply selecting the project with the highest NPV isn't always sufficient. Several factors can complicate the decision:

1. Budgetary Constraints:

A firm's capital budget is rarely unlimited. This constraint forces a prioritization process, demanding a careful evaluation of projects' relative merits beyond their individual financial attractiveness. The preference decision aims to maximize overall value within the budget limitations.

2. Mutually Exclusive Projects:

Often, projects compete for the same resources (e.g., land, equipment, managerial attention). Selecting one project automatically excludes others. This necessitates a comparative analysis focusing on the incremental benefits and costs of choosing one over the other.

3. Varying Project Lifetimes:

Projects may have different lifespans. Direct comparison based solely on NPV or IRR becomes challenging when projects have uneven time horizons. Techniques such as equivalent annual annuity (EAA) can help in such cases.

4. Risk and Uncertainty:

Projects inherently carry different levels of risk. A high-NPV project might be excessively risky, while a lower-NPV project offers greater certainty. The preference decision must consider a firm's risk appetite and its capacity to manage risk effectively.

5. Strategic Alignment:

Capital budgeting decisions should align with a firm's overall strategic goals. A project with slightly lower financial returns might be preferred if it strategically positions the firm for future growth or market leadership.

Techniques for Making Preference Decisions

Several techniques can assist in making informed preference decisions in capital budgeting. These methods go beyond simply ranking projects by NPV or IRR, incorporating factors like risk, budget constraints, and strategic fit:

1. Profitability Index (PI):

The PI calculates the ratio of the present value of future cash flows to the initial investment. A PI greater than 1 indicates a positive NPV. When faced with budget constraints, prioritizing projects with the highest PI can maximize the value created per unit of investment. However, PI can be misleading if projects have vastly different scales.

2. Equivalent Annual Annuity (EAA):

EAA converts the NPV of projects with different lifespans into an equivalent annual cash flow. This facilitates comparison by standardizing the returns over a common time horizon. EAA is particularly useful when deciding between projects with unequal lives. A higher EAA suggests a more attractive project.

3. Sensitivity Analysis and Scenario Planning:

These techniques help assess the impact of uncertainty on project profitability. Sensitivity analysis examines the change in NPV or IRR resulting from changes in key input variables (e.g., sales price, operating costs). Scenario planning considers multiple possible future outcomes, assigning probabilities to each scenario. This allows decision-makers to understand the potential range of outcomes and choose projects that are more resilient to adverse conditions.

4. Decision Trees:

Decision trees visually represent the sequence of decisions and outcomes in a project. They are particularly useful in situations involving sequential investments or where decisions depend on uncertain future events. Probabilities are assigned to different branches, and expected monetary values are calculated to guide the decision-making process.

5. Simulation:

Simulation models use statistical techniques to generate a large number of possible outcomes for a project, considering the uncertainty associated with various input variables. This produces a distribution of potential NPVs or IRRs, providing a more comprehensive understanding of the project's risk profile. This is exceptionally helpful for complex projects with many uncertain factors.

6. Real Options Analysis:

This technique explicitly considers the flexibility embedded in investment decisions. It recognizes that future opportunities may arise, allowing for modifications or abandonment of projects based on changing market conditions. Real options analysis can significantly enhance the value of projects by incorporating managerial flexibility.

Incorporating Qualitative Factors

Quantitative techniques are essential, but they don't capture the full picture. Qualitative factors significantly influence preference decisions:

1. Strategic Fit:

Does the project align with the firm's overall strategy? Will it enhance competitive advantage, open new market opportunities, or improve operational efficiency? Strategic alignment can outweigh minor differences in financial metrics.

2. Risk Tolerance:

The firm's risk appetite influences project selection. A conservative firm might favor projects with lower risk and potentially lower returns, while an aggressive firm might be willing to accept higher risk for potentially greater rewards. Risk assessment must go beyond standard deviation and consider the potential impact of adverse events.

3. Managerial Expertise and Resources:

Does the firm possess the necessary managerial expertise and resources to successfully implement the project? Underestimating managerial capacity or resource requirements can lead to project failure, regardless of its financial attractiveness.

4. Environmental and Social Impact:

Increasingly, firms consider the environmental and social implications of their investment decisions. Projects with negative externalities might be rejected even if they offer favorable financial returns. Environmental, Social, and Governance (ESG) factors are gaining prominence in capital budgeting decisions.

5. Stakeholder Engagement:

Engaging with relevant stakeholders (employees, customers, community members) can identify potential risks and opportunities associated with a project. This participatory approach can lead to more robust and socially responsible investment decisions.

Practical Considerations and Best Practices

Making sound preference decisions requires careful planning and execution:

1. Clearly Defined Objectives:

Establish clear and measurable objectives for the capital budgeting process. These objectives should align with the firm's overall strategic goals and provide a framework for evaluating projects.

2. Comprehensive Data Collection:

Accurately gathering and analyzing relevant data is crucial. This includes forecasting future cash flows, estimating costs, and assessing risks. Data quality directly impacts the reliability of the decision-making process.

3. Robust Analytical Techniques:

Employ a combination of quantitative and qualitative techniques to ensure a comprehensive evaluation of projects. Using multiple methods helps identify potential biases and cross-validate findings.

4. Transparency and Communication:

Maintain transparency throughout the capital budgeting process. Clearly communicate the decision-making criteria, the evaluation process, and the final selection to all stakeholders.

5. Post-Investment Evaluation:

Regularly monitor and evaluate the performance of selected projects. This allows for early detection of problems and provides valuable feedback for future investment decisions. This post-audit process helps refine future estimations and techniques.

Conclusion: Navigating the Labyrinth of Choice

The preference decision in capital budgeting is a complex undertaking that extends beyond simple financial calculations. By combining robust quantitative techniques with careful consideration of qualitative factors, firms can make informed choices that maximize long-term value, minimize risk, and align with their strategic objectives. A well-structured process that emphasizes transparency, thorough analysis, and ongoing monitoring is crucial for navigating the labyrinth of choices and ensuring successful capital investment. The process is iterative and requires ongoing refinement based on experience and evolving business conditions. By embracing these principles, firms can effectively manage their capital resources and achieve sustainable growth.

Latest Posts

Latest Posts

-

Where Should Glassware Be Stored After It Is Cleaned

Mar 17, 2025

-

A Favorable Labor Rate Variance Indicates That

Mar 17, 2025

-

Split The Worksheet Into Panes At Cell D16

Mar 17, 2025

-

A Winning Strategy Is One That

Mar 17, 2025

-

The Objective Of Inventory Management Is To

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about A Preference Decision In Capital Budgeting . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.