If A Company Recognizes Accrued Salary Expense

Holbox

Mar 17, 2025 · 6 min read

Table of Contents

If a Company Recognizes Accrued Salary Expense: A Comprehensive Guide

Accrued salary expense is a crucial aspect of financial accounting that often causes confusion. Understanding how and why a company recognizes this expense is vital for accurate financial reporting and effective financial management. This comprehensive guide will delve into the intricacies of accrued salaries, exploring its implications for various stakeholders and providing a clear, step-by-step understanding of the process.

What is Accrued Salary Expense?

Accrued salary expense refers to the salaries earned by employees but not yet paid by the company at the end of an accounting period. It represents an obligation the company has to its employees for services rendered. This is different from salaries that have been paid – those are already reflected in the cash account. Accrued salaries represent a liability, a debt the company owes.

Example: Imagine a company's accounting period ends on December 31st. Employees work until the 31st, but payroll processing isn't completed until January 5th. The salaries earned between December 27th and December 31st are accrued salary expenses. These are expenses incurred during the accounting period, even if the cash payment happens in the following period.

Why is Accrued Salary Expense Important?

Recognizing accrued salary expenses is paramount for several reasons:

1. Accurate Financial Reporting:

Failing to account for accrued salaries leads to understated expenses and overstated net income on the income statement. This provides a misleading picture of the company's financial health. Accrual accounting, which mandates the recognition of expenses when incurred, regardless of when cash changes hands, ensures a more accurate reflection of the company's financial performance.

2. Compliance with Accounting Standards:

Accruing salaries is a fundamental requirement under Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). Failure to do so can result in non-compliance and potentially severe penalties.

3. Creditworthiness and Investor Confidence:

Accurate financial statements, including the correct recognition of accrued expenses, are crucial for maintaining creditworthiness. Lenders and investors rely on reliable financial information to assess the company's risk profile and make informed decisions. Inaccurate reporting can damage a company's reputation and make it difficult to secure financing.

4. Tax Implications:

Accrued salaries directly impact a company's tax liability. Proper recognition ensures that the company's tax return accurately reflects its financial position and avoids potential tax disputes.

How to Recognize Accrued Salary Expense

The process of recognizing accrued salary expense involves several steps:

1. Calculating the Accrued Amount:

This involves determining the salaries earned by employees but not yet paid. This calculation will consider the following:

- Daily/Hourly Rate: For employees paid hourly or daily, multiply the applicable rate by the number of hours/days worked during the period but not yet paid.

- Salaried Employees: For salaried employees, determine the portion of their salary earned during the period but not yet paid. This usually involves prorating the salary based on the number of days worked in the period.

- Bonuses and Commissions: Any bonuses or commissions earned but unpaid during the period must also be included.

- Payroll Taxes: Employer's portion of payroll taxes (e.g., Social Security, Medicare) related to the accrued salaries should also be accounted for.

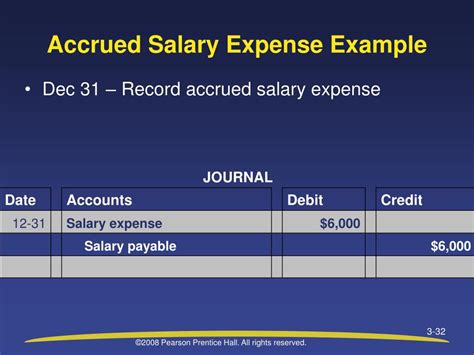

2. Journal Entry:

Once the accrued amount is calculated, a journal entry is made to record the expense and the corresponding liability. The journal entry will typically look like this:

Debit: Salary Expense (increases expense)

Credit: Salaries Payable (increases liability)

Example Journal Entry:

Let's say a company has $5,000 in accrued salaries and $500 in accrued payroll taxes at the end of the accounting period. The journal entry would be:

| Account Name | Debit | Credit |

|---|---|---|

| Salary Expense | $5,500 | |

| Salaries Payable | $5,500 | |

| To record accrued salaries and payroll taxes |

3. Adjusting Entries:

The journal entry made to recognize accrued salary expense is often an adjusting entry. Adjusting entries are made at the end of the accounting period to ensure that all revenues and expenses are properly recorded.

Impact on Financial Statements

The recognition of accrued salary expense has a direct impact on several key financial statements:

1. Income Statement:

The accrued salary expense increases the total expenses, thereby reducing net income. This ensures that the income statement accurately reflects the company's profitability for the period, including all expenses incurred, regardless of when they were paid.

2. Balance Sheet:

The accrued salary expense increases the current liabilities section of the balance sheet. Salaries Payable represents a short-term obligation the company owes to its employees.

3. Statement of Cash Flows:

The actual payment of salaries will be reflected in the cash outflow section of the statement of cash flows, typically under operating activities. The accrued salaries themselves do not appear on the statement of cash flows until payment is made.

Potential Complications and Considerations

While the basic principle of recognizing accrued salaries is straightforward, several complications can arise:

- Complex Payroll Structures: Companies with complex payroll structures, including various compensation plans (bonuses, commissions, stock options), may need more detailed calculations.

- Uncertainties in Compensation: Accruing for salaries with uncertain amounts (e.g., performance-based bonuses) requires careful estimation and judgment. Appropriate disclosures should be made in the financial statements.

- Changes in Employee Count: If significant changes occur in the number of employees during the accounting period, adjustments to the accrued salary calculations may be required.

- Foreign Currency Transactions: If a company operates internationally, any accrued salary payments in foreign currencies will necessitate currency conversion according to the prevailing exchange rate.

- Impact on Financial Ratios: Accurately recognizing accrued salaries directly influences key financial ratios like profit margins and current ratios, providing a more accurate assessment of financial health.

Best Practices for Accruing Salaries

To ensure accurate and compliant recognition of accrued salaries, companies should adopt the following best practices:

- Establish a Clear Payroll Process: Implement a well-defined payroll process with clear timelines for processing and payments. This reduces the risk of errors and omissions.

- Regular Reconciliation: Regularly reconcile payroll records with the general ledger to ensure accuracy and identify any discrepancies promptly.

- Utilize Payroll Software: Invest in payroll software to automate payroll processing and calculations, minimizing manual errors.

- Internal Controls: Establish robust internal controls to safeguard payroll processes and prevent fraud.

- Maintain Detailed Records: Keep meticulous records of all payroll transactions and supporting documentation.

Conclusion

The proper recognition of accrued salary expense is not merely a technical accounting requirement; it is a cornerstone of sound financial management. Accurately reflecting accrued salaries in the financial statements ensures transparency, promotes investor confidence, ensures regulatory compliance, and facilitates better decision-making. By understanding the underlying principles and adopting best practices, companies can ensure the accurate and timely recognition of this critical expense, leading to more reliable and informative financial reporting. Ignoring or misrepresenting this expense can have serious consequences, impacting the company's financial standing and potentially leading to significant legal and financial repercussions. Therefore, a robust and consistent approach to accrued salary expense accounting is vital for the long-term financial health and stability of any organization.

Latest Posts

Latest Posts

-

Goal Displacement Satisficing And Groupthink Are

Mar 17, 2025

-

Where Should Glassware Be Stored After It Is Cleaned

Mar 17, 2025

-

A Favorable Labor Rate Variance Indicates That

Mar 17, 2025

-

Split The Worksheet Into Panes At Cell D16

Mar 17, 2025

-

A Winning Strategy Is One That

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about If A Company Recognizes Accrued Salary Expense . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.