Which Of The Following Items Are Included In Cash

Holbox

Mar 18, 2025 · 5 min read

Table of Contents

Which Items Are Included in Cash? A Comprehensive Guide

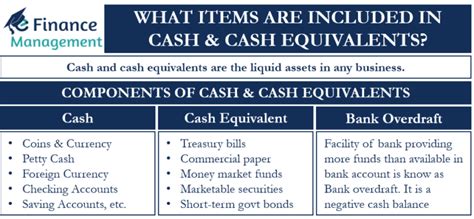

Determining what constitutes "cash" can be surprisingly complex, especially for accounting and financial reporting purposes. While the layman's understanding of cash is straightforward – physical currency and coins – the accounting definition is far broader and encompasses several liquid assets readily convertible to cash. This comprehensive guide will delve into the specifics, clarifying which items are included in cash and explaining the nuances involved.

Understanding the Accounting Definition of Cash

In accounting, cash isn't just the money in your wallet or till. It represents highly liquid assets that can be readily used to meet short-term obligations. This encompasses several categories, each with its own considerations. Understanding these distinctions is crucial for accurate financial reporting and analysis.

1. Currency and Coin: The Foundation of Cash

This is the most basic and universally understood component of cash. It refers to physical banknotes and coins held by a business or individual. This is the tangible form of money and forms the core of any cash balance.

- Example: Dollar bills, euro notes, coins in various denominations.

2. Demand Deposits: Easily Accessible Funds

Demand deposits represent funds held in checking accounts or other accounts where the funds can be withdrawn on demand without prior notice or penalty. This is a cornerstone of liquid assets often considered equivalent to cash.

- Example: Balances in checking accounts, current accounts, and demand deposit accounts held at banks or financial institutions. These are readily accessible through checks, debit cards, or electronic transfers.

3. Cash Equivalents: Short-Term, Highly Liquid Investments

Cash equivalents are short-term, highly liquid investments that are readily convertible to known amounts of cash and have a maturity date of three months or less from the date of acquisition. These are considered as good as cash due to their minimal risk and quick convertibility.

- Example: Treasury bills (T-bills), commercial paper, money market funds, and certificates of deposit (CDs) with maturities of less than three months. The key here is the short-term nature and minimal risk associated with these investments. Longer-term investments are not considered cash equivalents.

4. Petty Cash: Small Amounts for Minor Expenses

Petty cash funds are small amounts of cash kept on hand for minor, day-to-day expenses. This is usually held in a designated petty cash box or safe and requires internal controls to track inflows and outflows.

- Example: Funds used for office supplies, small reimbursements, or minor repairs. Proper documentation, such as receipts, is essential to maintain accurate records.

Items Not Included in Cash: The Crucial Distinctions

Several items, while liquid, are not considered part of cash in accounting. Understanding these distinctions is crucial for accurate financial reporting.

1. Restricted Cash: Funds with Limitations

Restricted cash represents funds that are not readily available for general use due to specific limitations or restrictions. These funds might be earmarked for a particular purpose, subject to legal restrictions, or held as collateral.

- Example: Cash held in escrow, funds designated for future capital expenditures, or cash set aside for debt repayment. These are not freely available and, therefore, not included in the cash balance.

2. Post-Dated Checks: Future Payment Promises

Post-dated checks represent checks written with a future date. Since these funds are not available until the specified future date, they are not included in the current cash balance.

- Example: A check written on December 15th, but dated for January 15th. This is a promise of future payment and not readily available cash.

3. IOUs and Promissory Notes: Uncertain Collection

IOUs (I owe you) and promissory notes represent promises of payment, but their collection is not guaranteed. The collectibility of these instruments is uncertain, making them unsuitable for inclusion in cash.

- Example: A signed agreement promising payment at a future date. The potential for non-payment makes these items fundamentally different from cash.

4. Money Market Accounts (Long-Term): Beyond the Three-Month Threshold

While money market accounts themselves can be cash equivalents if short-term, long-term money market accounts generally exceed the three-month threshold for cash equivalents. Therefore, they are reported as short-term investments, not as cash.

- Example: A money market account with a maturity date of six months or longer is not considered a cash equivalent.

5. Bank Overdrafts: Negative Cash Balances

A bank overdraft occurs when a business writes a check for an amount exceeding its available balance. This results in a negative balance and is not part of cash; instead, it is recorded as a liability.

- Example: A checking account with a balance of -$500 represents a liability, not an asset.

The Importance of Accurate Cash Reporting

Accurate cash reporting is paramount for several reasons:

- Liquidity Assessment: Knowing the true cash position allows for a realistic assessment of a company's short-term liquidity, its ability to meet immediate obligations.

- Financial Statement Accuracy: Correct cash reporting is essential for preparing accurate financial statements (balance sheet, income statement, cash flow statement).

- Creditworthiness: Lenders and investors rely on accurate cash balances to assess a company's creditworthiness and financial health.

- Internal Control: Accurate cash reporting enhances internal controls by detecting discrepancies and preventing fraud.

- Decision-Making: Accurate cash information aids in informed decision-making concerning investments, capital expenditures, and working capital management.

Cash Management Best Practices

Effective cash management involves optimizing cash inflows and outflows to maximize liquidity and minimize risk. Several best practices can help improve cash management:

- Cash Forecasting: Regularly forecast future cash inflows and outflows to anticipate potential shortfalls or surpluses.

- Bank Reconciliations: Reconcile bank statements regularly to ensure accuracy and identify discrepancies.

- Internal Controls: Implement robust internal controls to prevent theft or fraud.

- Investment Strategies: Explore short-term, low-risk investment options for surplus cash.

- Debt Management: Manage debt effectively to minimize interest expenses and maintain financial flexibility.

Conclusion: A Clearer Picture of Cash

The concept of "cash" in accounting goes beyond the everyday understanding of physical currency. It includes highly liquid assets readily convertible into cash within a short timeframe. While the inclusion of cash equivalents broadens the definition, it's crucial to understand the distinctions between cash and other liquid assets, such as restricted cash or post-dated checks. Accurate cash reporting is critical for sound financial management, informed decision-making, and maintaining a healthy financial position. By diligently adhering to best practices in cash management, businesses can optimize their liquidity and mitigate financial risks. Remember to always consult with a qualified accountant or financial professional for specific guidance on your unique circumstances.

Latest Posts

Latest Posts

-

Your Local Movie Theater Uses The Same Group Pricing Strategy

Mar 18, 2025

-

A Set Of Bivariate Data Was Used To Create

Mar 18, 2025

-

What Is The Product Of This Reaction

Mar 18, 2025

-

Record The Entry To Close The Dividends Account

Mar 18, 2025

-

Which Of The Following Best Describes The Operational Period Briefing

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Items Are Included In Cash . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.