Record The Entry To Close The Dividends Account.

Holbox

Mar 18, 2025 · 6 min read

Table of Contents

Recording the Entry to Close the Dividends Account: A Comprehensive Guide

Dividends, the distribution of profits to shareholders, are a crucial aspect of corporate finance. Understanding how to properly account for dividends, including the closing of the dividends account, is essential for maintaining accurate financial records. This comprehensive guide will delve into the process of recording the entry to close the dividends account, covering various scenarios and providing practical examples.

Understanding the Dividends Account

Before we explore the closing entry, it's vital to understand the nature of the dividends account. This account is a temporary account, meaning it's used to track dividend payments during a specific accounting period. It's typically a debit balance account, reflecting the outflow of cash or other assets to shareholders. At the end of the accounting period, this temporary account needs to be closed to prepare for the next period. Failure to close the dividends account will result in an inaccurate representation of the company's retained earnings and overall financial position.

The Role of Retained Earnings

The closing of the dividends account directly impacts the retained earnings account. Retained earnings represent the accumulated profits of a company that haven't been distributed as dividends. When dividends are declared, they reduce retained earnings. The closing entry transfers the debit balance in the dividends account to the retained earnings account, thereby reflecting this reduction.

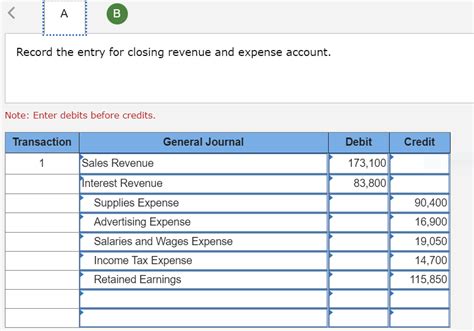

The Journal Entry to Close the Dividends Account

The process of closing the dividends account involves a simple journal entry. Since the dividends account has a debit balance (representing an expense), we need to credit it to reduce it to zero. The corresponding debit is made to the retained earnings account.

Here's the basic format of the journal entry:

| Date | Account Name | Debit | Credit |

|---|---|---|---|

| [Date] | Retained Earnings | [Amount] | |

| Dividends | [Amount] | ||

| To close the dividends account |

Example:

Let's say a company declared and paid dividends totaling $10,000. The journal entry to close the dividends account would be:

| Date | Account Name | Debit | Credit |

|---|---|---|---|

| December 31 | Retained Earnings | $10,000 | |

| Dividends | $10,000 | ||

| To close the dividends account |

This entry effectively transfers the $10,000 from the dividends account to the retained earnings account, reducing the retained earnings and zeroing out the dividends account.

Different Scenarios and Their Entries

While the basic closing entry is straightforward, several scenarios can influence the process. Let's examine a few common variations:

1. Cash Dividends vs. Stock Dividends

Cash Dividends: The most common type of dividend, involving a direct cash payment to shareholders. The closing entry remains the same as the basic example above.

Stock Dividends: These dividends involve issuing additional shares of stock to existing shareholders instead of cash. The accounting treatment is more complex. While the dividends account is still closed, the debit isn't directly to retained earnings. Instead, a portion of retained earnings is transferred to the additional paid-in capital account. This reflects the increase in the company's equity from the issuance of new shares.

2. Dividends Payable Account

In some cases, companies might have a separate "dividends payable" account to track dividends declared but not yet paid. In this scenario, the closing entry involves two steps:

Step 1: Close the Dividends Payable Account:

| Date | Account Name | Debit | Credit |

|---|---|---|---|

| [Date] | Dividends Payable | [Amount] | |

| Dividends | [Amount] | ||

| To close dividends payable account |

Step 2: Close the Dividends Account (as described above):

| Date | Account Name | Debit | Credit |

|---|---|---|---|

| [Date] | Retained Earnings | [Amount] | |

| Dividends | [Amount] | ||

| To close the dividends account |

3. Interim Dividends

Companies may declare interim dividends during the year, before the year-end closing. Each interim dividend requires a separate closing entry, following the same principle as outlined above. At year-end, the total dividends declared throughout the year are reflected in the retained earnings reduction.

4. Dividend Restrictions

Some companies might have legal or contractual restrictions on dividend distributions. These restrictions must be considered when preparing the closing entry. The amount of dividends that can be closed to retained earnings might be limited by these restrictions.

Importance of Accurate Record-Keeping

Maintaining accurate records regarding dividend payments is critical for several reasons:

- Compliance: Accurate accounting ensures compliance with relevant accounting standards and regulations.

- Financial Reporting: Correctly recording dividend transactions ensures the accuracy of financial statements, providing a true and fair view of the company's financial position.

- Investor Confidence: Transparent and accurate financial reporting builds trust and confidence among investors.

- Tax Purposes: Accurate records are essential for tax reporting purposes, both for the company and its shareholders.

Common Mistakes to Avoid

Several common mistakes can occur when closing the dividends account:

- Incorrect Account Balance: Ensure the dividend account balance is correctly calculated before preparing the closing entry.

- Wrong Account Used: Double-check that you are using the correct account names in the journal entry. Confusing dividends with other accounts can lead to errors.

- Omitting the Closing Entry: Failing to close the dividends account will result in an inaccurate representation of retained earnings and the company's overall financial position.

- Ignoring Dividend Restrictions: Failure to consider dividend restrictions can lead to violations and legal complications.

Best Practices for Closing the Dividends Account

To ensure a smooth and accurate closing process, follow these best practices:

- Regular Reconciliation: Regularly reconcile the dividends account with bank statements to identify any discrepancies.

- Documentation: Maintain proper documentation of all dividend transactions, including declaration dates, payment dates, and amounts.

- Internal Controls: Implement robust internal controls to prevent errors and fraud.

- Review and Approval: Have the closing entries reviewed and approved by authorized personnel.

Conclusion

Closing the dividends account is a fundamental process in accounting. Understanding the procedures, variations, and potential pitfalls is essential for maintaining accurate financial records and complying with accounting standards. By following the guidelines and best practices outlined in this guide, companies can ensure the accurate and efficient closing of their dividends account, thereby contributing to robust financial reporting and investor confidence. Remember to always consult with a qualified accountant or financial professional for specific guidance based on your company's circumstances. The information provided here is for educational purposes and should not be considered professional financial advice.

Latest Posts

Latest Posts

-

Interdependency Between Various Segments Of The Hospitality Industry Means

Mar 18, 2025

-

Utilization Is Defined As The Ratio Of

Mar 18, 2025

-

An Operations Manager Is Not Likely To Be Involved In

Mar 18, 2025

-

A Guest Enjoying A Few Cocktails

Mar 18, 2025

-

Apt Was Compared With Numerous Extant Methodologies

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Record The Entry To Close The Dividends Account. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.