Which Of The Following Are Classified As Receivables

Holbox

Mar 27, 2025 · 6 min read

Table of Contents

- Which Of The Following Are Classified As Receivables

- Table of Contents

- Which of the Following are Classified as Receivables? A Comprehensive Guide

- What are Receivables?

- Types of Receivables: A Detailed Breakdown

- 1. Accounts Receivable

- 2. Notes Receivable

- 3. Trade Receivables

- 4. Non-Trade Receivables

- 5. Other Receivables

- Which Items Qualify as Receivables? Examples and Non-Examples

- Importance of Effective Receivables Management

- Best Practices for Receivables Management

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

Which of the Following are Classified as Receivables? A Comprehensive Guide

Understanding receivables is crucial for businesses of all sizes. Properly classifying and managing receivables directly impacts cash flow, profitability, and overall financial health. This comprehensive guide delves into the definition of receivables, explores various types, and clarifies which specific items qualify as receivables. We'll also cover best practices for managing them effectively.

What are Receivables?

Receivables, in accounting, represent money owed to a company by its customers or other entities for goods or services provided on credit. They represent a current asset on the balance sheet, signifying a future inflow of cash. The classification of an item as a receivable depends on several key factors, including the nature of the transaction, the timing of payment, and the legal enforceability of the claim. The key characteristic is an expectation of future cash inflow resulting from a prior transaction.

Types of Receivables: A Detailed Breakdown

Several types of receivables exist, each with its own accounting treatment and implications:

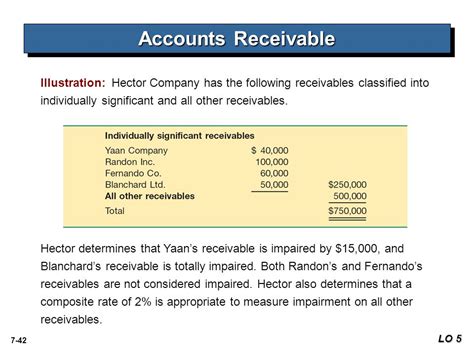

1. Accounts Receivable

This is the most common type of receivable. Accounts receivable arise from credit sales to customers. These are typically short-term, with payment terms ranging from 30 to 90 days. They represent the formal invoice issued to a customer for goods or services already delivered or performed. Accurate tracking of accounts receivable is crucial for monitoring outstanding payments and managing cash flow. Companies use various methods, including aging reports, to monitor the collectability of these receivables.

2. Notes Receivable

Unlike accounts receivable, notes receivable are formal written promises to pay a specific sum of money on a specified date. They often involve interest charges and offer a more formal agreement compared to open accounts. Notes receivable can stem from various transactions, such as lending money to customers, suppliers, or other parties, or extending credit for a larger or longer-term purchase. The formal nature of a note receivable provides greater legal recourse in case of non-payment.

3. Trade Receivables

This category encompasses both accounts receivable and notes receivable that arise from the company's normal business operations. Trade receivables represent the money owed by customers for goods or services sold in the ordinary course of business. The focus here is on the exchange of goods or services for a promise of future payment. Effective management of trade receivables is essential for maintaining healthy cash flow and minimizing bad debt.

4. Non-Trade Receivables

These receivables do not arise from the core business operations. Non-trade receivables can include loans made to employees, advances to subsidiaries, or interest receivable on investments. They are often longer-term and require separate monitoring and accounting compared to trade receivables. The diversity of these receivables necessitates careful classification and tracking to ensure accurate financial reporting.

5. Other Receivables

This is a catch-all category encompassing various items not neatly fitting into the previous categories. Examples include receivables from officers and employees, advances to suppliers, and claims against insurance companies. The "other receivables" category highlights the need for detailed accounting to correctly categorize all financial claims and ensures completeness of the balance sheet.

Which Items Qualify as Receivables? Examples and Non-Examples

Let's analyze specific scenarios to clarify which items are classified as receivables:

Examples of Receivables:

- A customer's unpaid invoice for goods purchased on credit: This is a classic example of accounts receivable.

- A promissory note from a client promising payment within six months: This clearly qualifies as a notes receivable.

- Money lent to an employee for a down payment on a house: Although not part of core business, this is a non-trade receivable.

- Interest earned but not yet received on a bank deposit: This constitutes interest receivable, a type of non-trade receivable.

- Payment due from a customer for services rendered: This is an accounts receivable if provided on credit.

Non-Examples of Receivables:

- Cash on hand: This is a liquid asset, not a receivable.

- Inventory: Inventory represents unsold goods, not amounts owed.

- Prepaid expenses: These are assets paid in advance, not amounts owed to the company.

- Equity investments: These represent ownership stakes, not amounts owed.

- Deposits paid to suppliers: These are advances made, not amounts due to the company.

Scenario Analysis:

Let's consider a few more intricate scenarios to solidify our understanding:

-

Scenario 1: A company provides consulting services to a client on a credit basis. The invoice has been issued, but the payment is overdue. This is an accounts receivable. The key is the service was already rendered and an invoice exists.

-

Scenario 2: A business lends money to its owner. This is a non-trade receivable. The transaction is unrelated to the core business operations.

-

Scenario 3: A company sells a product on a 'cash-on-delivery' basis. This is not a receivable; the transaction is settled immediately.

-

Scenario 4: A company sells goods and receives a check that subsequently bounces. This was initially an accounts receivable but is now considered a bad debt after the check bounced.

Importance of Effective Receivables Management

Effective receivables management is vital for several reasons:

-

Improved Cash Flow: Efficient collection of receivables ensures a steady flow of cash, enabling the business to meet its financial obligations and invest in growth opportunities.

-

Reduced Bad Debts: Implementing robust credit policies and collection procedures minimizes the risk of bad debts, protecting the company's profitability.

-

Enhanced Financial Reporting: Accurate classification and monitoring of receivables contribute to reliable financial statements, facilitating informed decision-making.

-

Stronger Customer Relationships: Professional and courteous collection practices can maintain healthy relationships with customers, fostering repeat business.

-

Improved Credit Risk Assessment: Tracking payment history helps in assessing creditworthiness of customers and making informed decisions about future credit extensions.

Best Practices for Receivables Management

Several key practices optimize receivables management:

-

Establish Clear Credit Policies: Define clear credit terms and criteria for extending credit to customers, minimizing the risk of bad debts.

-

Implement Robust Invoicing Procedures: Ensure timely and accurate invoice generation and delivery to customers.

-

Utilize Advanced Technologies: Employ accounting software and CRM systems to streamline receivables management processes.

-

Monitor Aging Reports: Regularly analyze aging reports to identify overdue payments and initiate timely collection actions.

-

Develop a Formal Collection Process: Implement a systematic collection process, escalating actions as needed, starting with friendly reminders and progressing to formal legal steps if necessary.

-

Regularly Review and Adjust: Periodically review credit policies and collection procedures to ensure their effectiveness and adapt to changing business conditions.

Conclusion

Proper classification and management of receivables are critical for the financial health and success of any business. Understanding the nuances between accounts receivable, notes receivable, trade receivables, non-trade receivables, and other receivables is fundamental. Implementing effective receivables management practices ensures timely cash collection, minimizes bad debts, and strengthens the overall financial position of the company. By carefully analyzing transactions and adhering to best practices, businesses can effectively manage their receivables and enhance their financial performance. Remember that accurate classification is paramount for accurate financial reporting and sound financial decision-making.

Latest Posts

Latest Posts

-

Draw Both The Organic And Inorganic Intermediate Species

Mar 31, 2025

-

Estimate The Following Limit Using Graphs Or Tables

Mar 31, 2025

-

Solve For Simplify Your Answer As Much As Possible

Mar 31, 2025

-

Match The Description With The Correct Type Of Neuron

Mar 31, 2025

-

An Item Is Considered Material If

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Are Classified As Receivables . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.