Using Accrual Accounting Expenses Are Recorded And Reported Only

Holbox

Mar 16, 2025 · 7 min read

Table of Contents

Using Accrual Accounting: Expenses Are Recorded and Reported Only When Incurred

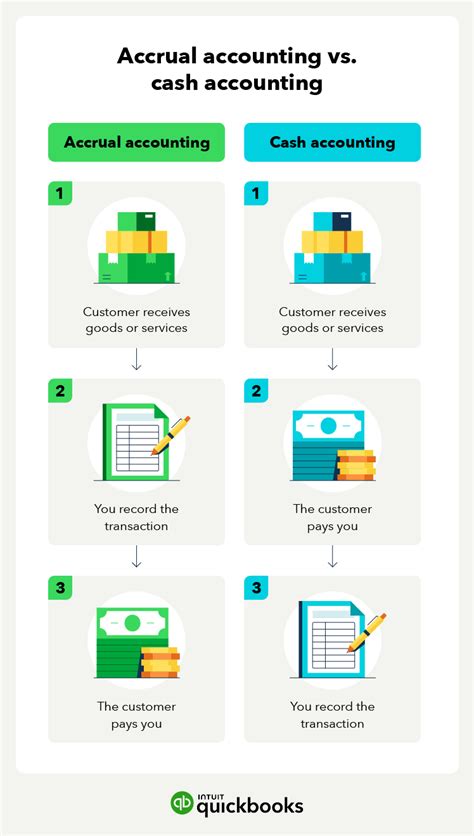

Accrual accounting is a cornerstone of financial reporting, providing a more accurate picture of a company's financial health than cash accounting. Unlike cash accounting, which records transactions only when cash changes hands, accrual accounting recognizes revenues when earned and expenses when incurred, regardless of when cash is received or paid. This crucial difference leads to a more comprehensive and reliable reflection of a company's financial performance and position. This article delves into the intricacies of accrual accounting, focusing specifically on how expenses are recorded and reported.

Understanding the Fundamentals of Accrual Accounting

At its core, accrual accounting follows the matching principle. This principle dictates that expenses should be recognized in the same accounting period as the revenues they help generate. This ensures that the financial statements accurately reflect the profitability of a specific period. Consider a business that provides services. If they receive payment upfront for services to be rendered over several months, they wouldn't recognize all the revenue at once under accrual accounting. Instead, they would recognize revenue over the months the services are performed, aligning it with the expenses incurred during those same months. Similarly, if they incur expenses in one month but don't pay for them until the following month, the expense is recognized in the month it was incurred, not the month it was paid.

Key Differences from Cash Accounting:

- Timing of Recognition: Cash accounting recognizes transactions when cash flows in or out. Accrual accounting recognizes transactions when they occur, regardless of cash flow.

- Financial Statement Accuracy: Accrual accounting leads to more accurate financial statements reflecting a company's true financial position and performance. Cash accounting can be misleading, particularly for businesses with significant credit transactions.

- Regulatory Compliance: Most larger companies and publicly traded companies are required to use accrual accounting for financial reporting purposes due to its superior accuracy and adherence to generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS).

Recording Expenses Under Accrual Accounting: A Detailed Look

Accrual accounting requires careful tracking and recording of expenses as they are incurred, even if payment isn't immediate. This often involves making adjusting journal entries at the end of an accounting period to ensure all expenses are properly accounted for.

Here's a breakdown of the process:

1. Identifying Expenses: The first step involves accurately identifying all expenses incurred during the accounting period. This encompasses a wide range of costs, including:

- Cost of Goods Sold (COGS): The direct costs associated with producing goods sold during the period.

- Salaries and Wages: Payments to employees for their services.

- Rent Expense: Payments for the use of property.

- Utilities Expense: Payments for electricity, water, gas, etc.

- Insurance Expense: Premiums paid for insurance coverage.

- Depreciation Expense: The allocation of the cost of a long-term asset over its useful life.

- Interest Expense: Payments on loans or other debt.

- Marketing and Advertising Expenses: Costs associated with promoting products or services.

- Research and Development Expenses: Costs incurred in developing new products or services.

2. Determining the Accrual: Not all expenses are paid immediately. Some are accrued, meaning they are incurred but not yet paid. Examples include:

- Accrued Salaries: Salaries earned by employees but not yet paid at the end of the accounting period.

- Accrued Interest: Interest expense incurred but not yet paid at the end of the accounting period.

- Accrued Rent: Rent expense incurred but not yet paid at the end of the accounting period.

- Accrued Utilities: Utility expenses incurred but not yet paid at the end of the accounting period.

3. Making Adjusting Entries: At the end of each accounting period, adjusting journal entries are necessary to reflect these accrued expenses. These entries increase the expense account and increase a liability account (accounts payable). For example, if employees earned $5,000 in salaries but haven't been paid yet, the adjusting entry would be:

- Debit Salaries Expense $5,000

- Credit Salaries Payable $5,000

This entry recognizes the expense in the current period and creates a liability reflecting the company's obligation to pay the employees.

4. Prepaid Expenses: Conversely, there are instances where payments are made in advance for expenses that will be incurred in future periods. These are known as prepaid expenses. Examples include insurance premiums paid in advance or rent paid in advance. At the end of the accounting period, a portion of the prepaid expense needs to be expensed. This involves reducing the prepaid expense account and increasing the expense account. For instance, if a company paid $12,000 for a year's worth of insurance, the adjusting entry at the end of the first quarter would be:

- Debit Insurance Expense $3,000 ($12,000 / 4 quarters)

- Credit Prepaid Insurance $3,000

5. Reporting Expenses: Once all adjusting entries are made, the expense accounts reflect the total expenses incurred during the accounting period. This information is then used to prepare the income statement, which shows the company's revenue and expenses, ultimately determining the net income or net loss for the period. The balance sheet also reflects the accrued expenses as liabilities, showcasing the company's financial obligations.

The Importance of Accurate Expense Recognition

Accurate expense recognition is vital for several reasons:

- Accurate Profitability Assessment: Properly matching expenses with revenues provides a true reflection of profitability. Mismatched expenses can distort profitability figures, leading to inaccurate business decisions.

- Compliance with Accounting Standards: Accurate expense recognition is crucial for compliance with GAAP or IFRS, ensuring the financial statements are reliable and trustworthy.

- Improved Decision-Making: Accurate financial information enables better informed decisions regarding pricing strategies, resource allocation, and future investments.

- Creditworthiness: Accurate financial statements are essential for obtaining loans and other forms of financing. Inaccurate expense recognition can negatively impact a company's creditworthiness.

- Tax Implications: Accurate expense recognition is crucial for determining the correct amount of taxes owed. Misreporting expenses can lead to penalties and legal repercussions.

Common Challenges and Considerations in Accrual Accounting for Expenses

While accrual accounting offers significant advantages, it also presents some challenges:

- Estimating Accruals: Accruing expenses sometimes requires estimations, particularly for items like bad debt expense or warranty expense. These estimations should be as accurate as possible to minimize the risk of misrepresenting financial performance.

- Complexity: Accrual accounting is generally more complex than cash accounting, requiring more detailed record-keeping and expertise in accounting principles.

- Timing Differences: The timing of recognizing revenue and expenses can be complex, especially in situations with long-term contracts or projects.

- Materiality: The impact of minor errors in expense recognition might be immaterial and may not significantly affect the overall financial statements. However, it's crucial to maintain a consistent and accurate approach regardless of the materiality of the error.

Advanced Accrual Accounting Concepts

Several more advanced concepts further illustrate the nuances of accrual accounting for expenses:

- Deferred Expenses: These are expenses paid in advance but benefit multiple accounting periods, such as prepaid insurance or rent. The expense is recognized over time as it is consumed.

- Contingent Liabilities: These are potential liabilities that depend on the occurrence of a future event, such as lawsuits or warranties. If the likelihood of the event occurring is high and the amount can be reasonably estimated, a liability is recognized.

- Provisions: Similar to contingent liabilities, provisions are liabilities of uncertain timing or amount. They require careful estimation and disclosure in financial statements.

- Depreciation Methods: The selection of depreciation methods (straight-line, declining balance, etc.) significantly impacts the expense recognized each period. The chosen method should be consistent and appropriate for the asset's nature.

Conclusion: Mastering Accrual Accounting for Success

Accrual accounting, with its focus on matching expenses with revenues, provides a far more accurate picture of a company's financial performance than cash accounting. While it presents complexities, the benefits of accurate financial reporting far outweigh the challenges. By understanding the principles of accrual accounting, implementing robust accounting systems, and employing skilled accounting professionals, businesses can leverage accrual accounting to make informed decisions, ensure compliance, and achieve greater financial success. Mastering accrual accounting, particularly the careful and accurate recording of expenses, is paramount for the long-term health and sustainability of any organization. Through diligent expense tracking and appropriate adjusting entries, businesses can generate accurate and reliable financial statements that serve as a cornerstone for effective financial management and strategic planning.

Latest Posts

Latest Posts

-

A Preference Decision In Capital Budgeting

Mar 17, 2025

-

If A Company Recognizes Accrued Salary Expense

Mar 17, 2025

-

Utma Accounts Are Opened Under The Tax Id Of The

Mar 17, 2025

-

In Which Situations Can Simplifying Jobs Be Most Beneficial

Mar 17, 2025

-

For The Hr Planning Process How Should Goals Be Determined

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Using Accrual Accounting Expenses Are Recorded And Reported Only . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.