The Understatement Of The Ending Inventory Balance Causes

Holbox

Mar 19, 2025 · 7 min read

Table of Contents

The Understatement of the Ending Inventory Balance: Causes, Consequences, and Corrections

The understatement of ending inventory is a common accounting error with significant consequences for a business's financial statements. It directly impacts the calculation of cost of goods sold (COGS) and, consequently, gross profit, net income, and even tax liabilities. Understanding the causes of this understatement is crucial for preventing it and mitigating its impact. This comprehensive guide delves into the various factors contributing to understated ending inventory, explores the resulting financial statement distortions, and provides strategies for accurate inventory management and correction.

Major Causes of Understated Ending Inventory

Several factors can lead to an understatement of the ending inventory balance. These can be broadly categorized into errors in physical inventory counting, inaccurate record-keeping, and flaws in inventory management systems.

1. Errors in Physical Inventory Counting:

This is perhaps the most frequent source of understatement. Inaccurate physical counts can stem from:

-

Inadequate Counting Procedures: Lack of a standardized, well-defined inventory counting procedure is a recipe for errors. This includes insufficient training for counting personnel, absence of clear instructions on handling damaged or obsolete goods, and the failure to implement double-checking mechanisms. Without a robust system, omissions are easily overlooked.

-

Obsolescence and Damage Overlooked: Failing to identify and properly account for obsolete or damaged goods directly reduces the recorded inventory value. These items may be physically present but are essentially worthless and shouldn't be included in the ending inventory at their original cost. The understatement happens when these items are either completely missed or included at an inflated value.

-

Theft or Shrinkage: Employee theft or shrinkage (loss due to damage, spoilage, or other unforeseen circumstances) is a significant concern. If inventory is stolen or lost, the physical count will be lower than the actual recorded amount, leading to an understatement of the ending inventory. Effective security measures and regular inventory checks are crucial in mitigating this risk.

-

Improper Handling of Returns: Returned goods might not be properly added back into the inventory count, resulting in an understated balance. A clear system for processing returns and incorporating them into the inventory count is vital.

-

Counting Errors: Even with careful procedures, simple counting errors can occur. Human error is inevitable, and using technology, like barcode scanners, can help reduce the incidence of such errors. However, even with technology, occasional mistakes still need to be addressed through double-checking and reconciliation.

2. Inaccurate Record-Keeping:

Poor record-keeping practices exacerbate the risk of understating ending inventory. This includes:

-

Lack of Perpetual Inventory System: A perpetual inventory system, which continuously updates inventory records with every transaction, helps to identify discrepancies in real-time. The absence of such a system makes it harder to detect errors until the physical count, potentially leading to a significant understatement.

-

Inaccurate Data Entry: Errors in data entry, such as incorrect quantities, prices, or item descriptions, directly distort the inventory records. This can be mitigated through data validation techniques and double-checking mechanisms.

-

Poor Inventory Classification: Failure to properly classify inventory items (e.g., raw materials, work-in-progress, finished goods) can lead to inaccurate valuations and ultimately affect the ending inventory balance. A standardized classification system is essential for accurate record-keeping.

-

Delayed or Missing Updates: Delays in updating inventory records can lead to significant discrepancies between the physical count and the recorded balance. A timely and efficient update process is critical.

3. Flaws in Inventory Management Systems:

Inefficient inventory management systems contribute to the risk of understating ending inventory. This includes:

-

Lack of Regular Cycle Counting: Regular cycle counting, which involves counting a small portion of inventory regularly instead of a complete physical count annually, helps detect discrepancies early on. The absence of this practice increases the likelihood of larger errors accumulating until the year-end count.

-

Poor Warehouse Management: A poorly organized warehouse can make it difficult to accurately count inventory, leading to omissions and understatements. Efficient warehouse management is essential for accurate inventory tracking and control.

-

Ineffective Technology Integration: Failure to effectively integrate inventory management software with other business systems (e.g., point-of-sale systems, accounting software) can create inconsistencies and inaccuracies. Seamless integration of technology is vital for real-time inventory tracking.

Consequences of Understating Ending Inventory

Understating ending inventory has far-reaching consequences, primarily impacting the accuracy of the financial statements:

-

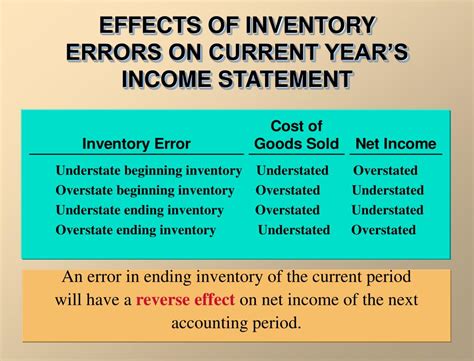

Overstated Cost of Goods Sold (COGS): The most direct impact is the overstatement of COGS. Since COGS is calculated as Beginning Inventory + Purchases – Ending Inventory, an understated ending inventory leads to a higher COGS figure.

-

Understated Gross Profit: The overstated COGS directly leads to an understatement of gross profit (Revenue – COGS). This distorts the profitability analysis and can mislead stakeholders about the company's performance.

-

Understated Net Income: The understated gross profit further impacts net income, leading to an overall understatement. This can have serious implications for investors, creditors, and tax authorities.

-

Understated Income Taxes: The understatement of net income can lead to a lower tax liability, which is a material misstatement. While seemingly beneficial, this is an illegal action that can result in significant penalties and legal ramifications.

-

Misleading Financial Ratios: Several key financial ratios, such as gross profit margin, inventory turnover, and return on assets, are affected by the understated ending inventory. This distorts the financial picture and can hinder informed decision-making.

-

Damaged Credibility: The discovery of understated inventory can severely damage a company's credibility with investors, creditors, and other stakeholders. It raises questions about the reliability of the company's financial reporting practices.

Correcting Understated Ending Inventory

Correcting an understated ending inventory requires careful analysis and adjustments:

-

Identify the Cause: The first step is to thoroughly investigate the cause of the understatement. This requires reviewing inventory counting procedures, record-keeping practices, and inventory management systems.

-

Perform a Recount: A complete recount of the inventory is often necessary to determine the accurate ending inventory balance. This should be conducted with improved procedures and better trained personnel.

-

Adjust Financial Statements: Once the accurate ending inventory balance is determined, the financial statements must be adjusted to reflect the correction. This involves recalculating COGS, gross profit, net income, and other affected line items.

-

Implement Corrective Measures: To prevent future understatements, it's crucial to implement corrective measures. This may include improving inventory counting procedures, upgrading inventory management systems, and enhancing employee training.

-

Disclosure: Depending on the materiality of the error, the company may need to disclose the correction in its financial statements and accompanying notes. Transparency is key in maintaining stakeholder confidence.

Prevention Strategies for Accurate Inventory Management:

Preventing the understatement of ending inventory requires a proactive approach to inventory management:

-

Implement a Robust Inventory System: Employ a perpetual inventory system coupled with regular cycle counting to continuously monitor inventory levels and identify discrepancies early on.

-

Standardize Inventory Counting Procedures: Establish clear, detailed, and standardized procedures for physical inventory counts, including training for all personnel involved.

-

Enhance Security Measures: Implement robust security measures to prevent theft and shrinkage. This includes access control, surveillance systems, and regular employee audits.

-

Regularly Review and Update Records: Regularly review and update inventory records to ensure accuracy. This includes verifying quantities, prices, and descriptions of all inventory items.

-

Use Technology Effectively: Integrate inventory management software with other business systems to ensure seamless data flow and real-time inventory tracking. Consider using barcode scanners and RFID technology to enhance accuracy and efficiency.

-

Improve Warehouse Management: Organize the warehouse efficiently to facilitate accurate inventory counting. Proper labeling, storage, and location tracking are essential.

-

Conduct Regular Audits: Conduct internal and external audits to assess the effectiveness of inventory management processes and identify areas for improvement. Regular audits provide independent verification and help maintain compliance.

-

Employee Training: Invest in comprehensive training for employees responsible for inventory management, emphasizing accuracy, diligence, and adherence to established procedures.

Conclusion:

The understatement of ending inventory is a serious accounting error with significant financial and legal repercussions. Understanding the various causes, their impact on financial statements, and the necessary corrective measures is crucial for maintaining accurate financial reporting and preserving the company's credibility. By implementing effective inventory management practices, including robust systems, standardized procedures, and regular audits, companies can minimize the risk of understating ending inventory and ensure the reliability of their financial information. Proactive measures are far more effective and less costly than dealing with the consequences of a misstated inventory balance after it's been discovered. Investing in robust inventory management is an investment in the company's long-term financial health and stability.

Latest Posts

Latest Posts

-

Operations Management In The Service Sector Is Focused On Creating

Mar 19, 2025

-

Classify The Radicals Into The Appropriate Categories

Mar 19, 2025

-

The Balance Of Trade Is Also Referred To As Countertrade

Mar 19, 2025

-

A Basic Characteristic Of Flexible Manufacturing Is That It

Mar 19, 2025

-

A User Would Navigate To Alteryx Community To

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about The Understatement Of The Ending Inventory Balance Causes . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.