The Balance Of Trade Is Also Referred To As Countertrade

Holbox

Mar 19, 2025 · 6 min read

Table of Contents

The Balance of Trade: Understanding Countertrade and its Nuances

The balance of trade, a crucial component of a nation's overall economic health, often gets intertwined with the concept of countertrade. While not entirely synonymous, they are closely related, especially when examining international commerce. This comprehensive article will delve deep into the balance of trade, explore various forms of countertrade, analyze their implications, and discuss their impact on global economies.

What is the Balance of Trade?

The balance of trade, also known as the net exports, represents the difference between the monetary value of a country's exports (goods and services sold to other countries) and its imports (goods and services purchased from other countries) over a specific period, typically a year. A trade surplus occurs when a country exports more than it imports, resulting in a positive balance of trade. Conversely, a trade deficit arises when imports exceed exports, leading to a negative balance of trade.

Analyzing the Balance of Trade: Key Indicators

Analyzing a nation's balance of trade is crucial for understanding its economic standing and competitiveness. Several key indicators are used:

- Export Value: The total value of goods and services a country sells abroad.

- Import Value: The total value of goods and services a country buys from abroad.

- Trade Balance: The difference between export value and import value.

- Trade Volume: The combined value of exports and imports.

These indicators provide insights into a country's production capacity, consumption patterns, and its position in the global market. A consistently positive balance of trade often indicates a strong export-oriented economy, whereas a persistent trade deficit might suggest reliance on foreign goods and services.

Countertrade: A Closer Look

Countertrade, also known as reciprocal trade, encompasses a broad range of international trade transactions where payment is made in kind, rather than solely in cash or credit. It's a mechanism used to overcome various obstacles in international trade, particularly in situations where traditional payment methods are difficult or impossible.

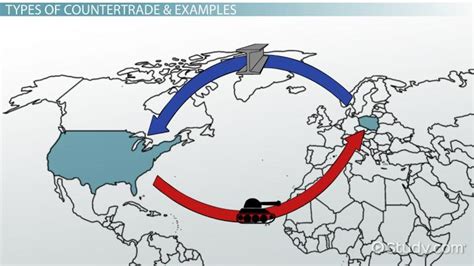

Types of Countertrade

Countertrade encompasses diverse forms, each with its own complexities:

- Barter: The simplest form, involving a direct exchange of goods or services without the use of money. For example, country A provides agricultural products in exchange for country B's manufactured goods.

- Compensation Trade: A combination of cash payments and goods exchanges. A portion of the transaction is settled in hard currency, while the remainder is paid through the supply of goods or services.

- Counterpurchase: This involves two separate contracts: one for the sale of goods and another for the purchase of goods from the buyer's country. The contracts are linked but not directly tied to each other in terms of timing or price. This creates a complex set of relationships that may prove difficult to administer.

- Buy-Back Agreements: The seller agrees to supply technology or equipment, and in return, receives a portion of the output produced using that technology or equipment. This is common in large-scale industrial projects, such as power plants or manufacturing facilities.

- Switch Trading: A third party intermediary facilitates the trade, enabling the exchange of goods between two countries that may not have a direct trade relationship. This often involves managing complex trade balances and currency issues.

Choosing the appropriate countertrade method depends on the specific circumstances, including the nature of the goods, the financial capabilities of the involved parties, and the overall economic environment.

Countertrade and the Balance of Trade: A Complex Relationship

Countertrade directly impacts the balance of trade, although its effect can be complex and difficult to measure accurately. While it can lead to an increase in exports, it can also create accounting challenges, and it can potentially inflate the value of recorded exports if the goods involved in the countertrade are overvalued.

When analyzing the balance of trade in the presence of countertrade, economists must consider several factors:

- Valuation of Countertrade Goods: The value of goods exchanged in countertrade must be accurately assessed, which is challenging given the lack of standard market pricing.

- Hidden Costs: Countertrade transactions may involve additional costs like transportation, storage, and marketing of goods received in exchange.

- Transparency Issues: Countertrade agreements can sometimes lack transparency, making it difficult to gather reliable data for balance of trade calculations.

Why Choose Countertrade?

Countertrade, despite its complexities, offers several compelling advantages, particularly for countries or companies facing specific trade challenges:

- Circumventing Foreign Exchange Restrictions: Countertrade can overcome limitations on hard currency, making it a valuable option for countries with limited access to foreign exchange reserves.

- Boosting Exports: By enabling exports to markets that might otherwise be inaccessible, countertrade can significantly increase a country's export volume.

- Access to New Markets: It can facilitate entry into new markets, especially emerging economies, where cash transactions might not be readily available.

- Securing Supplies of Essential Goods: Countertrade can be crucial for obtaining essential goods and commodities that might be in short supply.

Risks and Challenges Associated with Countertrade

Despite the potential benefits, countertrade carries inherent risks and challenges:

- Valuation Difficulties: Assessing the true value of goods exchanged can be difficult and might lead to disputes between trading parties.

- Marketing and Distribution Challenges: Selling goods received in countertrade requires effective marketing and distribution strategies, which can be costly and complex.

- Risk of Inferior Goods: There's a risk of receiving goods of inferior quality or those that are difficult to sell in the domestic market.

- Administrative Complexity: Managing countertrade agreements can be administratively demanding and time-consuming.

- Lack of Price Transparency: The absence of a free market for pricing the goods exchanged in the transactions can lead to difficulties.

Countertrade in a Globalized World

The prevalence of countertrade has shifted over time. In the earlier stages of globalization, it was more common, particularly in centrally planned economies and developing countries with limited access to hard currencies. With the increase in global financial integration and more robust international financial markets, the use of countertrade has somewhat declined. However, it remains a relevant instrument for certain transactions, particularly in regions with less developed financial systems or where political and economic factors create unique trade barriers.

The Future of Countertrade

While the prominence of countertrade might have decreased, it is unlikely to disappear entirely. In specific circumstances, such as:

- Developing Economies: Countries with limited foreign exchange reserves may still find countertrade a useful tool to boost their exports and access essential goods.

- Sanctions and Embargoes: In situations where standard trade channels are restricted due to sanctions or embargoes, countertrade can provide an alternative mechanism for international exchange.

- Commodity-Based Economies: Countries heavily reliant on the export of raw materials might find countertrade a suitable way to acquire manufactured goods or technological advancements.

Countertrade will likely continue to play a niche role in global commerce, adapting to evolving economic and political landscapes. Its future will likely depend on global economic instability, the availability of conventional financing mechanisms, and the ongoing development of financial markets in emerging economies.

Conclusion

The balance of trade and countertrade are intrinsically linked but not identical concepts. The balance of trade reflects a nation's overall import and export performance, providing a crucial macroeconomic indicator. Countertrade, as a specific type of trade transaction, influences the balance of trade but presents its own set of complexities. Understanding the nuances of both is essential for comprehending international trade dynamics, particularly the strategies employed by nations and companies operating in a globalized world. While the use of countertrade may not be as prevalent as it once was, it remains a vital tool under certain circumstances and will likely continue to adapt to the ever-evolving global economic landscape. Accurate accounting and transparent agreements are key to successful countertrade transactions and their accurate reflection in national balance of trade figures.

Latest Posts

Latest Posts

-

Industrial Machinery Is An Example Of

Mar 19, 2025

-

Two Systems Of Defensive Driving Are

Mar 19, 2025

-

Refers To All Data In Computer Storage

Mar 19, 2025

-

Determine Which Is The Correct Action Of The Featured Muscle

Mar 19, 2025

-

What Is The Most Immediate Concern Regarding Estelles Hematocrit

Mar 19, 2025

Related Post

Thank you for visiting our website which covers about The Balance Of Trade Is Also Referred To As Countertrade . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.