The Objectives Of Internal Control Are To

Holbox

Mar 20, 2025 · 5 min read

Table of Contents

The Objectives of Internal Control Are To… Safeguard Assets, Ensure Reliable Financial Reporting, and More

Internal controls are the bedrock of any successful organization. They are the processes, policies, and procedures designed to provide reasonable assurance regarding the achievement of objectives across various operational areas. But what are those objectives, precisely? Understanding these goals is crucial for implementing effective internal controls and safeguarding your business. This comprehensive guide will delve into the multifaceted objectives of internal controls, exploring their importance and implications for different organizational sizes and structures.

Primary Objectives of Internal Control

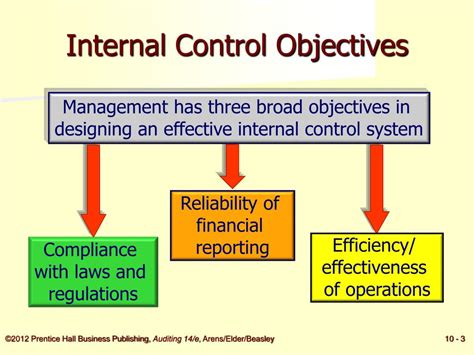

The objectives of internal control systems can be broadly categorized, though the specifics may vary depending on the organization's size, industry, and risk profile. However, three overarching objectives consistently emerge:

1. Safeguarding Assets

This is perhaps the most intuitive objective. Internal controls aim to protect the organization's assets, both tangible and intangible. This includes:

- Physical Assets: Inventory, equipment, buildings, and vehicles. Controls here might include physical security measures (locks, security systems), access restrictions, regular inventory counts, and maintenance schedules.

- Financial Assets: Cash, accounts receivable, investments, and intellectual property. Controls encompass segregation of duties, bank reconciliations, authorization procedures for transactions, and robust accounting systems.

- Information Assets: Data, software, and intellectual property. Controls here involve access controls, data encryption, regular backups, and cybersecurity measures to prevent unauthorized access, data breaches, and cyberattacks.

Strong internal controls minimize the risk of theft, fraud, damage, and loss of assets. They establish accountability and transparency, ensuring that all assets are properly managed and accounted for.

2. Ensuring the Reliability of Financial Reporting

Accurate and reliable financial reporting is critical for making informed business decisions, attracting investors, and complying with regulatory requirements. Internal controls play a vital role in achieving this objective by:

- Promoting Accurate Record-Keeping: Controls like proper documentation procedures, segregation of duties (preventing one person from handling all aspects of a transaction), and regular reconciliation of accounts ensure that financial records are accurate and complete.

- Preventing and Detecting Errors and Fraud: Internal controls help prevent errors from occurring in the first place and provide mechanisms to detect and correct errors or fraudulent activities if they do occur. This includes checks and balances, independent reviews, and audits.

- Compliance with Accounting Standards: Internal controls ensure that the organization's financial reporting complies with generally accepted accounting principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the relevant jurisdiction.

3. Promoting and Improving Operational Efficiency and Effectiveness

Internal controls are not just about preventing losses; they are also about optimizing operations. Effective controls can:

- Streamline Processes: Well-designed controls can eliminate redundancies, improve workflows, and enhance efficiency in various business processes. This leads to cost savings and increased productivity.

- Enhance Decision-Making: Reliable data and accurate reporting, facilitated by robust internal controls, improve the quality of management decision-making. Informed decisions lead to better strategic planning and resource allocation.

- Improve Customer Satisfaction: Efficient operations and error-free processes contribute directly to customer satisfaction. For example, accurate order processing and timely delivery enhance the customer experience.

Secondary Objectives of Internal Control

While the three primary objectives form the core of internal control systems, several secondary objectives contribute to their overall effectiveness. These often overlap and support the primary objectives:

-

Compliance with Laws and Regulations: Internal controls are essential for adhering to various laws, regulations, and industry standards. This includes tax regulations, environmental regulations, and industry-specific compliance requirements. Non-compliance can lead to significant penalties and reputational damage.

-

Risk Management: Effective internal controls identify, assess, and mitigate risks that could threaten the organization's ability to achieve its objectives. This involves proactively addressing potential threats and vulnerabilities.

-

Maintaining Ethical Conduct: Internal controls foster a culture of ethical behavior and accountability. This includes implementing codes of conduct, whistleblowing mechanisms, and regular ethics training for employees.

-

Improving Corporate Governance: Strong internal control systems are a cornerstone of good corporate governance. They enhance transparency, accountability, and the overall effectiveness of the organization's board of directors and management team.

Implementing Effective Internal Controls: A Practical Guide

Implementing effective internal controls requires a systematic approach. Here are some key steps:

-

Risk Assessment: Identify and assess potential risks that could affect the achievement of objectives. This involves considering both internal and external factors.

-

Control Design and Implementation: Design and implement control activities to mitigate identified risks. Controls should be tailored to the specific risks and the organization's context.

-

Documentation: Document all internal control procedures and policies. This ensures consistency, facilitates training, and provides an audit trail.

-

Monitoring and Evaluation: Regularly monitor the effectiveness of internal controls and make adjustments as needed. This might involve internal audits, management reviews, and performance evaluations.

-

Ongoing Improvement: Internal controls are not static; they need to be continuously improved to adapt to changing circumstances, technology advancements, and emerging risks.

Tailoring Internal Controls to Organizational Size and Structure

The approach to internal controls varies significantly depending on the size and structure of the organization.

Small Businesses: Often rely on less formal controls, such as direct supervision by owners or managers. However, even small businesses need basic controls, like separation of duties where feasible and regular bank reconciliations.

Medium-Sized Businesses: May employ more sophisticated controls, including documented policies and procedures, dedicated internal audit functions, and specialized software solutions.

Large Enterprises: Typically have comprehensive internal control systems, often including enterprise resource planning (ERP) systems, dedicated internal audit departments, and external audits. They often adhere to stringent regulatory frameworks.

Conclusion: The Importance of Strong Internal Controls

The objectives of internal control are multifaceted and crucial for the long-term success and sustainability of any organization. From safeguarding assets and ensuring reliable financial reporting to improving operational efficiency and fostering ethical conduct, strong internal controls are a cornerstone of good governance and risk management. By understanding and implementing effective internal control systems tailored to their specific needs, organizations can significantly reduce risks, improve performance, and achieve their strategic objectives. Regular review and adaptation are vital to ensure these systems remain relevant and effective in a dynamic business environment. Remember that the ultimate goal is not just compliance, but the creation of a robust and resilient organizational structure that safeguards value and promotes success.

Latest Posts

Latest Posts

-

Differentiate Y Sec I Tan I

Mar 21, 2025

-

Human Anatomy And Physiology Lab Manual

Mar 21, 2025

-

Sophia Operates Her Own Accounting Practice

Mar 21, 2025

-

How Many Different Kinds Of 13c Peaks Will Be Seen

Mar 21, 2025

-

Which Of The Following Accurately Describes A Supply Chain Map

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about The Objectives Of Internal Control Are To . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.