The Objective Of Standard Cost Variance Analysis Is

Holbox

Mar 14, 2025 · 7 min read

Table of Contents

The Objective of Standard Cost Variance Analysis Is… Enhanced Decision-Making

Standard cost variance analysis is a crucial management accounting technique that plays a pivotal role in driving operational efficiency and profitability. Its primary objective is not simply to identify discrepancies between actual and standard costs, but to leverage those discrepancies to improve future performance. This in-depth exploration will delve into the core objectives, methodology, and practical applications of standard cost variance analysis, highlighting its significance in today's dynamic business environment.

Understanding Standard Costs and Variances

Before diving into the objectives, let's establish a clear understanding of the fundamental components:

What are Standard Costs?

Standard costs represent the predetermined cost of producing a unit of product or service. They are meticulously established based on historical data, industry benchmarks, engineering specifications, and anticipated future conditions. These costs encompass all elements, including:

- Direct Materials: The cost of raw materials directly used in production.

- Direct Labor: Wages and benefits paid to workers directly involved in production.

- Manufacturing Overhead: Indirect costs associated with production, such as factory rent, utilities, and depreciation.

Standard costs provide a benchmark against which actual costs can be compared. This comparison is the heart of variance analysis.

Types of Variances

When actual costs deviate from standard costs, variances arise. These variances are categorized into various types, primarily focusing on:

-

Material Variances: These variances highlight discrepancies between the actual and standard costs of materials used. They are further broken down into:

- Material Price Variance: The difference between the actual price paid for materials and the standard price.

- Material Usage Variance: The difference between the actual quantity of materials used and the standard quantity allowed for the output achieved.

-

Labor Variances: These variances analyze the differences between actual and standard labor costs. They include:

- Labor Rate Variance: The difference between the actual labor rate paid and the standard labor rate.

- Labor Efficiency Variance: The difference between the actual labor hours used and the standard labor hours allowed for the output achieved.

-

Overhead Variances: These variances examine discrepancies in manufacturing overhead costs. They are often subdivided into variable and fixed overhead variances, further broken down into spending and efficiency variances similar to material and labor variances.

The Core Objectives of Standard Cost Variance Analysis

The primary objective of standard cost variance analysis is to enhance decision-making by providing insightful information about cost behavior and operational efficiency. This overarching objective can be broken down into several key sub-objectives:

1. Identifying Areas for Improvement

Variance analysis acts as a powerful diagnostic tool, pinpointing areas within the production process where costs are exceeding expectations. By identifying the specific sources of variances – whether it's inefficient material usage, excessive labor costs, or unexpected overhead expenses – management can target improvement efforts effectively. This focused approach maximizes the impact of corrective actions.

2. Monitoring Operational Efficiency

Standard cost variance analysis provides a continuous monitoring mechanism for assessing operational efficiency. Regularly tracking variances allows managers to identify trends, anticipate potential problems, and take proactive measures to prevent cost overruns. This proactive approach is far more effective than reacting to problems after they have significantly impacted profitability.

3. Improving Cost Control

By understanding the root causes of variances, management can implement targeted cost control measures. This might involve negotiating better prices with suppliers, improving employee training to enhance efficiency, or streamlining production processes to reduce waste and overhead costs. Effective cost control is paramount for maintaining profitability and competitiveness.

4. Enhancing Budgeting and Forecasting Accuracy

Standard cost variance analysis feeds valuable information back into the budgeting and forecasting processes. By analyzing past variances, management can refine their cost estimates and improve the accuracy of future budgets and forecasts. This enhanced accuracy leads to more informed decision-making regarding pricing strategies, resource allocation, and capital investments.

5. Motivating Employees and Improving Accountability

When variances are systematically analyzed and communicated to employees, it can foster a culture of accountability and continuous improvement. By understanding the impact of their work on overall costs, employees are more likely to be motivated to enhance efficiency and reduce waste. This shared responsibility drives a more efficient and cost-conscious organization.

6. Facilitating Performance Evaluation

Standard cost variance analysis provides a valuable framework for evaluating the performance of different departments and individuals. By attributing variances to specific areas of responsibility, management can assess performance objectively and identify areas requiring additional training, support, or corrective action. This performance-based approach fosters continuous improvement throughout the organization.

Methodology of Standard Cost Variance Analysis

The process generally involves these steps:

- Establishing Standard Costs: Meticulously determine standard costs for materials, labor, and overhead based on historical data, industry benchmarks, and projected future conditions.

- Collecting Actual Costs: Accurately track and record actual costs incurred during the production process.

- Calculating Variances: Determine the difference between actual and standard costs for each cost element (materials, labor, and overhead). This often involves calculating price, quantity, rate, and efficiency variances.

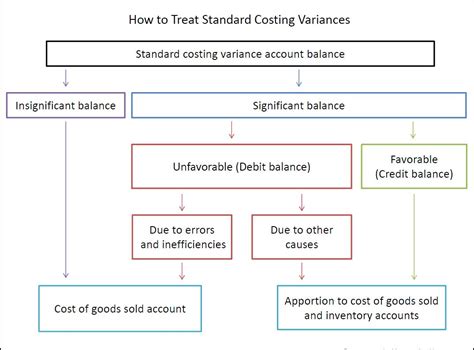

- Analyzing Variances: Investigate the underlying causes of significant variances. This requires careful examination of operational data, production records, and other relevant information.

- Reporting and Corrective Action: Present variance analysis reports to management, highlighting key findings and recommending appropriate corrective actions. This might involve implementing process improvements, negotiating better supplier contracts, or providing additional employee training.

- Continuous Monitoring and Improvement: Regularly monitor variances and continuously refine the standard cost system based on actual results and evolving circumstances.

Practical Applications and Benefits

Standard cost variance analysis is not a theoretical exercise; it holds significant practical value across various industries and business contexts. Here are some practical applications:

- Manufacturing: Analyzing variances in material usage, labor costs, and overhead expenses to optimize production processes and reduce waste.

- Service Industries: Evaluating variances in labor costs, overhead expenses, and customer service costs to improve efficiency and enhance customer satisfaction.

- Project Management: Tracking variances in project budgets and timelines to ensure projects are completed on time and within budget.

- Inventory Management: Analyzing variances in inventory levels to optimize inventory control and minimize storage costs.

The benefits of implementing a robust standard cost variance analysis system are manifold:

- Improved Profitability: By identifying and addressing cost inefficiencies, organizations can significantly enhance their profitability.

- Enhanced Operational Efficiency: Continuous monitoring and analysis of variances lead to streamlined processes and reduced waste.

- Better Decision-Making: Data-driven insights empower management to make more informed and strategic decisions.

- Increased Accountability: Clear responsibility for cost variances promotes accountability and encourages continuous improvement.

- Competitive Advantage: Enhanced efficiency and cost control contribute to a stronger competitive position.

Limitations of Standard Cost Variance Analysis

While standard cost variance analysis offers significant benefits, it's crucial to acknowledge its limitations:

- Oversimplification: Standard costs may not always accurately reflect the complexities of actual production processes.

- Data Dependency: The accuracy of variance analysis hinges on the reliability and accuracy of cost data.

- Inflexibility: Standard costs can become outdated if not regularly reviewed and updated.

- Focus on Cost Reduction Only: The emphasis on cost reduction may overshadow other important factors, such as quality and innovation.

- Potential for Manipulation: Standard costs can be manipulated to achieve desired results, undermining the integrity of the analysis.

Conclusion: The Power of Proactive Cost Management

The objective of standard cost variance analysis ultimately boils down to proactive cost management. It's not merely about identifying past problems, but about using those insights to prevent future issues, improve operational efficiency, and enhance profitability. By embracing a culture of continuous improvement and leveraging the power of data-driven insights, organizations can transform standard cost variance analysis from a simple accounting technique into a powerful engine for growth and sustainable success. The key lies in consistently implementing the methodology, interpreting the results critically, and using the findings to drive positive change within the organization. The ultimate goal is not just to understand why variances occur, but to proactively prevent them from occurring in the first place.

Latest Posts

Latest Posts

-

Manufacturing Costs Include Direct Materials Direct Labor And

Mar 14, 2025

-

Health Screenings Are Important Measures In

Mar 14, 2025

-

What Is The Conjugate Base Of Nh3

Mar 14, 2025

-

Contingent Liabilities Must Be Recorded If

Mar 14, 2025

-

A Price Setter Company Will Use More

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about The Objective Of Standard Cost Variance Analysis Is . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.