Contingent Liabilities Must Be Recorded If

Holbox

Mar 14, 2025 · 7 min read

Table of Contents

Contingent Liabilities Must Be Recorded If: A Comprehensive Guide

Contingent liabilities represent a potential financial obligation that may arise depending on the outcome of an uncertain future event. Understanding when to record these potential liabilities is crucial for accurate financial reporting and to avoid misleading investors and creditors. This comprehensive guide delves into the intricacies of contingent liabilities, providing a clear explanation of when they must be recorded, and the nuances involved in their accounting treatment.

What are Contingent Liabilities?

A contingent liability is a potential obligation that arises only if a specific uncertain future event occurs or fails to occur. Unlike a recognized liability, its existence is dependent on an uncertain future event. This event could be anything from a lawsuit to a warranty claim, or a breach of contract. The uncertainty associated with these liabilities makes their accounting treatment particularly nuanced and important.

Examples of contingent liabilities include:

- Lawsuits and legal claims: If a company is involved in litigation, the potential liability associated with an unfavorable outcome is a contingent liability.

- Guarantees and warranties: Companies often provide guarantees or warranties on their products or services. If a product fails and the company is obligated to provide a replacement or refund, this represents a contingent liability.

- Environmental liabilities: Potential cleanup costs associated with environmental contamination constitute contingent liabilities.

- Uncertain tax assessments: The potential liability arising from a tax audit or an ongoing tax dispute is also a contingent liability.

- Breach of contract: Potential damages or penalties resulting from a potential breach of contract.

When Must Contingent Liabilities Be Recorded?

The accounting standards (like IFRS and GAAP) provide clear guidance on when a contingent liability must be recorded as a liability in the financial statements. The key criterion is the likelihood of the occurrence of the uncertain future event and the ability to reliably estimate the amount of the liability.

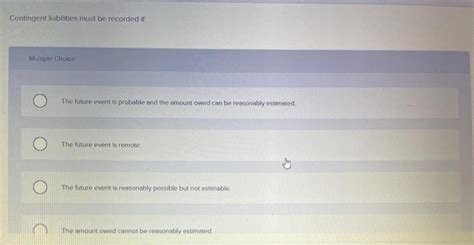

A contingent liability must be recorded (recognized) if:

-

It is probable that an outflow of resources embodying economic benefits will occur. This means that the likelihood of the event leading to the obligation is more likely than not. In other words, the probability of the event occurring is greater than 50%. This assessment requires careful consideration of all available evidence and expert opinion, if necessary.

-

The amount of the obligation can be reliably estimated. This requires a reasonable estimate of the potential loss, considering all available information. The estimate doesn’t need to be precise, but it must be sufficiently reliable to be included in the financial statements. Techniques such as discounted cash flow analysis, statistical modeling, and expert opinion may be used to arrive at the best estimate.

If both these criteria are met, the contingent liability is recognized in the financial statements by:

- Dr. Contingent Liability Expense (Income Statement)

- Cr. Contingent Liability (Balance Sheet)

This means that the expense is recognized in the income statement, reducing net income, and the liability is shown on the balance sheet, reflecting the potential obligation.

Disclosure of Contingent Liabilities

Even if a contingent liability doesn't meet the criteria for recognition (i.e., it's not probable or the amount cannot be reliably estimated), it still needs to be disclosed in the financial statements. This disclosure provides transparency to users of the financial statements about potential future obligations.

Disclosure of contingent liabilities typically includes:

- A description of the nature of the contingent liability. This involves explaining the event that could lead to the obligation and the potential consequences.

- An indication of the estimated amount or range of amounts, if estimable. If the amount cannot be reliably estimated, this should also be stated.

- An assessment of the likelihood of an outflow of resources embodying economic benefits. This should clearly articulate the probability of the event occurring, using terms like "probable," "reasonably possible," or "remote."

Examples Illustrating the Recording and Disclosure Requirements

Example 1: Lawsuit

A company is involved in a lawsuit. The company's legal counsel assesses that it is probable that the company will lose the case, and the estimated loss is $1 million. Since both criteria are met, the contingent liability of $1 million is recognized.

Example 2: Warranty Claim

A company sells products with a one-year warranty. Based on historical data, the company estimates that approximately 5% of its products will require a warranty claim. The estimated cost of each claim is $100. If the company sold 10,000 products, the estimated liability would be 500 claims x $100 = $50,000. This is recognized as a liability.

Example 3: Potential Environmental Liability

A company suspects that its operations have caused environmental contamination, but the extent of the contamination and the cleanup costs are uncertain. The company's environmental consultant assesses that it is reasonably possible that cleanup costs will be incurred, but the amount is not reliably estimable. In this case, the contingent liability is not recognized but is disclosed in the notes to the financial statements.

Example 4: Guarantee

A company guarantees the debt of another entity. It is possible that the other entity will default, and the company will have to pay. However, the probability of default is less than 50%. Therefore, the guarantee is not recognized but disclosed in the notes.

The Importance of Proper Accounting for Contingent Liabilities

Accurate accounting for contingent liabilities is critical for several reasons:

- Fair Presentation of Financial Position: Recognizing and disclosing contingent liabilities provides a more complete and accurate picture of a company's financial position. It ensures that users of the financial statements are aware of potential future obligations.

- Reliable Financial Reporting: Accurate accounting ensures that the financial statements are reliable and can be used by investors and creditors to make informed decisions.

- Compliance with Accounting Standards: Proper accounting for contingent liabilities is crucial for compliance with relevant accounting standards like IFRS and GAAP. Failure to comply can lead to penalties and reputational damage.

- Investor and Creditor Confidence: Transparent and accurate reporting enhances investor and creditor confidence, potentially leading to better access to capital.

Analyzing Contingent Liabilities: A Deeper Dive

The process of determining whether a contingent liability should be recognized involves a detailed analysis of several factors:

-

Legal Counsel Opinion: In cases involving litigation or potential legal action, obtaining an opinion from legal counsel is often essential. The legal counsel's assessment of the likelihood of an unfavorable outcome and the potential amount of damages significantly influences the accounting treatment.

-

Historical Data Analysis: For liabilities like warranty claims, historical data on the frequency and cost of past claims can be used to develop a reliable estimate of future liabilities. Statistical techniques can be employed to refine the estimates.

-

Expert Opinions: In complex situations involving specialized areas like environmental remediation or engineering failures, obtaining expert opinions may be necessary to accurately assess the potential liability.

-

Sensitivity Analysis: Conducting sensitivity analysis can help in understanding the range of possible outcomes and the impact of uncertainties on the estimated amount of the liability.

-

Scenario Planning: Considering various scenarios (best-case, worst-case, most-likely) can assist in developing a more robust estimate of the contingent liability.

Consequences of Improper Accounting

Failure to properly account for contingent liabilities can have significant consequences, including:

-

Misleading Financial Statements: Omitting or understating contingent liabilities can present a misleading picture of a company's financial position, potentially harming investors and creditors.

-

Regulatory Penalties: Non-compliance with accounting standards can lead to penalties and sanctions from regulatory bodies.

-

Reputational Damage: The discovery of inaccurate accounting can damage a company's reputation and erode investor trust.

-

Legal Action: In some cases, improper accounting for contingent liabilities can lead to legal action from shareholders or creditors.

Conclusion

Contingent liabilities are an inherent part of doing business. Understanding when to record them and how to disclose them appropriately is crucial for accurate financial reporting. By meticulously analyzing the likelihood of the uncertain future event and the ability to estimate the amount, companies can ensure that their financial statements provide a fair and accurate representation of their financial position, fostering investor confidence and maintaining compliance with accounting standards. The rigorous application of accounting principles and professional judgment are key to navigating the complexities of contingent liabilities.

Latest Posts

Latest Posts

-

Specialization In Production Is Important Primarily Because It

Mar 14, 2025

-

5 Client Findings That Require Further Evaluation

Mar 14, 2025

-

A Company Sells 10000 Shares Of Previously Authorized Stock Indeed

Mar 14, 2025

-

An Advantage Of Issuing Bonds Is That

Mar 14, 2025

-

Informed Consent Means Clearly Explaining All Of The Following Except

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about Contingent Liabilities Must Be Recorded If . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.