The Greater Is The Marginal Propensity To Consume The

Holbox

Mar 28, 2025 · 6 min read

Table of Contents

- The Greater Is The Marginal Propensity To Consume The

- Table of Contents

- The Greater is the Marginal Propensity to Consume the… Multiplier Effect!

- Understanding the Marginal Propensity to Consume (MPC)

- The Multiplier Effect: Amplifying the Impact of Changes in Spending

- The Relationship Between MPC and the Multiplier: A Deeper Dive

- Implications for Economic Policy

- Limitations and Considerations

- Conclusion

- Latest Posts

- Latest Posts

- Related Post

The Greater is the Marginal Propensity to Consume the… Multiplier Effect!

The statement "the greater is the marginal propensity to consume (MPC), the..." is incomplete without specifying its impact. The complete and accurate statement is: "The greater is the marginal propensity to consume (MPC), the larger the multiplier effect." This relationship is fundamental to understanding Keynesian economics and its implications for macroeconomic policy. This article delves deep into the concept of MPC, its influence on the multiplier, and the broader implications for economic growth and stability.

Understanding the Marginal Propensity to Consume (MPC)

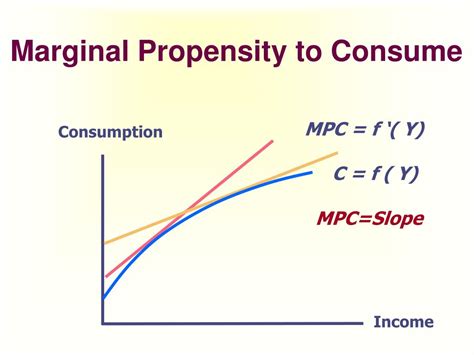

The marginal propensity to consume (MPC) is a crucial concept in macroeconomics. It represents the fraction of an additional dollar of disposable income that is spent on consumption. In simpler terms, it measures how much of a change in income leads to a change in spending. For instance, if an individual receives an extra $100 and spends $80 of it, their MPC is 0.8 (80/100). The remaining $20 is saved, representing the marginal propensity to save (MPS), which is 1 – MPC.

Key Characteristics of MPC:

- Positive but less than 1: MPC is always positive because an increase in income generally leads to an increase in consumption. However, it's always less than 1 because individuals typically save a portion of any additional income.

- Short-run vs. Long-run: MPC can vary depending on the time horizon. In the short run, MPC tends to be higher as individuals may not have time to adjust their spending habits fully. In the long run, MPC may be lower as individuals may adjust their savings behavior.

- Influencing Factors: Several factors affect MPC, including:

- Income Level: MPC tends to be higher for lower-income individuals as they have a greater need to spend their income on essential goods and services.

- Wealth: Wealthier individuals tend to have a lower MPC as they have more savings and less need to spend their additional income.

- Consumer Confidence: When consumer confidence is high, MPC tends to be higher as individuals are more willing to spend.

- Interest Rates: Higher interest rates can reduce MPC as saving becomes more attractive.

- Expectations about the Future: Expectations about future income or economic conditions can influence MPC.

The Multiplier Effect: Amplifying the Impact of Changes in Spending

The multiplier effect is a powerful consequence of the MPC. It describes how an initial change in aggregate demand (e.g., government spending, investment) can lead to a larger overall change in national income. This amplification is directly linked to the MPC.

Understanding the Mechanism:

Imagine the government increases spending by $100 million. This initial injection of money into the economy increases the income of those who receive the government funds. They, in turn, spend a portion of this increased income (determined by the MPC) on goods and services. This spending becomes income for others, who then spend a portion of their increased income, and so on. This chain reaction continues until the initial injection of $100 million has a much larger overall impact on national income.

The Multiplier Formula:

The simple multiplier is calculated as:

Multiplier = 1 / (1 - MPC) or 1 / MPS

If the MPC is 0.8, the multiplier is 1 / (1 - 0.8) = 5. This means that a $100 million increase in government spending will ultimately lead to a $500 million increase in national income.

The Relationship Between MPC and the Multiplier: A Deeper Dive

The relationship between MPC and the multiplier is directly proportional. A higher MPC leads to a larger multiplier, and vice-versa. This is because a higher MPC means a larger portion of any increase in income is spent, leading to a more significant chain reaction and a greater overall impact on national income.

Conversely, a lower MPC leads to a smaller multiplier effect. If individuals save a larger proportion of any additional income, the chain reaction of spending is less pronounced, resulting in a smaller overall increase in national income.

Illustrative Example:

Let's compare two scenarios:

Scenario 1: High MPC (0.9)

Multiplier = 1 / (1 - 0.9) = 10

A $100 million increase in government spending would lead to a $1 billion increase in national income.

Scenario 2: Low MPC (0.5)

Multiplier = 1 / (1 - 0.5) = 2

A $100 million increase in government spending would lead to a $200 million increase in national income.

This example clearly demonstrates the significant difference in the impact of government spending based on the MPC.

Implications for Economic Policy

The MPC and the multiplier effect have significant implications for economic policymaking. Governments and central banks can use this understanding to design policies aimed at stimulating or stabilizing the economy.

Fiscal Policy:

Governments use fiscal policy (changes in government spending and taxation) to influence aggregate demand. Knowing the MPC allows policymakers to estimate the impact of fiscal stimulus packages. If the MPC is high, a smaller fiscal stimulus can have a large impact, while a low MPC requires a larger stimulus to achieve the same effect.

Monetary Policy:

Central banks use monetary policy (changes in interest rates and money supply) to influence aggregate demand. Interest rate changes affect consumption and investment decisions, and MPC plays a role in determining the effectiveness of these policies. Lower interest rates can increase consumption if the MPC is high, stimulating economic growth.

Economic Forecasting:

Accurate forecasting of economic growth and stability requires a reliable estimate of the MPC. Economists use various econometric models and data analysis techniques to estimate MPC, but it can be challenging due to the complex factors that influence consumer spending.

Limitations and Considerations

While the simple multiplier model provides valuable insights, it has limitations:

-

Simplified Assumptions: The model assumes a closed economy without external trade and ignores other factors affecting income, like taxes and imports. In reality, these factors can significantly affect the multiplier effect. The presence of imports reduces the multiplier because some spending leaks out of the domestic economy. Similarly, taxes reduce disposable income, thereby impacting the spending multiplier. A more realistic multiplier formula considers the impact of these leakage effects.

-

Time Lags: The multiplier effect doesn't happen instantly. It takes time for the initial injection of spending to ripple through the economy. These time lags can make it challenging to predict the precise timing and magnitude of the multiplier effect.

-

Changes in MPC: The MPC is not constant. It can vary over time depending on various economic and psychological factors. Changes in consumer confidence, wealth distribution, and interest rates can significantly alter the MPC, leading to unpredictable changes in the multiplier.

-

Non-linearity: The relationship between changes in spending and national income might not always be perfectly linear. The multiplier effect can be different at different levels of income and economic activity.

Conclusion

The marginal propensity to consume is a pivotal concept in macroeconomics with far-reaching implications for economic policy and forecasting. The greater the MPC, the greater the multiplier effect, implying that changes in aggregate demand (through government spending or other means) will have a more significant impact on national income. Understanding the nuances of MPC, including its influencing factors and limitations, is crucial for policymakers to design effective economic policies. While the simple multiplier model offers a valuable framework, it's essential to acknowledge its limitations and consider more sophisticated models that incorporate the complexities of the real-world economy for accurate economic analysis and policy recommendations. The accurate estimation of MPC remains a crucial challenge for economists and policymakers, requiring continuous refinement of econometric models and data analysis techniques to enhance the predictability and effectiveness of economic policies. Further research into behavioral economics and consumer psychology can offer valuable insights into understanding and predicting fluctuations in MPC and, thus, refining the multiplier effect estimations.

Latest Posts

Latest Posts

-

Label The Parts Of The Skin And Subcutaneous Tissue

Mar 31, 2025

-

The Contractile Molecules In Muscle Cells Are Blank

Mar 31, 2025

-

The Text Defines As The Flow Of Events Or Transactions

Mar 31, 2025

-

Bond Ratings Classify Bonds Based On

Mar 31, 2025

-

Special Channels That Enable Water To Cross The Plasma Membrane

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about The Greater Is The Marginal Propensity To Consume The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.