The Cpi Differs From The Gdp Deflator In That

Holbox

Mar 18, 2025 · 6 min read

Table of Contents

The CPI Differs From the GDP Deflator: A Deep Dive into Price Indices

Understanding inflation is crucial for both individuals and policymakers. Two key metrics used to measure inflation are the Consumer Price Index (CPI) and the GDP deflator. While both track price changes over time, they differ significantly in their scope, methodology, and the resulting insights they provide. This article delves deep into the key distinctions between the CPI and the GDP deflator, exploring their components, limitations, and practical applications.

Understanding the Consumer Price Index (CPI)

The Consumer Price Index (CPI) measures the average change in prices paid by urban consumers for a basket of consumer goods and services. It's a widely used indicator of inflation, providing insights into the cost of living for a typical household. The CPI's construction involves:

1. Defining the Basket of Goods and Services:

The CPI meticulously tracks prices for a vast range of consumer goods and services, categorized into various groups like food, housing, transportation, healthcare, and recreation. The specific items and their weights within the basket reflect the spending patterns of urban consumers, determined through regular surveys and consumer expenditure data. This basket is regularly updated to reflect changes in consumer behavior and the introduction of new products. This regular updating is crucial for maintaining the CPI's relevance and accuracy over time.

2. Collecting Price Data:

Price data is collected from a wide range of sources, including retailers, wholesalers, and service providers. Data collection involves a complex process of sampling, ensuring representation across various geographic regions and types of retail outlets. Prices are collected for specific items within the basket, reflecting variations in quality and features. This rigorous data collection process is vital for generating reliable and comprehensive price indices.

3. Calculating the CPI:

The CPI is calculated using a weighted average of the price changes for all items in the basket. The weights assigned to each item reflect its relative importance in consumer spending. A common method is the Laspeyres index, which compares the current cost of the fixed basket of goods and services to its cost in a base period. This provides a measure of how much more (or less) it costs to buy the same basket of goods today compared to a chosen reference period. Changes in the CPI are expressed as a percentage change from the base period.

Limitations of the CPI:

Despite its widespread use, the CPI has limitations:

- Substitution Bias: The CPI assumes consumers purchase the same basket of goods over time, ignoring the fact that consumers often substitute cheaper alternatives when prices rise. This can lead to an overestimation of inflation.

- Quality Bias: Improvements in the quality of goods and services over time are difficult to account for accurately. If the quality of a good improves, the price increase may reflect the improved quality rather than pure inflation.

- New Product Bias: The introduction of new products and services can take time to be incorporated into the CPI basket, potentially underestimating inflation in rapidly changing markets.

Understanding the GDP Deflator

The GDP deflator, unlike the CPI, is a broader measure of price inflation that covers all goods and services produced within a country's economy – including those consumed domestically and those exported. It's calculated as the ratio of nominal GDP to real GDP, multiplied by 100:

GDP Deflator = (Nominal GDP / Real GDP) x 100

Nominal GDP reflects the current market value of all final goods and services produced, while real GDP adjusts for inflation by valuing output at constant prices. The GDP deflator therefore reflects the overall price level changes in an economy, capturing the impact of inflation on the entire production process.

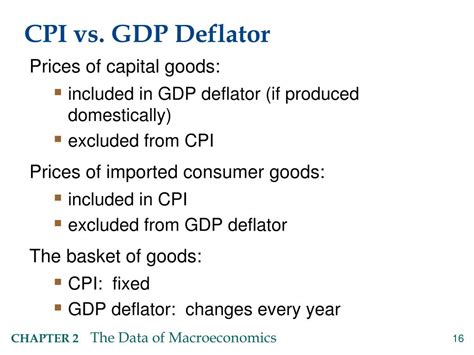

Key Differences between CPI and GDP Deflator:

The core differences between the CPI and the GDP deflator are summarized below:

| Feature | Consumer Price Index (CPI) | GDP Deflator |

|---|---|---|

| Scope | Measures prices of goods and services consumed by urban consumers | Measures prices of all goods and services produced domestically |

| Basket of Goods | Fixed basket of goods and services, updated periodically | Changes automatically with changes in GDP composition |

| Weighting | Based on consumer spending patterns | Based on the relative contribution of different sectors to GDP |

| Imported Goods | Includes imported goods consumed domestically | Excludes imported goods |

| Government Purchases | Excludes government purchases of goods and services | Includes government purchases |

| Investment Goods | Excludes investment goods | Includes investment goods |

| Bias | Prone to substitution bias, quality bias, and new product bias | Less prone to substitution bias, but subject to changes in GDP composition |

Which Measure is Better?

Neither the CPI nor the GDP deflator is inherently "better." Their suitability depends on the specific purpose.

-

CPI is preferred for tracking changes in the cost of living for consumers, influencing policy decisions related to social security benefits and wage adjustments.

-

GDP Deflator is a more comprehensive measure of inflation in the overall economy, suitable for analyzing macroeconomic trends and productivity growth. It's often favored by economists studying long-term economic growth and inflation patterns.

However, both indicators have their strengths and weaknesses, and using both provides a more complete picture of inflationary pressures within an economy.

Practical Applications and Policy Implications

Both the CPI and the GDP deflator have significant policy implications:

-

Monetary Policy: Central banks closely monitor both indices to guide monetary policy decisions. If inflation rises above the target rate, central banks might raise interest rates to cool down the economy, curbing inflation. Conversely, if inflation is too low, they may lower interest rates to stimulate economic growth.

-

Fiscal Policy: Governments use inflation data to adjust tax policies, social welfare programs, and government spending. Understanding the impact of inflation on different sectors and income groups helps tailor fiscal policies to mitigate its effects.

-

Wage Negotiations: Both indices are crucial in wage negotiations between employers and employees. CPI data is often used as a benchmark for adjusting wages to maintain the purchasing power of workers, protecting them from the erosion of their incomes due to inflation.

-

Investment Decisions: Investors use inflation data to make informed investment choices. Inflation affects the real return on investments, and understanding its impact is essential for portfolio management and risk assessment.

-

International Comparisons: While using CPI and GDP deflator for international comparisons requires careful consideration due to differences in methodology and coverage, they offer valuable insights into comparative levels of inflation across countries.

Conclusion: Understanding the Nuances for Informed Decisions

The CPI and GDP deflator are invaluable tools for understanding price changes and inflation. While both aim to quantify inflation, their distinct methodologies and scopes make them suitable for different analytical purposes. Recognizing their strengths and limitations is crucial for making informed economic decisions at both the individual and policy levels. Understanding the differences, not just the numbers, is key to effective policymaking and sound economic planning. By carefully considering both indices, policymakers and individuals gain a richer perspective on the dynamic nature of price changes and their impact on economic well-being. The seemingly subtle differences between the CPI and the GDP deflator have significant implications for how we understand and respond to inflationary pressures, underscoring the need for a nuanced understanding of both metrics.

Latest Posts

Latest Posts

-

A Set Of Bivariate Data Was Used To Create

Mar 18, 2025

-

What Is The Product Of This Reaction

Mar 18, 2025

-

Record The Entry To Close The Dividends Account

Mar 18, 2025

-

Which Of The Following Best Describes The Operational Period Briefing

Mar 18, 2025

-

The Second Largest Number Of Pacs Are Those Associated With

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about The Cpi Differs From The Gdp Deflator In That . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.