The Catch Up Effect Refers To The Idea That

Holbox

Mar 20, 2025 · 6 min read

Table of Contents

The Catch-Up Effect: Why Poorer Countries Can Grow Faster

The catch-up effect, also known as convergence, is a fundamental concept in economics that describes the tendency for poorer countries to grow faster than richer countries. This doesn't mean that poor countries will inevitably surpass rich ones, but rather that they have the potential for faster growth due to several key factors. Understanding the catch-up effect is crucial for policymakers, investors, and anyone interested in global economic development. This article will delve deep into the mechanics of the catch-up effect, exploring its drivers, limitations, and real-world implications.

Understanding the Core Principle: Closing the Gap

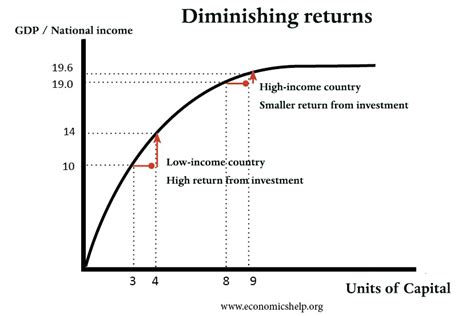

At its heart, the catch-up effect rests on the idea of diminishing returns. Rich countries, having accumulated a vast amount of capital (physical and human), technology, and infrastructure, experience slower growth because adding more capital or technology yields increasingly smaller increases in output. Imagine a farmer with a small plot of land; adding one more tool significantly boosts productivity. However, for a large farm already equipped with numerous tools, adding another tool has a much smaller impact.

Poorer countries, on the other hand, start with significantly less capital and technology. Therefore, relatively small investments in these areas can lead to substantial productivity gains and economic growth. They can "borrow" or adopt existing technologies from wealthier nations, benefiting from advancements already made without having to incur the same research and development costs. This allows them to leapfrog certain developmental stages and experience rapid economic expansion.

Key Drivers of the Catch-Up Effect

Several factors contribute to the catch-up effect:

1. Technological Diffusion: Leapfrogging Ahead

One of the most significant drivers is the diffusion of technology. Poorer countries can adopt and adapt existing technologies from more advanced economies, often at a lower cost. This avoids the lengthy and expensive process of independent innovation. For example, many developing nations have bypassed the development of landline telephone infrastructure and directly adopted mobile phone technologies, achieving significant improvements in communication infrastructure relatively quickly.

2. Capital Accumulation: Investing in Growth

Investing in physical capital (factories, machinery, infrastructure) is crucial. Poorer countries often have a higher marginal productivity of capital, meaning that each additional unit of capital invested yields a larger increase in output compared to wealthier nations. This allows for rapid expansion of productive capacity and economic growth. Foreign direct investment (FDI) plays a crucial role here, providing capital inflow and technological know-how.

3. Human Capital Development: Investing in People

Investing in human capital, through education, healthcare, and training, is equally vital. A well-educated and healthy workforce is more productive, leading to higher economic output. Improving literacy rates, promoting technical skills, and improving healthcare outcomes all contribute to a more productive and dynamic economy.

4. Institutional Reforms: Creating a Conducive Environment

Sound economic institutions, including stable political systems, effective governance, rule of law, and property rights protection, are essential for sustainable growth. These institutions create a predictable and transparent environment that encourages investment, innovation, and entrepreneurship. Without these foundations, even the most favorable initial conditions may fail to deliver sustained catch-up growth.

5. Access to Global Markets: Expanding Opportunities

Access to global markets provides opportunities for export-led growth. By integrating into the global economy, poorer countries can access larger markets for their goods and services, fostering economic expansion. This requires effective trade policies and infrastructure that facilitates international trade.

Limitations and Challenges to Catching Up

While the potential for catch-up growth is significant, several factors can hinder its realization:

1. Institutional Weakness: Barriers to Progress

Weak institutions, corruption, and lack of rule of law can severely hamper economic development. Uncertainty and instability discourage investment, hindering capital accumulation and technological diffusion. This is perhaps the most significant obstacle to the catch-up effect.

2. Technological Gaps: The Innovation Challenge

While technology diffusion can be rapid, bridging the gap in cutting-edge technological innovation remains a challenge. Poorer countries often lack the research and development capabilities to develop their own leading-edge technologies. This dependence on external technology can create vulnerabilities and limit long-term growth potential.

3. Demographic Factors: Population Dynamics

Rapid population growth can negate the benefits of increased productivity. If the population grows faster than the economy, per capita income may not increase significantly, limiting the overall impact of the catch-up effect.

4. Resource Curse: The Paradox of Abundance

Countries rich in natural resources sometimes experience slower growth (the "resource curse"). This can be due to factors like dependence on volatile commodity prices, corruption, and a lack of diversification in the economy.

5. Global Economic Shocks: External Vulnerabilities

Global economic downturns or crises can disproportionately affect developing countries, potentially reversing progress made towards catching up. These external shocks can disrupt trade, investment flows, and overall economic stability.

Case Studies: Real-World Examples of Convergence and Divergence

Several countries illustrate the dynamics of the catch-up effect:

South Korea: Following the Korean War, South Korea achieved remarkable economic growth, demonstrating a strong catch-up effect through targeted investments in education, infrastructure, and export-oriented industries.

China: China's rapid economic growth over the past few decades provides another powerful example. Opening up to global markets, attracting foreign investment, and implementing significant economic reforms have fuelled impressive growth.

India: India's growth story also showcases elements of catch-up, albeit with some challenges. While significant progress has been made, institutional weaknesses and inequality continue to hinder faster convergence.

Sub-Saharan Africa: Many countries in Sub-Saharan Africa have struggled to achieve substantial catch-up growth due to persistent institutional weaknesses, conflict, and disease burdens. This highlights the significant role of governance and stability in realizing the potential of the catch-up effect.

These examples demonstrate that the catch-up effect is not a guaranteed outcome. Success hinges on effective policies, sound institutions, and favorable external conditions.

Policy Implications and Future Perspectives

The catch-up effect has profound policy implications. Policymakers in developing countries must focus on:

- Investing in human capital: Education, healthcare, and skills development are essential.

- Improving infrastructure: Transportation, communication, and energy infrastructure are vital for economic growth.

- Strengthening institutions: Good governance, rule of law, and property rights protection are crucial.

- Promoting foreign direct investment: Attracting foreign investment can bring in capital and technology.

- Diversifying the economy: Reducing reliance on single industries or commodities helps to mitigate risks.

- Integrating into the global economy: Access to global markets is essential for export-led growth.

The catch-up effect is not a simple formula for guaranteed economic success. It's a complex process influenced by numerous interacting factors. However, understanding its underlying principles provides valuable insights for policymakers, investors, and anyone seeking to promote economic development and reduce global inequality. By fostering sound institutions, investing in human and physical capital, and promoting integration into the global economy, developing countries can significantly enhance their prospects for rapid economic growth and reduce the gap between themselves and wealthier nations. While the path to convergence is rarely smooth and linear, the potential rewards for those who successfully navigate its challenges are immense.

Latest Posts

Latest Posts

-

Differentiate Y Sec I Tan I

Mar 21, 2025

-

Human Anatomy And Physiology Lab Manual

Mar 21, 2025

-

Sophia Operates Her Own Accounting Practice

Mar 21, 2025

-

How Many Different Kinds Of 13c Peaks Will Be Seen

Mar 21, 2025

-

Which Of The Following Accurately Describes A Supply Chain Map

Mar 21, 2025

Related Post

Thank you for visiting our website which covers about The Catch Up Effect Refers To The Idea That . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.