The Amount Of Current Assets Minus Current Liabilities Is Called

Holbox

Mar 15, 2025 · 6 min read

Table of Contents

The Amount of Current Assets Minus Current Liabilities is Called: Working Capital – A Deep Dive

The difference between a company's current assets and its current liabilities is a crucial financial metric known as working capital. Understanding working capital is essential for assessing a company's short-term financial health, its ability to meet its immediate obligations, and its overall operational efficiency. This comprehensive guide delves deep into the concept of working capital, exploring its calculation, interpretation, and significance in various business contexts.

What is Working Capital?

Working capital, at its core, represents the net liquid assets available to a business for its day-to-day operations. It's the capital readily available to fund ongoing activities and cover short-term expenses. A positive working capital figure indicates that a company has sufficient resources to cover its immediate debts and continue its operations smoothly. Conversely, a negative working capital balance suggests potential financial difficulties and a reliance on short-term financing to meet its obligations.

The Formula for Calculating Working Capital

The calculation of working capital is straightforward:

Working Capital = Current Assets - Current Liabilities

Let's break down the components:

-

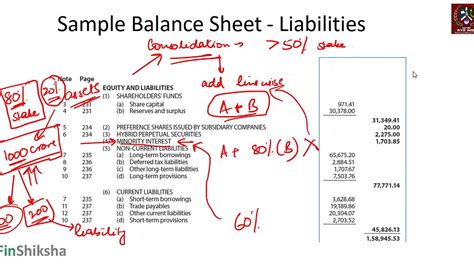

Current Assets: These are assets that are expected to be converted into cash within one year or the company's operating cycle, whichever is longer. Examples include:

- Cash and Cash Equivalents: Money readily available in bank accounts, short-term investments, and marketable securities.

- Accounts Receivable: Money owed to the company by its customers for goods or services sold on credit.

- Inventory: Raw materials, work-in-progress, and finished goods held for sale.

- Prepaid Expenses: Expenses paid in advance, such as insurance premiums or rent.

-

Current Liabilities: These are obligations due within one year or the company's operating cycle. Examples include:

- Accounts Payable: Money owed to suppliers for goods or services purchased on credit.

- Short-Term Loans: Loans due within one year.

- Accrued Expenses: Expenses incurred but not yet paid, such as salaries or utilities.

- Current Portion of Long-Term Debt: The portion of long-term debt that is due within one year.

Interpreting Working Capital: What Does it Mean?

The interpretation of working capital depends heavily on the context of the business and its industry. A high working capital figure doesn't automatically signify financial strength, and a low figure doesn't necessarily indicate weakness. Several factors influence the ideal level of working capital:

-

Industry Benchmarks: Different industries have different working capital needs. A manufacturing company typically requires a higher working capital level than a service-based business due to the need to hold significant inventory. Comparing a company's working capital to industry averages provides valuable context.

-

Business Size and Growth Stage: Larger, established companies generally have higher working capital balances than smaller, rapidly growing startups. Startups often rely on external financing to fund their growth, potentially resulting in lower or even negative working capital.

-

Operational Efficiency: A company with efficient operations and strong inventory management may require less working capital than a company with less efficient processes. Improved inventory turnover and efficient collection of accounts receivable contribute to a healthier working capital position.

-

Seasonality: Businesses with seasonal sales fluctuations will experience changes in their working capital throughout the year. During peak seasons, working capital may increase as inventory builds up and accounts receivable rise. During slower periods, working capital may decrease.

Analyzing Working Capital Trends: The Power of Time Series Data

Analyzing working capital over time offers valuable insights into a company's financial health and operational effectiveness. Examining trends in working capital, rather than focusing solely on a single point in time, provides a more holistic understanding of the company's financial performance. A consistent increase in working capital might suggest healthy growth and effective management of resources. Conversely, a continuous decline might signal emerging financial problems.

Analyzing working capital trends involves:

- Calculating working capital for multiple periods: Compare working capital figures from different quarters or years to identify trends.

- Calculating the working capital ratio: Divide current assets by current liabilities to assess the company's ability to meet its short-term obligations. A ratio greater than 1 suggests a strong ability to meet these obligations.

- Analyzing changes in individual current assets and liabilities: Examine changes in specific components of current assets and liabilities, such as accounts receivable turnover, inventory turnover, and days payable outstanding, to identify areas for improvement.

Working Capital Management Strategies: Optimizing for Success

Effective working capital management is crucial for optimizing a company's financial performance. Strategies to improve working capital include:

-

Efficient Inventory Management: Implementing just-in-time inventory systems, improving forecasting accuracy, and reducing obsolete inventory can free up significant capital.

-

Accelerated Accounts Receivable Collection: Implementing stricter credit policies, offering early payment discounts, and utilizing electronic payment systems can improve cash flow.

-

Negotiating Favorable Payment Terms with Suppliers: Negotiating longer payment terms with suppliers extends the time available to utilize the funds.

-

Effective Cash Management: Optimizing cash flow through accurate forecasting, disciplined budgeting, and investment of surplus cash in short-term, liquid investments.

-

Strategic Financing: Utilizing short-term financing options, such as lines of credit, to manage short-term liquidity needs when necessary.

The Significance of Working Capital Across Industries

The importance of working capital varies depending on the industry. Some industries are inherently more capital-intensive than others.

High Working Capital Industries:

- Manufacturing: Requires substantial investments in raw materials, work-in-progress, and finished goods.

- Retail: Needs significant inventory to meet customer demand.

- Construction: Involves large upfront investments in materials and equipment.

Lower Working Capital Industries:

- Software Development: Primarily involves intellectual property and human capital, with relatively lower inventory needs.

- Consulting: Typically involves minimal inventory and primarily relies on service provision.

- Financial Services: Working capital requirements are lower compared to industries that require large physical inventories.

Working Capital and Business Valuation

Working capital is a key factor considered during business valuations. It provides insights into the company's ability to generate cash flow and meet its operational needs. A strong working capital position typically enhances the valuation of a business, reflecting its financial stability and operational efficiency. Conversely, a weak working capital position can negatively impact the valuation, suggesting potential financial risks.

Working Capital and Financial Distress

Negative working capital is often associated with financial distress. When a company consistently fails to generate sufficient cash flow to cover its short-term obligations, it faces increasing challenges in meeting its payment obligations, potentially leading to insolvency. While negative working capital isn't always an indicator of imminent failure, it warrants close monitoring and prompt corrective action.

Conclusion: Mastering Working Capital for Sustainable Growth

Working capital is a fundamental indicator of a company's short-term financial health and operational efficiency. Understanding how to calculate, interpret, and manage working capital is crucial for both internal decision-making and external assessments of a company's financial standing. By implementing effective working capital management strategies and regularly monitoring key metrics, businesses can optimize their cash flow, enhance their financial stability, and pave the way for sustainable growth. Remember that the ideal level of working capital varies significantly across industries and depends on a company's specific circumstances. The key is to maintain a level that supports the business's operational needs while ensuring sufficient liquidity to cover short-term obligations. Consistent analysis and strategic planning are crucial for effective working capital management and overall business success.

Latest Posts

Latest Posts

-

A Preference Decision In Capital Budgeting

Mar 17, 2025

-

If A Company Recognizes Accrued Salary Expense

Mar 17, 2025

-

Utma Accounts Are Opened Under The Tax Id Of The

Mar 17, 2025

-

In Which Situations Can Simplifying Jobs Be Most Beneficial

Mar 17, 2025

-

For The Hr Planning Process How Should Goals Be Determined

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about The Amount Of Current Assets Minus Current Liabilities Is Called . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.