Tax Cost Recovery Methods Do Not Include

Holbox

Mar 21, 2025 · 5 min read

Table of Contents

Tax Cost Recovery Methods: What They Don't Include

Tax cost recovery is a crucial aspect of financial planning, allowing businesses and individuals to recoup expenses incurred in generating income. Understanding what isn't included in tax cost recovery is just as important as understanding what is. This comprehensive guide delves into the intricacies of tax cost recovery, highlighting the common misconceptions and exclusions to help you navigate this complex area effectively.

What is Tax Cost Recovery?

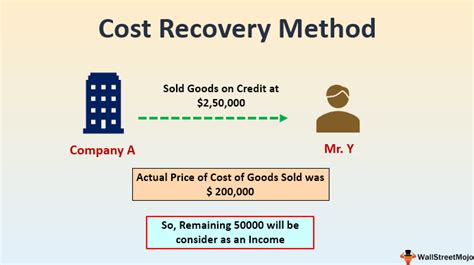

Before we explore the exclusions, let's briefly define tax cost recovery. It's the process of deducting eligible expenses from your taxable income, thereby reducing your overall tax liability. These expenses are directly related to the generation of income, ensuring that you only pay taxes on your net income, not your gross income. This applies to various income sources, from business profits to investment gains. The methods employed vary depending on the type of expense and the applicable tax laws.

Common Tax Cost Recovery Methods: A Quick Overview

Several methods facilitate tax cost recovery, including:

- Depreciation: This method allows businesses to gradually deduct the cost of tangible assets (like equipment and buildings) over their useful life. This spreads the tax benefit over several years instead of a single year.

- Amortization: Similar to depreciation, but applied to intangible assets (like patents and copyrights).

- Capital Losses: When investments decline in value, you can deduct capital losses against capital gains, reducing your tax burden.

- Business Expenses: A wide range of business expenses, from rent and utilities to salaries and marketing costs, are typically deductible.

- Tax Credits: These directly reduce your tax liability, rather than reducing your taxable income. Examples include the Earned Income Tax Credit (EITC) or child tax credits.

What Tax Cost Recovery Methods Do Not Include:

This is the crux of our discussion. Many expenses, while seemingly related to income generation, are not eligible for tax cost recovery. Understanding these exclusions is paramount to avoid errors and penalties.

1. Personal Expenses: The Clear Cut Exclusion

This is perhaps the most straightforward exclusion. Personal expenses – those incurred for personal comfort or enjoyment, rather than directly for business or investment purposes – are generally not deductible. Examples include:

- Groceries: Even if you're entertaining clients, the majority of grocery costs are personal.

- Clothing: Unless it's specifically required for work (e.g., a uniform) and isn't suitable for general wear.

- Household bills: Rent, utilities, and other household expenses are personal unless you're running a home-based business (with strict criteria met).

- Travel for leisure: Personal vacations and leisure trips are entirely excluded. Only business travel (with proper documentation) is eligible.

- Entertainment (Non-Business Related): While business entertainment might be partially deductible under certain conditions, personal entertainment is never deductible.

2. Illegal Activities: A Strict Prohibition

Expenses related to illegal activities are absolutely prohibited from tax cost recovery. This is a non-negotiable aspect of tax law. Trying to claim deductions for illegal activities will lead to severe consequences, including penalties and potential legal action.

3. Capital Expenditures That Don't Qualify for Depreciation or Amortization:

While capital investments can be recovered through depreciation or amortization, certain capital expenses might not qualify. This often depends on the nature of the asset and its use. For instance, some improvements might enhance the value of a personal property, but not qualify for tax deductions unless it's directly used for business purposes and meets specific criteria.

4. Penalties and Fines: No Deductions Allowed

Penalties and fines incurred due to violating laws or regulations are generally not deductible. This applies to various contexts, from traffic violations to tax penalties themselves. The logic is simple: you shouldn't be rewarded for illegal or unethical behavior.

5. Political Contributions: A Separate Sphere

Political contributions are not deductible for tax purposes. These are considered personal contributions and are separate from business expenses.

6. Life Insurance Premiums: Limited Exceptions

Generally, life insurance premiums are not deductible. There are limited exceptions, primarily concerning business life insurance policies, but these are complex and require careful consideration of specific regulations.

7. Hobby Expenses vs. Business Expenses: A Fine Line

The distinction between hobby expenses and business expenses can be blurry. The IRS assesses whether an activity is a legitimate business or a hobby based on several factors, including the intention of profit, the level of expertise, and the time and effort invested. If deemed a hobby, expenses are not deductible beyond the revenue generated.

8. Certain Types of Interest: Specific Rules Apply

While interest expenses can sometimes be deductible (e.g., home mortgage interest, business loan interest), specific rules apply. Personal interest expenses, such as credit card interest or personal loan interest, are generally not deductible.

9. Gifts and Charitable Donations: Specific Deductions Apply

While charitable donations are deductible, they have specific rules. You need to itemize deductions and meet the requirements for claiming such deductions. Similarly, gifts are generally not deductible unless they are specifically business-related and meet stringent criteria for business gift deduction limits.

10. Certain Taxes: State and Local Taxes (SALT)

The deductibility of state and local taxes (SALT) has undergone changes. While previously fully deductible, limitations have been introduced, impacting the amount you can deduct. Careful attention should be paid to the current tax laws governing SALT deductions.

Navigating the Complexities: Key Considerations

Understanding the exclusions is only half the battle. Several additional factors add complexity:

- Record Keeping: Meticulous record-keeping is essential. Maintain detailed records of all expenses, receipts, and supporting documentation to substantiate your deductions.

- Tax Laws and Regulations: Tax laws are constantly evolving. Staying updated on the latest regulations is critical to ensure compliance.

- Professional Advice: Seeking guidance from a qualified tax professional is highly recommended, especially for complex financial situations or significant transactions. They can help you navigate the nuances of tax cost recovery and ensure you're maximizing your deductions legally.

Conclusion: Informed Planning is Crucial

Tax cost recovery methods are valuable tools for reducing your tax burden. However, understanding what isn't included is equally important to avoid mistakes and penalties. Careful planning, meticulous record-keeping, and seeking professional advice when needed are crucial for effectively utilizing tax cost recovery strategies and ensuring compliance with tax laws. By thoroughly understanding these exclusions and proactively managing your finances, you can maximize your tax benefits and improve your overall financial well-being. Remember that this information is for general guidance only and should not substitute for professional tax advice tailored to your specific circumstances.

Latest Posts

Latest Posts

-

Lewis Dot Structure For Aso4 3

Mar 22, 2025

-

Management Is More Progressive Today There Is More Emphasis On

Mar 22, 2025

-

Water Is A Polar Molecule Meaning It Carries Partial Charges

Mar 22, 2025

-

Top Management Usually Performs All Of The Following Tasks Except

Mar 22, 2025

-

An Automatic Session Lock Is Not Required

Mar 22, 2025

Related Post

Thank you for visiting our website which covers about Tax Cost Recovery Methods Do Not Include . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.