Prepare A Post Closing Trial Balance

Holbox

Mar 15, 2025 · 6 min read

Table of Contents

Preparing a Post-Closing Trial Balance: A Comprehensive Guide

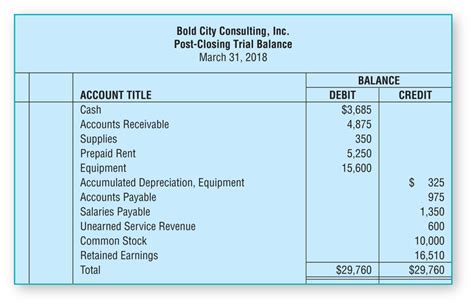

A post-closing trial balance is a crucial step in the accounting cycle, serving as a final check to ensure the accuracy of your financial records. It's a list of all general ledger accounts and their balances after the closing entries have been made. This means all temporary accounts (revenue, expenses, and dividends) have been closed to retained earnings, leaving only permanent accounts (assets, liabilities, and equity) with balances. Understanding how to prepare one accurately is essential for maintaining sound financial health and avoiding errors that can impact your business's bottom line.

Understanding the Purpose of a Post-Closing Trial Balance

The primary purpose of a post-closing trial balance is verification. It verifies that the double-entry bookkeeping system is balanced after the closing process. A balanced post-closing trial balance indicates that the total debits equal the total credits, confirming the accuracy of the closing entries and the overall integrity of the accounting records. This provides assurance that the financial statements accurately reflect the financial position of the business.

Beyond verification, the post-closing trial balance serves as a valuable tool for:

- Starting the next accounting period: It provides the opening balances for the next accounting period, ensuring a clean and accurate starting point for tracking financial transactions.

- Detecting errors: While its main purpose is verification, a post-closing trial balance can help identify errors made during the closing process itself. An imbalance indicates an error requiring investigation and correction.

- Financial statement preparation: The post-closing trial balance directly feeds into the preparation of the balance sheet, providing the necessary balances for assets, liabilities, and owner's equity.

Steps to Prepare a Post-Closing Trial Balance

Preparing a post-closing trial balance involves a series of steps that build upon each other. Accuracy at each stage is crucial for a reliable final result. Here's a detailed walkthrough:

1. Complete the Closing Entries

The most crucial step before preparing a post-closing trial balance is to accurately complete all closing entries. This involves transferring the balances of temporary accounts (revenue, expense, and dividend accounts) to retained earnings. For example:

- Closing revenue accounts: Debit revenue accounts (to reduce their balance to zero) and credit retained earnings (to increase it).

- Closing expense accounts: Credit expense accounts (to reduce their balance to zero) and debit retained earnings (to decrease it).

- Closing dividends accounts: Debit retained earnings (to decrease it) and credit dividends accounts (to reduce their balance to zero).

Remember: Accurate closing entries are fundamental to a correct post-closing trial balance. Any errors at this stage will directly affect the final result. Double-check your calculations and ensure you've correctly identified all temporary accounts.

2. Update the General Ledger

After posting the closing entries, update your general ledger accounts. This reflects the changes in the balances after closing. Ensure all temporary accounts have zero balances, and that the retained earnings account reflects the net income or loss from the period, plus any dividends declared. This updated general ledger forms the foundation for the post-closing trial balance.

3. Prepare the Post-Closing Trial Balance Worksheet

A worksheet is a helpful tool for preparing the post-closing trial balance. It typically has three columns:

- Account Name: This column lists all the permanent accounts from your general ledger (assets, liabilities, and equity accounts).

- Debit: This column lists the debit balances of each permanent account.

- Credit: This column lists the credit balances of each permanent account.

Transfer the updated balances from your general ledger onto the worksheet. Ensure you accurately record both debit and credit balances.

4. Calculate Totals

Once all the accounts and their balances are recorded on the worksheet, calculate the total debits and total credits. These totals must be equal. If they aren't equal, it indicates an error somewhere in the closing entries or the transfer of information to the worksheet. This requires a thorough review of your work.

5. Prepare the Post-Closing Trial Balance Statement

The final step is to prepare the formal post-closing trial balance statement. This statement formally presents the information from your worksheet. It typically includes:

- Company Name: The name of the business.

- Post-Closing Trial Balance: The title of the statement.

- Date: The date the trial balance was prepared (usually the end of the accounting period).

- Account Name: A list of all permanent accounts.

- Debit: The debit balance for each account.

- Credit: The credit balance for each account.

- Total Debits: The sum of all debit balances.

- Total Credits: The sum of all credit balances.

Crucially: The total debits and total credits should be equal, confirming the accuracy of the closing entries and the balances in the permanent accounts.

Common Errors and How to Avoid Them

Several common errors can occur when preparing a post-closing trial balance. Being aware of these potential pitfalls can save significant time and effort:

- Incorrect Closing Entries: The most frequent source of error is inaccuracies in the closing entries themselves. Double-checking calculations and ensuring all temporary accounts are correctly closed is paramount.

- Omitted Accounts: Forgetting to include an account in the post-closing trial balance will lead to an imbalance. Carefully review the general ledger to ensure all permanent accounts are included.

- Incorrect Balances: Transcribing incorrect balances from the general ledger to the worksheet is another common mistake. Always double-check your entries before calculating the totals.

- Mathematical Errors: Simple addition or subtraction errors can easily cause an imbalance. Use a calculator and double-check your calculations.

- Mismatched Debits and Credits: Incorrectly identifying accounts as debit or credit will result in an imbalance. Understanding the normal balance of each account is crucial.

Preventing these errors involves:

- Thorough review of closing entries: Check and re-check your work.

- Using a worksheet: A worksheet provides a structured approach, minimizing the chance of errors.

- Careful data entry: Accuracy is key when transferring balances to the worksheet.

- Independent verification: Have another person review your work.

Importance of Accuracy in the Post-Closing Trial Balance

The accuracy of the post-closing trial balance is paramount. It's the foundation for accurate financial reporting. An unbalanced post-closing trial balance signals an error that needs to be corrected before proceeding to the next accounting period. Failure to rectify the error can lead to misstated financial statements, inaccurate financial analysis, and potentially flawed business decisions.

A correct post-closing trial balance ensures the smooth transition to the next accounting period, provides accurate starting balances, and supports the preparation of reliable financial statements. It's a crucial component of maintaining accurate and trustworthy financial records, which are essential for the success of any business.

Post-Closing Trial Balance: Beyond the Basics

While the core process remains consistent, the specifics of preparing a post-closing trial balance can vary depending on the accounting software used and the complexity of a business's operations. For instance, businesses with multiple departments or subsidiaries may have more complex general ledgers and require more detailed trial balances.

Regardless of the complexity, the fundamental principles remain the same: accurate closing entries, careful data entry, and thorough verification are essential to generating a reliable post-closing trial balance. Mastering this process is a key skill for any accountant or finance professional. Continuous practice and attention to detail will build proficiency and minimize the risk of errors. Remember, a well-prepared post-closing trial balance is the cornerstone of accurate financial reporting and sound financial decision-making.

Latest Posts

Latest Posts

-

The Accounts In The Ledger Of Monroe Entertainment Co

Mar 17, 2025

-

A Process Cost Accounting System Is Most Appropriate When

Mar 17, 2025

-

An Example Of A Breach Of Ephi Is

Mar 17, 2025

-

What Is Involved In Safety Monitoring

Mar 17, 2025

-

Which Of The Following Best Describes The Term Cleavage

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Prepare A Post Closing Trial Balance . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.