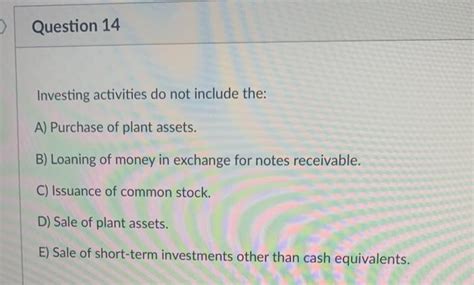

Investing Activities Do Not Include The

Holbox

Mar 16, 2025 · 5 min read

Table of Contents

Investing Activities Do Not Include: A Comprehensive Guide to What's Not Investing

Investing, at its core, is the process of allocating resources with the expectation of generating future income or appreciation in value. While the possibilities seem endless, it's crucial to understand what doesn't constitute investing. Confusing these activities with true investment can lead to significant financial losses and missed opportunities. This comprehensive guide will clarify the boundaries of investing and highlight common activities often mistaken for investment strategies.

Understanding the Core Principles of Investing

Before diving into the activities that don't qualify as investing, let's establish a foundational understanding of what does. True investing involves:

- Long-term Perspective: Investing is generally a long-term game. While short-term fluctuations are inevitable, successful investors focus on the long-term growth potential of their assets.

- Risk Management: All investments carry some level of risk. Effective investors carefully assess and manage risk, diversifying their portfolios to minimize potential losses.

- Growth Potential: The primary goal is to increase the value of your assets over time, either through capital appreciation (increase in asset price) or through income generation (dividends, interest, rent).

- Due Diligence: Thorough research and analysis are crucial before investing in any asset. Understanding the underlying fundamentals is essential for making informed decisions.

Activities Often Mistaken for Investing

Many activities share superficial similarities with investing but lack the key characteristics of genuine investment strategies. Let's examine some common examples:

1. Speculation: Gambling, Not Investing

Speculation involves trading assets based on short-term price movements, often driven by market sentiment or rumors rather than fundamental analysis. Speculation prioritizes short-term gains and often involves high risk. Unlike investing, which focuses on long-term growth and risk management, speculation resembles gambling. Examples include:

- Day trading: Buying and selling assets within the same day, relying heavily on short-term price fluctuations.

- Options trading without a clear strategy: Options can be a valuable investment tool, but using them solely for quick profits without a well-defined strategy increases risk significantly.

- Cryptocurrency trading based on hype: The volatile nature of cryptocurrencies makes them susceptible to speculative bubbles, making it easy to lose money quickly.

Key Difference: Investors analyze fundamental value; speculators bet on price movements.

2. Spending: Consuming, Not Investing

Spending money on goods and services for immediate consumption is not an investment activity. While some purchases, like a house, may appreciate in value over time, the primary purpose is consumption, not investment. Examples include:

- Buying luxury goods: Purchasing expensive items for personal enjoyment does not generate a return on investment.

- Everyday expenses: Groceries, utilities, and entertainment are essential expenses, not investments.

- Unnecessary purchases: Impulse buys and non-essential goods provide no financial return.

Key Difference: Investing aims for future returns; spending fulfills immediate needs or wants.

3. Saving: Preserving Capital, Not Growing It

Saving money in a low-yield savings account or money market account is a crucial part of financial planning, but it is not, in itself, investing. While it protects your capital from inflation, it doesn't typically offer significant growth potential.

- Low-interest savings accounts: While providing liquidity and safety, these accounts often fail to keep pace with inflation.

- Checking accounts: These are designed for daily transactions, not investment growth.

Key Difference: Investing aims for growth; saving aims for preservation.

4. Collectibles: High Risk, Uncertain Returns

Collectibles, such as art, antiques, or rare stamps, can appreciate in value, but their market is highly illiquid and unpredictable. Their value is subjective and dependent on market trends and collector interest. This makes them a highly speculative asset, not a reliable investment.

- Rare coins and stamps: Their value is subject to significant fluctuations and expert appraisals are often necessary.

- Art and antiques: The market for these items is highly specialized and prone to market manipulation.

Key Difference: Investing relies on predictable returns; collectibles depend heavily on market sentiment and expert opinions.

5. Gambling: Pure Chance, No Investment Strategy

Gambling, in any form, is not investing. It relies purely on chance, not on careful analysis and risk management. There's no underlying asset or investment strategy; only the potential for random gains or losses. Examples include:

- Lottery tickets: The odds of winning are extremely low, making this a pure gamble.

- Casino games: These are designed to favor the house, resulting in consistent losses for the majority of players.

- Sports betting: While some knowledge of the game may improve the odds, this remains primarily a gamble.

Key Difference: Investing involves informed decision-making; gambling is based on pure chance.

6. Real Estate Flipping (without proper strategy): High Risk, Fast-Paced

While real estate investment can be a sound strategy, flipping properties without a clear understanding of market dynamics, repair costs, and potential risks can lead to significant losses. This high-risk approach is more akin to speculation than thoughtful investing.

- Buying and selling properties quickly without proper due diligence: This involves rapid transactions with high risk of unforeseen problems.

- Overestimating renovation costs: Underestimating repair expenses can easily wipe out profits.

- Market timing mistakes: Purchasing at market peaks and selling during downturns is a common pitfall.

Key Difference: Real estate investing involves careful analysis; flipping often emphasizes speed over strategy.

Distinguishing Investing from Other Financial Activities

To effectively differentiate investing from other financial activities, consider these factors:

- Time Horizon: Investing usually involves a long-term commitment. Short-term activities are typically not considered investing.

- Risk Tolerance: Investments carry risk, but responsible investors carefully assess and manage their risk exposure. High-risk activities with low return potential are not considered sound investments.

- Return Expectations: Investing aims for a positive return on investment over time. Activities that consistently generate losses are not investments.

- Due Diligence: Investments should be based on thorough research and analysis of the underlying asset. Impulsive decisions without proper research are not part of investing.

Conclusion: A Clear Understanding is Crucial

Successfully navigating the world of finance requires a clear understanding of what constitutes investing. By differentiating investing from speculation, spending, saving, and other activities, you can make more informed decisions, manage risk effectively, and work toward achieving your long-term financial goals. Remember, investing is a marathon, not a sprint. Focus on a long-term strategy, diligent research, and responsible risk management to maximize your chances of success. Avoid the pitfalls of mistaking short-term gains for genuine investment, and concentrate on building a strong and diversified portfolio based on sound financial principles. This will ultimately lead to sustainable wealth creation and financial security.

Latest Posts

Latest Posts

-

What Is The Value Of I

Mar 17, 2025

-

The Accounts In The Ledger Of Monroe Entertainment Co

Mar 17, 2025

-

A Process Cost Accounting System Is Most Appropriate When

Mar 17, 2025

-

An Example Of A Breach Of Ephi Is

Mar 17, 2025

-

What Is Involved In Safety Monitoring

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about Investing Activities Do Not Include The . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.