If Manufacturing Overhead Is Underapplied Then

Holbox

Mar 17, 2025 · 6 min read

Table of Contents

If Manufacturing Overhead is Underapplied, Then… Understanding the Implications and Corrections

Manufacturing overhead represents all indirect costs incurred in the production process. Unlike direct costs (direct materials and direct labor), overhead costs aren't easily traceable to specific products. When the actual overhead costs exceed the applied overhead, we have an underapplied overhead situation. This means that the company hasn't allocated enough overhead costs to its products, potentially underestimating the true cost of production. Understanding the implications of underapplied overhead and the appropriate corrections is crucial for accurate financial reporting and informed decision-making.

Understanding Underapplied Overhead

Before diving into the consequences, let's solidify our understanding of what underapplied overhead signifies. It occurs when the predetermined overhead rate, used to allocate overhead costs throughout the production period, is too low. This could be due to several factors:

-

Inaccurate Overhead Cost Estimation: The initial budget might have underestimated the actual overhead costs. This could stem from unforeseen expenses, inaccurate predictions of production volume, or changes in indirect cost structures (e.g., increased utility costs).

-

Lower than Expected Production Volume: If the actual production volume is significantly lower than the budgeted volume, the overhead costs are spread over fewer units, resulting in a higher cost per unit than anticipated. This leads to a higher actual overhead cost compared to the applied overhead cost based on the original budget.

-

Unexpected Increases in Indirect Costs: Unexpected increases in indirect costs, like maintenance, repairs, or utilities, could also contribute to underapplied overhead. These unforeseen expenses inflate the actual overhead costs beyond the predetermined rate.

Calculating Underapplied Overhead

The calculation is straightforward:

Underapplied Overhead = Actual Overhead Costs – Applied Overhead Costs

Where:

-

Actual Overhead Costs: The total indirect costs incurred during the period. This includes items like factory rent, utilities, indirect labor, depreciation on factory equipment, and factory supplies.

-

Applied Overhead Costs: The overhead costs allocated to production based on the predetermined overhead rate. This rate is typically calculated at the beginning of the accounting period using a predetermined formula, often based on a chosen allocation base (e.g., direct labor hours, machine hours).

The Implications of Underapplied Overhead

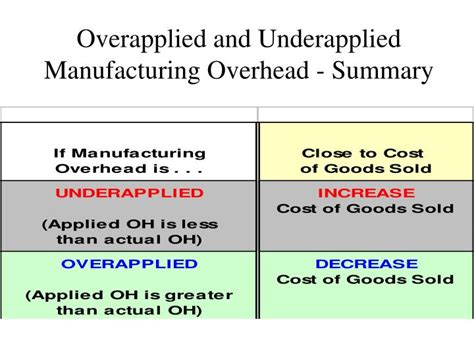

An underapplied overhead balance suggests that the cost of goods sold (COGS) and inventory values have been understated. This has several important implications:

-

Understated Cost of Goods Sold: If the overhead is underapplied, the cost of goods sold will be lower than the actual cost. This directly impacts the gross profit calculation, potentially leading to an overstatement of profitability. This is because the true cost of producing the goods sold wasn't fully accounted for.

-

Understated Inventory Values: Similarly, the value of ending inventory will be understated because the true cost of producing the goods in inventory hasn't been fully captured. This impacts the balance sheet, presenting a less accurate picture of the company's assets.

-

Distorted Financial Statements: The inaccuracies in COGS and inventory values lead to distorted financial statements, making it difficult to accurately assess the company's financial health and performance. This could lead to flawed business decisions based on misleading financial data.

-

Impact on Decision Making: Understated costs can lead to poor decision-making, such as underpricing products, leading to lower profit margins than anticipated. Also, it could lead to incorrect capacity planning, as the actual production costs are higher than initially reflected.

-

Tax Implications: Depending on the accounting standards followed, underapplied overhead could also have tax implications. If the understatement of COGS leads to an overstatement of profits, this could result in higher taxes payable.

Correcting Underapplied Overhead

Several methods exist to correct for underapplied overhead at the end of the accounting period. The most common approaches are:

1. Adjusting Cost of Goods Sold (COGS)

This is the simplest and most widely used method. The entire amount of underapplied overhead is added to the cost of goods sold. This corrects the understatement of COGS and reflects the true cost of goods sold during the period.

- Journal Entry:

- Debit: Cost of Goods Sold

- Credit: Manufacturing Overhead

This approach is relatively straightforward and easy to implement. However, it's worth noting that this method doesn't reflect any overhead costs that may still be in the ending work-in-process (WIP) or finished goods inventories.

2. Prorating the Underapplied Overhead

This method allocates the underapplied overhead across the ending balances of work-in-process (WIP) inventory, finished goods inventory, and cost of goods sold. This provides a more accurate reflection of the true cost allocation across all three accounts. The proration is based on the relative proportion of the ending balances of each account compared to the total ending balances of all three accounts.

-

Calculation: Determine the proportion of each account (WIP, Finished Goods, and COGS) relative to the total (WIP + Finished Goods + COGS). Then, multiply the underapplied overhead by each proportion to determine the amount allocated to each account.

-

Journal Entries: Separate journal entries are created to adjust each account (WIP, Finished Goods, and COGS) accordingly.

This method is more complex than simply adjusting COGS, but it provides a more precise and accurate allocation of the overhead costs. It better reflects the reality that a portion of the underapplied overhead might relate to unsold goods.

3. Using a Variance Account

A variance account (usually called Manufacturing Overhead Variance) can be used to temporarily hold the underapplied overhead. This approach is especially useful in situations where the cause of the underapplication needs further investigation before making any adjustments. This provides a clearer picture of the discrepancy between actual and applied overhead. At the end of the accounting period, the variance is closed out to COGS or prorated across WIP, Finished Goods, and COGS.

-

Initial Journal Entry (recording the underapplied overhead):

- Debit: Manufacturing Overhead Variance

- Credit: Manufacturing Overhead

-

Closing Journal Entries (at the end of the period): These entries would be similar to the adjustments described in the previous methods.

This approach offers greater transparency and allows for more detailed analysis of the reasons for overhead underapplication. It helps in identifying areas for improvement in cost control and overhead estimation for future periods.

Preventing Underapplied Overhead

Proactive measures can significantly reduce the likelihood of underapplied overhead. These include:

-

Accurate Budgeting and Forecasting: Developing a detailed and realistic budget is paramount. This requires careful analysis of historical data, consideration of potential changes in the business environment (e.g., inflation, changes in production methods), and robust forecasting techniques.

-

Regular Overhead Cost Monitoring: Monitoring actual overhead costs throughout the period and comparing them to the budgeted amounts allows for early detection of any significant variances. This early detection enables timely corrective actions to avoid significant under or over application of overhead.

-

Selecting an Appropriate Allocation Base: Choosing the right allocation base (e.g., machine hours, direct labor hours, or a combination of factors) is crucial for accurate overhead allocation. The chosen base should have a strong correlation with the incurrence of overhead costs.

-

Refining the Overhead Rate Calculation: Regularly review and adjust the predetermined overhead rate. This adjustment should consider changes in the production process, expected production volumes, and fluctuations in indirect costs. Periodic recalculations ensure that the rate stays relevant and accurate.

Conclusion

Underapplied overhead necessitates corrective action to ensure accurate financial reporting. While adjusting COGS is the simplest method, prorating the underapplied overhead provides a more precise allocation. The variance account offers a more detailed and transparent approach, facilitating analysis and future improvements. Proactive measures, including accurate budgeting, monitoring, and a well-chosen allocation base, are crucial for minimizing the occurrence of underapplied overhead. By understanding the implications and employing appropriate correction methods, companies can maintain accurate financial records and make well-informed business decisions.

Latest Posts

Latest Posts

-

What Is The Narrowest Definition Of The Number 6

Mar 17, 2025

-

Strategic Implementation Is Thought To Be

Mar 17, 2025

-

Laker Company Reported The Following January

Mar 17, 2025

-

Quantitative Analysis Of Vinegar Via Titration

Mar 17, 2025

-

The Interest Rate A Company Pays On 1 Year 5 Year

Mar 17, 2025

Related Post

Thank you for visiting our website which covers about If Manufacturing Overhead Is Underapplied Then . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.