How To Find Maturity Risk Premium

Holbox

Mar 28, 2025 · 5 min read

Table of Contents

- How To Find Maturity Risk Premium

- Table of Contents

- How to Find the Maturity Risk Premium: A Comprehensive Guide

- Understanding the Maturity Risk Premium

- Methods for Estimating the Maturity Risk Premium

- 1. The Empirical Approach: Analyzing Historical Yield Curves

- 2. The Expectations Hypothesis: A Theoretical Approach

- 3. The Liquidity Premium Theory: Acknowledging Liquidity Differences

- 4. The Term Structure Models: Sophisticated Quantitative Approaches

- Interpreting the Maturity Risk Premium

- Using the Maturity Risk Premium in Investment Decisions

- Conclusion: A Multifaceted Challenge

- Latest Posts

- Latest Posts

- Related Post

How to Find the Maturity Risk Premium: A Comprehensive Guide

The maturity risk premium (MRP) is a crucial concept in finance, representing the extra compensation investors demand for holding longer-term bonds. Understanding how to find the MRP is vital for making informed investment decisions, accurately pricing bonds, and building robust financial models. This comprehensive guide will delve into the intricacies of calculating and interpreting the MRP, exploring various methods and their limitations.

Understanding the Maturity Risk Premium

Before diving into the calculation methods, let's solidify our understanding of the MRP. It's the additional yield investors require to compensate for the increased risk associated with longer-term bonds. This risk stems from several factors:

-

Interest Rate Risk: Fluctuations in interest rates directly impact bond prices. Longer-term bonds are more sensitive to these fluctuations, as their prices fall more significantly when interest rates rise.

-

Reinvestment Risk: The risk that future coupon payments will be reinvested at lower interest rates, reducing the overall return. This is particularly relevant for longer-maturity bonds.

-

Inflation Risk: The risk that inflation will erode the purchasing power of future coupon payments and the principal repayment. Longer-term bonds are more exposed to this risk.

-

Liquidity Risk: Longer-term bonds are generally less liquid than shorter-term bonds, making them harder to sell quickly without incurring a loss.

Methods for Estimating the Maturity Risk Premium

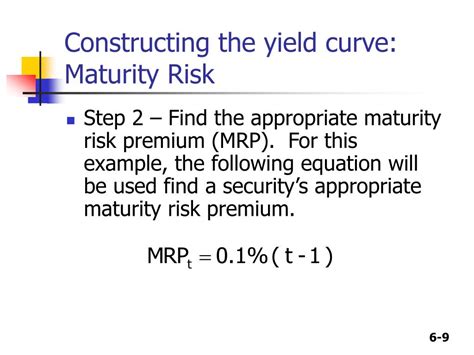

Unfortunately, there's no single, universally accepted formula for calculating the MRP. Its estimation inherently involves judgment and relies on several assumptions. However, several approaches can provide reasonable approximations:

1. The Empirical Approach: Analyzing Historical Yield Curves

This method involves analyzing the historical relationship between bond yields and maturities. By plotting the yield curve (a graph showing yields of bonds with different maturities at a specific point in time) over an extended period, you can observe the average yield spread between long-term and short-term bonds. This spread can be considered an approximation of the MRP.

Steps:

-

Gather Data: Collect historical yield data for government bonds with various maturities (e.g., 1-year, 5-year, 10-year, 30-year). Ensure you use data from a reliable source.

-

Calculate Yield Spreads: For each point in time, calculate the difference in yield between long-term bonds (e.g., 10-year) and short-term bonds (e.g., 1-year). This difference represents the yield spread for that period.

-

Average the Spreads: Calculate the average yield spread over the entire historical period. This average represents an estimate of the MRP.

Limitations:

-

Historical Data May Not Reflect Future Expectations: Past performance isn't necessarily indicative of future results. The MRP can change significantly depending on economic conditions and market sentiment.

-

Ignoring Other Factors: This approach doesn't explicitly account for other factors influencing bond yields, such as credit risk or liquidity risk.

2. The Expectations Hypothesis: A Theoretical Approach

The expectations hypothesis suggests that long-term interest rates reflect the market's expectations of future short-term interest rates. According to this hypothesis, the MRP is zero, meaning investors are indifferent to the maturity of the bond. Any difference in yield between bonds of different maturities is solely due to expectations of future interest rate changes.

Limitations:

-

Oversimplification: The expectations hypothesis assumes perfect foresight and ignores the risk factors associated with longer-term investments.

-

Difficult to Predict Future Rates: Accurately predicting future short-term interest rates is exceptionally challenging.

3. The Liquidity Premium Theory: Acknowledging Liquidity Differences

The liquidity premium theory acknowledges that longer-term bonds are generally less liquid than shorter-term bonds. Therefore, investors demand an extra premium (the liquidity premium) to compensate for the reduced liquidity. This liquidity premium is included within the observed yield spread, making it difficult to isolate the MRP.

Limitations:

-

Difficulty in Separating MRP and Liquidity Premium: Quantifying the separate contributions of the MRP and liquidity premium is challenging.

-

Subjectivity: Assessing the liquidity premium requires subjective judgments about the market's perception of liquidity.

4. The Term Structure Models: Sophisticated Quantitative Approaches

Several sophisticated quantitative models, such as the Cox-Ingersoll-Ross (CIR) model and the Vasicek model, attempt to model the term structure of interest rates and estimate the MRP. These models incorporate various factors, including interest rate volatility and mean reversion.

Limitations:

-

Complexity: These models require advanced mathematical knowledge and sophisticated software to implement.

-

Parameter Estimation Challenges: Accurately estimating the model parameters can be challenging, potentially leading to inaccurate results.

Interpreting the Maturity Risk Premium

Once you've obtained an estimate of the MRP, it's crucial to interpret it correctly. A higher MRP indicates that investors demand greater compensation for holding longer-term bonds, reflecting a higher perceived risk. Conversely, a lower MRP suggests that investors are less concerned about the increased risk associated with longer maturities.

The MRP can vary over time due to changes in economic conditions, market sentiment, and central bank policies. Factors such as inflation expectations, economic growth forecasts, and government borrowing needs significantly influence the MRP.

Using the Maturity Risk Premium in Investment Decisions

The MRP plays a crucial role in various investment decisions:

-

Bond Portfolio Construction: Understanding the MRP allows investors to construct bond portfolios with a desired level of risk and return. Investors can tailor their portfolios based on their risk tolerance and the expected MRP.

-

Bond Valuation: The MRP is a critical component of discounted cash flow models used to value bonds. Accurately estimating the MRP is essential for obtaining accurate bond valuations.

-

Fixed Income Strategy: The MRP helps investors make informed decisions on the duration and maturity of their bond holdings, allowing for effective fixed income strategies.

-

Yield Curve Analysis: The MRP contributes to a more insightful interpretation of the yield curve, providing clues about future interest rate expectations and market sentiment.

Conclusion: A Multifaceted Challenge

Determining the maturity risk premium is not a straightforward task. While several approaches offer estimates, each has limitations. The best approach often involves combining different methods and using judgment based on current market conditions and economic forecasts. The MRP remains a critical concept for understanding and navigating the bond market, requiring careful consideration of multiple factors and a nuanced understanding of its inherent uncertainties. Remember that the estimated MRP is only one piece of the puzzle, and thorough due diligence is essential before making any significant investment decisions. By carefully considering the methods and their limitations, investors can gain a more informed understanding of the MRP and its implications for their investment strategies.

Latest Posts

Latest Posts

-

Label The Components Of A Synapse

Mar 31, 2025

-

Cost Accounting Systems Are Used To

Mar 31, 2025

-

Under Accrual Basis Accounting Companies Typically Report Expenses

Mar 31, 2025

-

Essentials Of Nursing Research Appraising Evidence For Nursing Practice

Mar 31, 2025

-

Classify Each Of The Following As Acidic Basic Or Neutral

Mar 31, 2025

Related Post

Thank you for visiting our website which covers about How To Find Maturity Risk Premium . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.