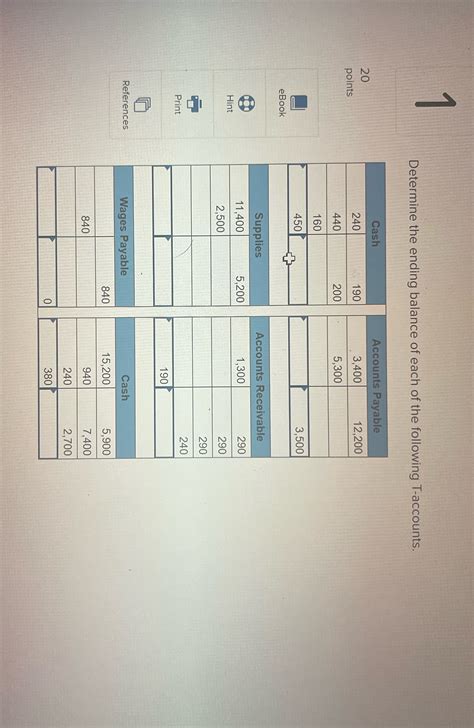

Determine The Ending Balance Of Each Of The Following T-accounts.

Holbox

Mar 20, 2025 · 6 min read

Table of Contents

Determining the Ending Balance of T-Accounts: A Comprehensive Guide

Understanding T-accounts is fundamental to mastering accounting. This comprehensive guide will walk you through the process of determining the ending balance of various T-accounts, covering different scenarios and complexities. We'll explore the mechanics, provide step-by-step examples, and offer tips for accuracy and efficiency. By the end, you'll be confident in calculating ending balances and applying this crucial skill to your accounting tasks.

What is a T-Account?

A T-account is a visual representation of a general ledger account. Its name comes from its resemblance to the letter "T," with debits recorded on the left side and credits recorded on the right side. This simple yet powerful tool helps accountants track increases and decreases in account balances. The left side (debit) typically represents increases for assets, expenses, and dividends, while the right side (credit) typically represents increases for liabilities, equity, and revenues. This is often summarized with the mnemonic DEAD CLIC (Debit Expenses, Assets, Dividends; Credit Liabilities, Income, Capital). Understanding this fundamental principle is crucial for accurate T-account analysis.

Determining the Ending Balance: A Step-by-Step Approach

The process of determining the ending balance of a T-account involves several key steps:

-

Identify the Account Type: The first step is to identify the type of account (asset, liability, equity, revenue, or expense). This dictates which side (debit or credit) represents increases and decreases.

-

Record All Transactions: Carefully record all debits and credits related to the account. Ensure accuracy in both the amounts and the dates of the transactions. Any errors at this stage will propagate through the entire calculation.

-

Sum the Debits and Credits Separately: Add up all the debit entries and all the credit entries individually. Use a calculator to avoid simple arithmetic errors, especially when dealing with numerous transactions.

-

Calculate the Difference: Subtract the smaller total (either debits or credits) from the larger total. The result is the ending balance of the account.

-

Determine the Normal Balance: The normal balance is the side where increases are recorded. Assets, expenses, and dividends have a normal debit balance, while liabilities, equity, and revenues have a normal credit balance. The ending balance will always be on the normal balance side of the account.

Examples of Determining Ending Balances

Let's illustrate the process with several examples, covering various account types and scenarios.

Example 1: Cash Account (Asset)

Let's assume the following transactions for a Cash account:

| Date | Description | Debit | Credit |

|---|---|---|---|

| Jan 1 | Beginning Balance | $5,000 | |

| Jan 5 | Sales Revenue | $2,000 | |

| Jan 10 | Purchase Supplies | $500 | |

| Jan 15 | Customer Payment | $1,000 | |

| Jan 20 | Rent Expense | $800 |

Step 1: Identify Account Type: Asset (normal debit balance)

Step 2: Record Transactions (already done in the table above)

Step 3: Sum Debits and Credits:

- Total Debits: $5,000 + $500 + $1,000 = $6,500

- Total Credits: $2,000

Step 4: Calculate the Difference:

- $6,500 (Debits) - $2,000 (Credits) = $4,500

Step 5: Determine Normal Balance: Debit

Ending Balance: $4,500 (Debit)

Example 2: Accounts Payable (Liability)

Consider the following transactions for an Accounts Payable account:

| Date | Description | Debit | Credit |

|---|---|---|---|

| Feb 1 | Beginning Balance | $3,000 | |

| Feb 5 | Purchase Inventory | $1,500 | |

| Feb 10 | Payment to Supplier | $1,000 | |

| Feb 15 | Purchase Equipment | $800 |

Step 1: Identify Account Type: Liability (normal credit balance)

Step 2: Record Transactions (already done)

Step 3: Sum Debits and Credits:

- Total Debits: $1,000

- Total Credits: $3,000 + $1,500 + $800 = $5,300

Step 4: Calculate the Difference:

- $5,300 (Credits) - $1,000 (Debits) = $4,300

Step 5: Determine Normal Balance: Credit

Ending Balance: $4,300 (Credit)

Example 3: Retained Earnings (Equity)

Here are some transactions for a Retained Earnings account:

| Date | Description | Debit | Credit |

|---|---|---|---|

| Mar 1 | Beginning Balance | $10,000 | |

| Mar 5 | Net Income | $3,000 | |

| Mar 10 | Dividends Paid | $1,500 |

Step 1: Identify Account Type: Equity (normal credit balance)

Step 2: Record Transactions (already done)

Step 3: Sum Debits and Credits:

- Total Debits: $1,500

- Total Credits: $10,000 + $3,000 = $13,000

Step 4: Calculate the Difference:

- $13,000 (Credits) - $1,500 (Debits) = $11,500

Step 5: Determine Normal Balance: Credit

Ending Balance: $11,500 (Credit)

Example 4: Sales Revenue (Revenue)

Consider the following transactions for a Sales Revenue account:

| Date | Description | Debit | Credit |

|---|---|---|---|

| Apr 1 | Sales | $5,000 | |

| Apr 10 | Sales Returns | $200 | |

| Apr 15 | Sales Discounts | $100 |

Step 1: Identify Account Type: Revenue (normal credit balance)

Step 2: Record Transactions (already done)

Step 3: Sum Debits and Credits:

- Total Debits: $200 + $100 = $300

- Total Credits: $5,000

Step 4: Calculate the Difference:

- $5,000 (Credits) - $300 (Debits) = $4,700

Step 5: Determine Normal Balance: Credit

Ending Balance: $4,700 (Credit)

Handling Multiple Transactions and Complex Scenarios

The examples above showcase straightforward scenarios. In real-world accounting, you might encounter many more transactions within a given period. The process remains the same: meticulously record each transaction, sum the debits and credits, and calculate the difference. Spreadsheets or accounting software can significantly simplify this process, particularly when dealing with numerous transactions. Always double-check your work for accuracy.

Importance of Accurate T-Account Balances

Accurate T-account balances are crucial for several reasons:

-

Financial Statement Preparation: The ending balances of T-accounts are the foundation for preparing accurate financial statements (balance sheet, income statement, and statement of cash flows). Inaccurate T-account balances will lead to inaccurate financial statements, potentially misleading stakeholders and hindering decision-making.

-

Internal Control: Maintaining accurate T-accounts is a crucial aspect of internal control. It helps detect and prevent errors and fraud. Regularly reconciling T-accounts with supporting documents helps ensure the integrity of financial records.

-

Auditing: During audits, auditors carefully examine T-accounts to verify the accuracy and reliability of financial records. Accurate T-accounts are essential for a smooth audit process and a positive audit outcome.

-

Decision Making: Accurate T-account balances provide reliable information for management decision-making. This information is essential for planning, budgeting, and evaluating the performance of the business.

Tips for Efficient T-Account Management

-

Use Accounting Software: Accounting software automates many of the tasks associated with managing T-accounts, reducing the risk of errors and saving time.

-

Regular Reconciliation: Regularly reconcile T-accounts with supporting documents (bank statements, invoices, receipts) to identify and correct any discrepancies.

-

Maintain a Consistent System: Establish a consistent system for recording transactions in T-accounts, ensuring uniformity and accuracy across all accounts.

-

Double-Check Your Work: Always double-check your calculations and entries to minimize the risk of errors.

Conclusion

Mastering the ability to determine the ending balance of T-accounts is a cornerstone of accounting proficiency. By understanding the principles of debits and credits, carefully recording transactions, and diligently calculating the difference, you can confidently manage your T-accounts and ensure the accuracy of your financial records. Remember that accuracy is paramount, and utilizing tools like spreadsheets or accounting software can significantly enhance efficiency and reduce the potential for error. This skill is essential for accurate financial reporting, robust internal controls, and effective decision-making within any organization.

Latest Posts

Latest Posts

-

Draw The Major And Minor Monobromination Products Of This Reaction

Mar 20, 2025

-

Here Are Sketches Of Four Electron Orbitals

Mar 20, 2025

-

Why Might You Prefer Tiktok Over Instagram

Mar 20, 2025

-

Susan Regularly Violates Her Organizations Security Policies

Mar 20, 2025

-

A Company Achieves Sustainable Competitive Advantage When

Mar 20, 2025

Related Post

Thank you for visiting our website which covers about Determine The Ending Balance Of Each Of The Following T-accounts. . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.