Classify The Cost Referenced In Each Scenario

Holbox

Mar 18, 2025 · 7 min read

Table of Contents

Classify the Cost Referenced in Each Scenario: A Comprehensive Guide

Cost classification is a crucial aspect of accounting and financial management. Understanding how to categorize costs allows businesses to make informed decisions regarding pricing, budgeting, and resource allocation. This article will delve into various cost classification methods, providing examples for each scenario to enhance your understanding. We'll explore different types of costs, including fixed, variable, semi-variable, direct, indirect, and more, showing how they apply to real-world business situations.

Understanding Cost Classification Methods

Before we dive into specific scenarios, let's establish a foundational understanding of the key cost classification methods. These methods provide a framework for analyzing and interpreting cost behavior within a business.

1. Cost Classification by Behavior:

This method categorizes costs based on how they react to changes in activity levels. The primary classifications are:

-

Fixed Costs: These costs remain constant regardless of the production volume or sales revenue. Examples include rent, salaries of permanent staff, and insurance premiums. Important Note: While the total fixed cost remains constant, the per-unit fixed cost decreases as production increases.

-

Variable Costs: These costs fluctuate directly with changes in production volume or sales. Examples include raw materials, direct labor (in some cases), and sales commissions. The per-unit variable cost remains constant, while the total variable cost increases with production.

-

Semi-Variable Costs (or Mixed Costs): These costs contain both fixed and variable components. They have a fixed base cost and a variable component that changes with activity levels. Examples include utilities (a fixed base charge plus a variable charge based on usage) and maintenance (fixed preventative maintenance plus variable reactive maintenance). Separating the fixed and variable components of semi-variable costs often requires techniques like the high-low method or regression analysis.

2. Cost Classification by Traceability:

This method classifies costs based on how easily they can be directly traced to a specific product, service, or department. The main classifications are:

-

Direct Costs: These costs are directly attributable to a specific cost object (e.g., a product, project, or department). Examples include direct materials (raw materials used in production), direct labor (wages of workers directly involved in production), and direct expenses (costs specifically incurred for a particular project).

-

Indirect Costs (or Overhead Costs): These costs cannot be directly traced to a specific cost object. They are shared across multiple products, services, or departments. Examples include rent, factory utilities, administrative salaries, and depreciation of factory equipment. Indirect costs are often allocated to cost objects using methods such as machine hours, labor hours, or revenue.

3. Cost Classification by Function:

This method classifies costs based on their purpose or function within the business. Common functional classifications include:

-

Production Costs: Costs directly associated with the manufacturing process, encompassing direct materials, direct labor, and manufacturing overhead.

-

Selling Costs: Costs incurred in promoting and selling the company's products or services. This includes advertising, sales commissions, and sales salaries.

-

Administrative Costs: Costs related to the general administration and management of the business, such as executive salaries, rent for administrative offices, and general administrative expenses.

-

Research and Development Costs: Costs associated with the creation of new products or services or the improvement of existing ones. This includes salaries of R&D personnel, laboratory costs, and patent fees.

Scenario-Based Cost Classification

Now, let's apply these classification methods to various scenarios.

Scenario 1: The Bakery

A small bakery produces custom cakes. Let's classify the following costs:

-

Flour, sugar, and eggs: These are direct variable costs. They are directly traceable to the cakes and vary with the number of cakes produced.

-

Rent for the bakery: This is a fixed cost. The rent remains constant regardless of the number of cakes baked.

-

Baker's salary: This could be categorized as either a fixed cost (if the baker is a salaried employee) or a variable cost (if the baker is paid per cake).

-

Electricity bill: This is a semi-variable cost. There's a fixed base charge, and the amount increases with increased oven usage.

-

Advertising in local newspapers: This is a selling cost and typically considered a fixed cost (if the ads run consistently) or a variable cost if the advertising budget changes frequently according to the number of sales.

Scenario 2: The Software Company

A software company develops and sells custom software applications. Consider these costs:

-

Salaries of programmers: These are direct costs if the programmers work exclusively on a specific project. Otherwise, they might be considered indirect costs if their time is allocated across multiple projects. They can be fixed costs (salaried) or variable costs (contract-based).

-

Office rent: This is an indirect fixed cost.

-

Cost of servers and infrastructure: This is an indirect cost, potentially semi-variable, as there might be a fixed cost for basic infrastructure and a variable cost based on usage.

-

Marketing and advertising expenses: These are indirect selling costs. They are typically considered fixed costs (for consistent campaigns) or variable costs (if spending fluctuates significantly).

Scenario 3: The Manufacturing Plant

A manufacturing plant produces widgets. Consider the following costs:

-

Raw materials (metal, plastic): Direct variable costs.

-

Factory rent: Indirect fixed cost.

-

Wages of assembly line workers: Direct variable costs (often paid per unit or hour).

-

Depreciation of machinery: Indirect fixed cost.

-

Electricity used for the assembly line: Indirect semi-variable cost. A fixed charge exists, with usage-based variable costs.

-

Supervisory salaries: These are indirect fixed costs.

-

Shipping costs: These are usually variable costs as they are dependent on the number of widgets shipped. These can be considered direct costs if assigned per shipment/client.

Scenario 4: The Retail Store

A retail store sells clothing. Consider the following costs:

-

Cost of goods sold (clothing purchased from suppliers): Direct variable cost.

-

Store rent: Fixed cost.

-

Sales staff salaries: These may be fixed costs (salaried employees) or variable costs (commission-based).

-

Utilities (electricity, heating): Semi-variable cost.

-

Advertising and marketing: Selling costs, often fixed costs (for consistent campaigns) or variable costs (if spending fluctuates based on sales).

Scenario 5: The Consulting Firm

A consulting firm provides services to clients. Let's examine these costs:

-

Consultant salaries: These are usually direct costs (time spent on a specific client project). They are normally variable costs if the consultants are paid hourly or per project, and fixed costs for salaried consultants.

-

Office rent: Indirect fixed cost.

-

Travel expenses for consultants: Direct variable costs depending on the client project and the consultants' travel needs.

-

Marketing and business development: Indirect selling costs, typically fixed costs for consistent outreach, or variable costs if spending is tied to client acquisition goals.

-

Software subscriptions: Indirect semi-variable cost, with fixed subscription fees and potential variable costs for add-ons or increased usage.

Advanced Cost Classifications and Considerations

Beyond the basic classifications, several other aspects of cost accounting warrant attention:

-

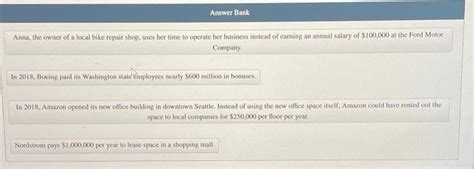

Opportunity Cost: The potential benefit that is given up when one alternative is selected over another. For example, the opportunity cost of investing in one project might be the potential return from a different investment.

-

Sunk Cost: A cost that has already been incurred and cannot be recovered. Sunk costs should not influence future decision-making.

-

Relevant Cost: A cost that is relevant to a specific decision. Only relevant costs should be considered when making decisions.

-

Marginal Cost: The cost of producing one additional unit of output.

Accurate cost classification is essential for effective decision-making. By consistently applying these classification methods, businesses gain valuable insights into their cost structures, enabling better pricing strategies, improved resource allocation, and ultimately, enhanced profitability. Remember that the classification of costs can be context-dependent, requiring careful consideration of the specific circumstances and the purpose of the analysis. Understanding the nuances of cost behavior is critical for the long-term success of any enterprise.

Latest Posts

Latest Posts

-

A Set Of Bivariate Data Was Used To Create

Mar 18, 2025

-

What Is The Product Of This Reaction

Mar 18, 2025

-

Record The Entry To Close The Dividends Account

Mar 18, 2025

-

Which Of The Following Best Describes The Operational Period Briefing

Mar 18, 2025

-

The Second Largest Number Of Pacs Are Those Associated With

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about Classify The Cost Referenced In Each Scenario . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.