An Oligopoly Is A Market That Is Characterized By

Holbox

Mar 18, 2025 · 6 min read

Table of Contents

An Oligopoly: A Market Characterized by a Few Powerful Players

An oligopoly is a market structure characterized by a small number of large firms dominating the industry. Unlike a monopoly, where a single firm controls the market, or perfect competition, where many small firms compete, oligopolies are defined by their interdependence and the significant impact each firm's actions have on its competitors. This interdependence leads to complex strategic interactions, making oligopolistic markets fascinating and challenging to analyze. This article delves deep into the defining characteristics of an oligopoly, exploring the factors that contribute to its formation, its various forms, the strategic behaviors exhibited by firms within this structure, and the implications for consumers and the overall economy.

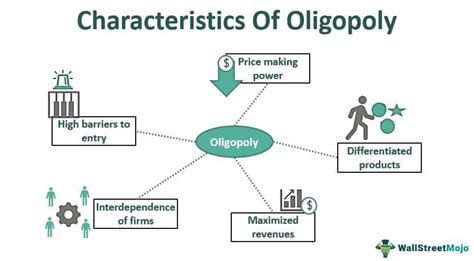

Defining Characteristics of an Oligopoly

Several key characteristics distinguish an oligopoly from other market structures:

1. A Few Dominant Firms:

The most prominent feature is the presence of only a few large firms that control a significant portion of the market share. This concentration of power allows these firms to exert considerable influence over prices, output, and market conditions. The exact number of firms constituting an oligopoly is not rigidly defined, but typically ranges from two (a duopoly) to a dozen or so. The crucial factor is that the actions of any one firm significantly affect the others and the overall market.

2. High Barriers to Entry:

Similar to monopolies, oligopolies often feature high barriers to entry, preventing new firms from easily entering the market. These barriers can include:

- High capital requirements: The need for substantial initial investment in infrastructure, technology, and marketing can deter potential entrants.

- Economies of scale: Existing large firms may benefit from economies of scale, allowing them to produce goods at lower average costs, making it difficult for new entrants to compete.

- Control over essential resources: Oligopolies may control key resources or technologies necessary for production, limiting access for potential competitors.

- Government regulations: Licensing requirements, patents, and other regulations can restrict entry into the market.

- Brand loyalty: Established brands often enjoy strong customer loyalty, making it challenging for newcomers to attract customers.

3. Interdependence and Strategic Behavior:

This is arguably the most defining characteristic of an oligopoly. Firms in an oligopoly are highly interdependent; the actions of one firm directly impact the others. This interdependence leads to strategic behavior, where firms carefully consider the potential reactions of their competitors when making decisions regarding pricing, output, advertising, and other aspects of their business. This necessitates sophisticated game-theoretic analysis to predict and understand the dynamics of the market.

4. Non-Price Competition:

Because of the interdependence and the potential for price wars, oligopolists often engage in non-price competition. This can involve:

- Product differentiation: Firms may strive to differentiate their products through quality, features, branding, and marketing to attract customers and reduce price competition.

- Advertising and marketing: Extensive advertising and marketing campaigns are common in oligopolies, aiming to build brand loyalty and increase market share.

- Innovation: Firms may invest heavily in research and development to create new and improved products, gaining a competitive edge.

- Service quality: Offering superior customer service can be a significant differentiator in an oligopolistic market.

Types of Oligopolies

Oligopolies can be categorized into several types based on their behavior and structure:

1. Collusive Oligopolies:

In collusive oligopolies, firms cooperate to limit competition. This can involve:

- Cartels: A formal agreement among firms to fix prices, output, or market share. Cartels are often illegal under antitrust laws.

- Tacit collusion: An informal agreement or understanding among firms to avoid price competition, often achieved through signaling or other indirect means. This can be more difficult to detect and prosecute than explicit collusion.

2. Non-Collusive Oligopolies:

In non-collusive oligopolies, firms compete actively, but their actions are still influenced by the behavior of their rivals. Several models illustrate this behavior:

- Cournot model: Firms choose their output levels simultaneously, assuming the output of competitors remains constant.

- Bertrand model: Firms compete by setting prices, assuming competitors will hold their prices constant.

- Stackelberg model: One firm (the leader) sets its output or price first, and the other firms (the followers) react accordingly.

The Impact of Oligopolies

Oligopolies have significant impacts on various aspects of the economy:

1. Prices and Output:

Oligopolies often result in prices that are higher than in perfectly competitive markets, and output is lower. This is because firms have some market power and can restrict supply to maintain higher prices. However, the degree of price distortion depends on the level of competition among firms and the extent of collusion.

2. Innovation and Technological Advancement:

Oligopolies can be a source of both innovation and stagnation. The large size and resources of these firms can allow them to invest in research and development, leading to technological advancements. However, the lack of intense competition can also discourage innovation, as firms may be less motivated to invest in new technologies.

3. Consumer Welfare:

The impact on consumer welfare is mixed. While higher prices are a disadvantage, oligopolies can offer product diversity and quality improvements that might not be present in more competitive markets. The balance between these competing effects determines the net impact on consumer welfare.

4. Economic Efficiency:

Oligopolies are generally considered to be less economically efficient than perfectly competitive markets. The restriction of output and higher prices result in deadweight loss, a reduction in overall societal welfare. However, the potential for innovation and economies of scale can mitigate this inefficiency to some extent.

Antitrust Laws and Regulation

Governments often intervene in oligopolistic markets to prevent anti-competitive practices and promote greater competition. Antitrust laws are designed to prohibit:

- Price fixing: Agreements among firms to set prices at an artificially high level.

- Market allocation: Agreements among firms to divide the market among themselves.

- Predatory pricing: Setting prices below cost to drive out competitors.

- Mergers and acquisitions: These can be blocked if they lead to excessive market concentration.

Conclusion: Navigating the Complexities of Oligopoly

The oligopoly market structure, characterized by its few dominant firms, high barriers to entry, and strategic interdependence, presents a complex and fascinating area of economic study. The actions of firms within an oligopoly are profoundly interconnected, leading to a wide range of possible outcomes, from cooperative collusion to fierce competition. Understanding the different types of oligopolies, the strategic behaviors employed by firms, and the impacts on consumers and the economy is vital for policymakers, businesses, and consumers alike. The ongoing tension between promoting innovation and competition, while simultaneously preventing anti-competitive practices, remains a key challenge in managing these influential market structures. Effective antitrust regulation and a thorough understanding of game theory are crucial tools for navigating the complexities of oligopolistic markets and promoting a more efficient and equitable economic landscape.

Latest Posts

Latest Posts

-

Your Local Movie Theater Uses The Same Group Pricing Strategy

Mar 18, 2025

-

A Set Of Bivariate Data Was Used To Create

Mar 18, 2025

-

What Is The Product Of This Reaction

Mar 18, 2025

-

Record The Entry To Close The Dividends Account

Mar 18, 2025

-

Which Of The Following Best Describes The Operational Period Briefing

Mar 18, 2025

Related Post

Thank you for visiting our website which covers about An Oligopoly Is A Market That Is Characterized By . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.