Allocating Common Fixed Expenses To Business Segments

Holbox

Mar 14, 2025 · 6 min read

Table of Contents

Allocating Common Fixed Expenses to Business Segments: A Comprehensive Guide

Allocating common fixed expenses across different business segments is a crucial yet complex task for multi-segment companies. Accurate allocation is essential for informed decision-making, performance evaluation, and profitability analysis. This guide delves into the intricacies of this process, exploring various methods, their advantages and disadvantages, and best practices to ensure fairness and accuracy.

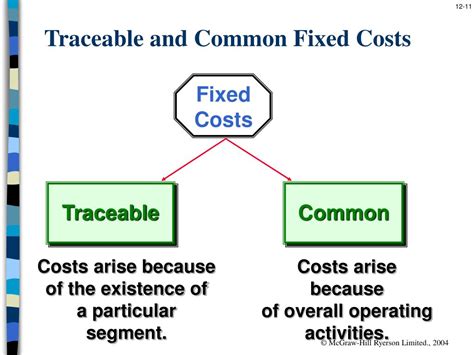

Understanding the Challenge of Common Fixed Expenses

Common fixed expenses, also known as indirect costs, are those incurred for the benefit of multiple business segments rather than a single unit. These expenses cannot be directly traced to a specific segment. Examples include:

- Rent: For a company occupying a single building with multiple departments.

- Utilities: Electricity, water, and gas consumed by the entire company.

- Salaries of Executive Management: Leadership overseeing multiple segments.

- Marketing Costs: General brand-building campaigns.

- IT Infrastructure: Maintaining the company's computer network and systems.

- Insurance: Premiums covering the entire business operation.

- Depreciation: Of shared assets like machinery or equipment.

The challenge lies in fairly and accurately apportioning these costs to each segment to get a true picture of their individual profitability and performance. Inaccurate allocation can lead to flawed strategic decisions, inefficient resource allocation, and misinterpretations of segment performance.

Methods for Allocating Common Fixed Expenses

Several methods exist for allocating common fixed expenses. The best choice depends on the company's specific circumstances, industry, and the nature of its segments. Each method has its strengths and weaknesses. Let's explore some prominent approaches:

1. Revenue-Based Allocation

This is the simplest method, allocating expenses based on each segment's proportion of total revenue. For example, if Segment A generates 60% of the total revenue, it receives 60% of the common fixed expenses.

Advantages:

- Simplicity: Easy to understand and implement.

- Readily Available Data: Revenue data is typically readily available.

Disadvantages:

- Inaccuracy: Doesn't reflect the actual consumption of resources by each segment. A segment with high revenue might not necessarily consume a proportionally higher share of common fixed expenses.

- Distorts Performance: Can unfairly penalize high-revenue segments or reward low-revenue segments with disproportionately low expense allocations.

2. Cost Driver-Based Allocation

This method assigns expenses based on a specific cost driver that correlates with the consumption of the shared resource. The cost driver should be a reasonable proxy for the use of the common fixed asset or service. Examples include:

- Square footage: For rent allocation, based on the space occupied by each segment.

- Number of employees: For IT support or administrative expenses.

- Machine hours: For depreciation of shared machinery.

- Direct labor hours: For certain overhead expenses.

Advantages:

- More Accurate: Provides a more accurate reflection of resource consumption compared to revenue-based allocation.

- Fairer Allocation: Better reflects the actual use of shared resources.

Disadvantages:

- Requires Identification of Relevant Cost Drivers: Finding appropriate cost drivers can be challenging and require careful consideration.

- Data Collection Challenges: Collecting accurate data for cost drivers can be time-consuming and resource-intensive.

3. Activity-Based Costing (ABC)

ABC is a more sophisticated method that identifies and assigns costs based on the activities that consume resources. It goes beyond simple cost drivers to analyze the specific activities driving the expense. For example, instead of simply allocating IT costs based on the number of employees, ABC would track the specific IT services used by each segment and allocate costs accordingly.

Advantages:

- Highly Accurate: Provides the most accurate allocation of common fixed expenses.

- Improved Decision-Making: Offers granular insights into cost drivers, aiding better cost management and decision-making.

Disadvantages:

- Complex and Time-Consuming: Requires significant data collection, analysis, and expertise.

- High Implementation Costs: Can be expensive to implement and maintain.

4. Negotiated Allocation

In some cases, the allocation of common fixed expenses can be determined through negotiation between the business segments. This approach can be particularly useful when different segments have different levels of influence or bargaining power.

Advantages:

- Flexibility: Allows for flexibility in allocating expenses based on specific circumstances and needs.

- Improved Buy-in: Can foster cooperation and buy-in from segment managers.

Disadvantages:

- Subjectivity and Bias: The allocation may be subject to biases and negotiations may not result in an objective and fair distribution.

- Potential for Conflict: Disagreements can arise between segments during the negotiation process.

Choosing the Right Allocation Method

Selecting the optimal method depends on several factors:

- Company Size and Complexity: Larger, more complex companies may benefit from more sophisticated methods like ABC.

- Industry: Certain industries may necessitate specific allocation methods.

- Data Availability: The availability of reliable data is crucial for certain methods.

- Cost and Time Constraints: Consider the resources required to implement and maintain the chosen method.

- Accuracy Requirements: The desired level of accuracy dictates the complexity of the chosen method.

Best Practices for Allocating Common Fixed Expenses

Regardless of the chosen method, adhering to best practices is crucial:

- Clearly Define Segments: Establish clear definitions of business segments to ensure consistent allocation.

- Document Allocation Methodology: Document the chosen method and rationale for its selection to enhance transparency and accountability.

- Regular Review and Adjustment: Periodically review and adjust the allocation method to reflect changes in the business environment and operational structure.

- Use Multiple Methods for Comparison: Employing multiple methods and comparing the results can offer a more comprehensive understanding and highlight potential biases.

- Focus on Decision-Relevance: Prioritize methods that provide meaningful insights for decision-making and performance evaluation.

- Consider Qualitative Factors: Supplement quantitative data with qualitative factors to gain a more holistic view.

- Transparency and Communication: Ensure transparency in the allocation process and communicate the rationale to all stakeholders to ensure buy-in and understanding.

Impact on Performance Evaluation and Decision-Making

Accurate allocation of common fixed expenses directly impacts the accuracy of segment performance evaluations. Inaccurate allocation can lead to:

- Misleading Profitability Assessments: Segments may appear more or less profitable than they actually are.

- Suboptimal Resource Allocation: Resources might be allocated inefficiently based on flawed profitability assessments.

- Incorrect Strategic Decisions: Strategic choices may be made based on distorted performance data, leading to suboptimal outcomes.

By accurately allocating these expenses, businesses can:

- Identify Profitable and Unprofitable Segments: Gain clarity on the performance of each segment, aiding in strategic decision-making regarding investment, expansion, or divestment.

- Improve Cost Management: Understand cost drivers and opportunities for improvement within each segment.

- Enhance Pricing Strategies: Accurately evaluate costs to set optimal pricing strategies.

- Make Informed Investment Decisions: Base investment decisions on accurate assessments of segment profitability.

Conclusion: A Necessary but Complex Task

Allocating common fixed expenses is a critical task for multi-segment companies. Choosing the right method and adhering to best practices are essential for accurate performance evaluations and informed decision-making. While the process can be complex, the benefits of accurate allocation far outweigh the challenges. By carefully considering the available methods and factors discussed, businesses can ensure a fair and accurate distribution of these expenses, leading to enhanced operational efficiency, improved profitability, and a stronger competitive position.

Latest Posts

Latest Posts

-

An Advantage Of Issuing Bonds Is That

Mar 14, 2025

-

Informed Consent Means Clearly Explaining All Of The Following Except

Mar 14, 2025

-

Which Tools Would You Use To Make

Mar 14, 2025

-

Which Of The Following Is An Inflation Adjusted Return

Mar 14, 2025

-

What Type Of Cell Is Shown At A

Mar 14, 2025

Related Post

Thank you for visiting our website which covers about Allocating Common Fixed Expenses To Business Segments . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.