Which Of The Following Is An Inflation-adjusted Return

Holbox

Mar 14, 2025 · 6 min read

Table of Contents

Which of the following is an inflation-adjusted return? Understanding Real Returns vs. Nominal Returns

Investing involves navigating a complex landscape of financial metrics, and understanding the difference between nominal and real returns is crucial for making informed decisions. While a high nominal return might seem impressive at first glance, it’s the inflation-adjusted return, or real return, that truly reflects your investment's growth in purchasing power. This article delves deep into the concept of inflation-adjusted returns, explaining how to calculate them, their importance, and how they differ from nominal returns. We'll also explore various investment scenarios and provide practical examples to solidify your understanding.

Understanding Nominal Returns

Before diving into inflation-adjusted returns, let's clarify what nominal returns represent. A nominal return is the stated rate of return on an investment before accounting for inflation. It's the raw percentage increase in your investment's value over a specific period. For instance, if your investment grows from $10,000 to $11,000 in a year, your nominal return is 10%.

Examples of Nominal Returns:

- Stock Market Returns: The annual percentage change in a stock's price.

- Bond Yields: The interest rate paid on a bond.

- Real Estate Appreciation: The percentage increase in a property's value.

- Savings Account Interest: The interest earned on a savings account.

The Impact of Inflation

Inflation erodes the purchasing power of money. Simply put, the same amount of money buys fewer goods and services as prices rise. This is why focusing solely on nominal returns can be misleading. A 10% nominal return might seem substantial, but if inflation is also 5%, your real return is only 5%. This means your investment's purchasing power has only increased by 5%, not 10%.

Understanding Inflation's Role:

Inflation is a persistent increase in the general price level of goods and services in an economy over a period of time. When inflation rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy.

Several factors contribute to inflation, including:

- Increased Demand: When demand for goods and services exceeds supply, prices tend to rise.

- Increased Production Costs: Rising wages, raw material prices, or energy costs can push up the prices of finished goods.

- Government Policies: Government spending and monetary policies can influence inflation levels.

- External Shocks: Unexpected events, such as natural disasters or global supply chain disruptions, can cause temporary inflation spikes.

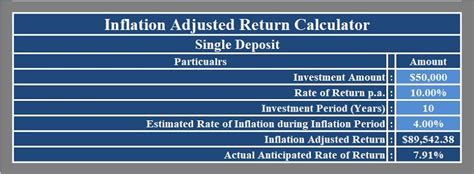

Calculating Inflation-Adjusted Returns (Real Returns)

The inflation-adjusted return, also known as the real return, accurately reflects the growth of your investment's purchasing power after accounting for inflation. The formula to calculate the real return is:

Real Return = [(1 + Nominal Return) / (1 + Inflation Rate)] - 1

Let's illustrate this with an example:

Assume your investment generated a nominal return of 10% (or 0.10), and the inflation rate during the same period was 5% (or 0.05).

Real Return = [(1 + 0.10) / (1 + 0.05)] - 1 = (1.10 / 1.05) - 1 = 1.0476 - 1 = 0.0476 or 4.76%

Therefore, your real return is 4.76%, meaning your investment's purchasing power increased by 4.76% after accounting for inflation.

Why Real Returns Matter

Focusing on real returns is critical for several reasons:

- Accurate Assessment of Investment Performance: Real returns provide a true picture of your investment's growth in terms of purchasing power. Ignoring inflation leads to an overestimation of your investment's actual performance.

- Long-Term Financial Planning: For long-term financial goals like retirement, real returns are essential for accurate projections. Inflation significantly impacts the future value of your savings.

- Comparative Analysis: When comparing different investment options, using real returns ensures a fair comparison based on purchasing power, not just nominal growth.

- Informed Decision-Making: Understanding real returns empowers you to make more informed investment decisions, aligning your portfolio with your long-term financial objectives.

Inflation-Adjusted Return vs. Nominal Return: Key Differences Summarized

| Feature | Nominal Return | Real Return (Inflation-Adjusted Return) |

|---|---|---|

| Definition | Stated return before adjusting for inflation | Return adjusted for inflation, reflecting changes in purchasing power |

| Calculation | Simple percentage change in investment value | Requires inflation rate: [(1 + Nominal Return) / (1 + Inflation Rate)] - 1 |

| Inflation | Does not account for inflation | Accounts for inflation |

| Accuracy | Can be misleading due to inflation's impact | Provides a more accurate reflection of investment performance |

| Long-term Use | Less reliable for long-term financial planning | Essential for long-term financial planning |

Practical Applications and Examples

Let's explore a few scenarios to illustrate the importance of real returns:

Scenario 1: Retirement Planning

Suppose you're planning for retirement 30 years from now. You expect a 7% annual nominal return on your investments. However, if the average annual inflation rate is 3%, your real return is only around 3.9%, significantly lower than your nominal return. This highlights the need to account for inflation when projecting your retirement savings.

Scenario 2: Comparing Investments

You're considering two investment options:

- Option A: A bond offering a 6% nominal return.

- Option B: A stock offering an 11% nominal return.

However, if the inflation rate is 4%, the real return for Option A is approximately 1.9%, while the real return for Option B is around 6.7%. In this case, even though Option B has a higher nominal return, Option B provides a more substantial increase in purchasing power.

Scenario 3: Impact of Unexpected Inflation

Suppose you invested $100,000, anticipating a 5% nominal return and a 2% inflation rate. After one year, your investment grows to $105,000 (a 5% nominal return). However, due to unexpected economic events, inflation surges to 7%. Your real return is now negative:

Real Return = [(1 + 0.05) / (1 + 0.07)] - 1 ≈ -0.0187 or -1.87%

This shows how unexpected inflation can significantly impact your purchasing power, even if your nominal return meets expectations.

Finding the Inflation Rate

To calculate real returns accurately, you need a reliable inflation rate. Common sources include:

- Consumer Price Index (CPI): A widely used measure of inflation that tracks the average change in prices paid by urban consumers for a basket of goods and services.

- Producer Price Index (PPI): Measures the average change over time in the selling prices received by domestic producers for their output.

- GDP Deflator: A broader measure of inflation that includes all goods and services produced in an economy.

Conclusion: Prioritize Real Returns for True Investment Success

While nominal returns provide a basic measure of investment growth, it's the inflation-adjusted return (real return) that truly reflects the increase in your investment's purchasing power. By understanding how to calculate and interpret real returns, you can make more informed investment decisions, plan for the long term, and accurately assess your investment performance. Always remember that inflation erodes the value of money, making real returns a crucial factor in your financial success. Failing to account for inflation can lead to unrealistic expectations and potentially poor financial outcomes. Therefore, consistently focusing on real returns will empower you to navigate the complexities of investing and secure your financial future.

Latest Posts

Latest Posts

-

Efficiency In A Market Is Achieved When

Mar 15, 2025

-

4 Isopropyl 2 4 5 Trimethylheptane

Mar 15, 2025

-

What Is The Current Flowing Through The 6 Ohm Resistor

Mar 15, 2025

-

You Receive A Text Message From A Vendor

Mar 15, 2025

-

An Automatic Session Lock Is Not Required If

Mar 15, 2025

Related Post

Thank you for visiting our website which covers about Which Of The Following Is An Inflation-adjusted Return . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.