A Customer Complains That Paying Her Bills Online Is Complicated

Holbox

Mar 26, 2025 · 6 min read

Table of Contents

- A Customer Complains That Paying Her Bills Online Is Complicated

- Table of Contents

- A Customer Complains That Paying Her Bills Online Is Complicated: A Deep Dive into Online Bill Payment Usability

- The Frustrations of Online Bill Pay: A User's Perspective

- Common Pain Points:

- Why Online Bill Payment Systems Fail to Deliver

- 1. Legacy Systems and Technological Limitations:

- 2. Lack of User-Centered Design:

- 3. Inadequate Testing and Quality Assurance:

- 4. Insufficient Training and Support for Staff:

- 5. Failure to Incorporate Feedback:

- Best Practices for Designing User-Friendly Online Bill Payment Systems

- 1. Streamlined User Interface (UI) and User Experience (UX):

- 2. Robust Security Measures:

- 3. Seamless Integration with Existing Accounts:

- 4. Comprehensive Customer Support:

- 5. Continuous Improvement and Feedback Mechanisms:

- The Future of Online Bill Payment: Innovation and User-Centricity

- Conclusion: Prioritizing the Customer Experience

- Latest Posts

- Latest Posts

- Related Post

A Customer Complains That Paying Her Bills Online Is Complicated: A Deep Dive into Online Bill Payment Usability

Many of us take online bill pay for granted. It's supposed to be convenient, efficient, and stress-free. However, for a significant number of users, the reality is quite different. A common complaint revolves around the perceived complexity of online bill payment systems. This article delves into the reasons behind this frustration, exploring the usability challenges faced by consumers and offering solutions for businesses to improve their online bill pay systems.

The Frustrations of Online Bill Pay: A User's Perspective

The seemingly simple act of paying a bill online can turn into a frustrating ordeal. Imagine this scenario: A customer, let's call her Sarah, receives her monthly utility bill. She decides to pay it online, expecting a quick and straightforward process. Instead, she encounters a convoluted website with confusing navigation, unclear instructions, and multiple logins. She spends 20 minutes wrestling with the system only to discover she needs to create a new account, even though she's already a customer. This experience isn't uncommon. Many customers share similar frustrations, leading to negative feelings towards the company and potentially impacting their loyalty.

Common Pain Points:

-

Multiple Logins and Account Creation: Requiring customers to create separate accounts for each bill payment service is a major pain point. It adds complexity and requires users to remember numerous usernames and passwords. This contributes to password fatigue and increases the risk of security breaches through password reuse.

-

Confusing Navigation and User Interface (UI): Poorly designed websites with cluttered layouts, inconsistent terminology, and unintuitive navigation create confusion and frustration. Customers should easily find the “pay bill” option without navigating through multiple pages.

-

Lack of Clear Instructions: Ambiguous instructions and a lack of helpful guidance can lead to errors and wasted time. Clear, concise, and visually appealing instructions are essential for a smooth user experience.

-

Inconsistent Bill Payment Methods: Different companies offer varied payment options, creating confusion. Some might only accept credit cards, while others prefer eChecks or direct debit. Consistency and clear indication of accepted methods are crucial.

-

Technical Glitches and System Errors: Website crashes, slow loading times, and payment processing errors are all major sources of frustration. Robust system architecture and regular maintenance are vital to prevent these issues.

-

Lack of Customer Support: If problems arise, the absence of readily available and helpful customer support exacerbates the frustration. Clear contact information, FAQs, and easily accessible support options are essential.

-

Security Concerns: Customers are naturally concerned about the security of their financial information. Clear security measures and certifications (like SSL encryption) build trust and alleviate anxieties.

Why Online Bill Payment Systems Fail to Deliver

The reasons behind the complexities of online bill payment systems are multifaceted:

1. Legacy Systems and Technological Limitations:

Many companies struggle to update their legacy systems, resulting in outdated interfaces and poor user experiences. Modernizing systems requires significant investment and expertise.

2. Lack of User-Centered Design:

Companies often prioritize their internal processes over the user experience. A user-centered design approach, where the needs and preferences of customers are at the forefront, is crucial for creating intuitive and efficient systems.

3. Inadequate Testing and Quality Assurance:

Thorough testing and quality assurance are essential to identify and resolve usability issues before the system goes live. Without these crucial steps, customers are left to grapple with a poorly functioning system.

4. Insufficient Training and Support for Staff:

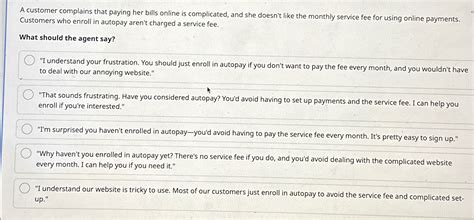

Customer service representatives need adequate training to effectively address customer queries and resolve issues related to online bill payments.

5. Failure to Incorporate Feedback:

Collecting and analyzing customer feedback is crucial for identifying areas of improvement. Ignoring customer feedback prevents businesses from addressing pain points and enhancing the user experience.

Best Practices for Designing User-Friendly Online Bill Payment Systems

To address the issues raised above, companies should focus on implementing best practices for online bill payment system design:

1. Streamlined User Interface (UI) and User Experience (UX):

Prioritize simplicity and clarity: The design should be intuitive and easy to navigate. Use clear and concise language, consistent terminology, and visually appealing elements.

Minimize steps: Reduce the number of steps required to complete a payment. A streamlined process minimizes frustration and improves user satisfaction.

Mobile responsiveness: Ensure the system is accessible and functional across different devices, including desktops, tablets, and smartphones.

2. Robust Security Measures:

Secure data transmission: Implement strong encryption protocols (like SSL/TLS) to protect sensitive customer data during transmission.

Secure authentication: Use multi-factor authentication (MFA) to add an extra layer of security and prevent unauthorized access.

Regular security audits: Conduct regular security audits to identify and address vulnerabilities.

3. Seamless Integration with Existing Accounts:

Allow single sign-on (SSO): Enable customers to use their existing credentials to access the bill payment system, eliminating the need for multiple accounts.

Integrate with popular payment gateways: Offer a variety of secure payment methods, including credit cards, debit cards, eChecks, and mobile payment options.

4. Comprehensive Customer Support:

Provide clear contact information: Make it easy for customers to find contact information and get in touch with support staff.

Develop a comprehensive FAQ section: Address common questions and concerns proactively.

Offer multiple support channels: Provide support via phone, email, live chat, and social media.

5. Continuous Improvement and Feedback Mechanisms:

Implement user testing: Conduct regular user testing to identify usability issues and areas for improvement.

Collect customer feedback: Use surveys, feedback forms, and other methods to collect customer input and insights.

Iterative design: Continuously improve the system based on user feedback and performance data.

The Future of Online Bill Payment: Innovation and User-Centricity

The future of online bill payment lies in embracing innovation and user-centricity. Several trends are shaping the landscape:

-

Artificial Intelligence (AI)-powered chatbots: AI-powered chatbots can provide instant support and resolve simple queries, reducing the burden on human customer service agents.

-

Personalized bill payment experiences: Tailored payment reminders, customized payment options, and personalized dashboards enhance user experience.

-

Increased use of mobile payments: Mobile payments are becoming increasingly popular, offering convenience and accessibility.

-

Blockchain technology: Blockchain technology can enhance security and transparency in bill payment processes.

-

Open banking initiatives: Open banking initiatives enable secure data sharing between banks and bill payment providers, streamlining the payment process.

Conclusion: Prioritizing the Customer Experience

Addressing the complaints of customers who find online bill payment complicated requires a concerted effort from businesses to prioritize user experience. By implementing the best practices outlined in this article, companies can create more intuitive, efficient, and secure online bill payment systems. This will not only improve customer satisfaction but also foster loyalty and enhance the overall brand image. Ultimately, focusing on a user-centered design philosophy is not just a matter of convenience; it's a strategic imperative for success in today's competitive marketplace. The investment in improved usability and a streamlined payment process will yield significant returns in the form of happier customers, increased efficiency, and reduced operational costs. The era of complicated online bill pay should be a thing of the past. The future is seamless, secure, and user-friendly.

Latest Posts

Latest Posts

-

When A Company Receives An Interest Bearing Note Receivable It Will

Mar 30, 2025

-

Classify Each Substituent As Electron Donating Or Electron Withdrawing

Mar 30, 2025

-

Levine Company Uses The Perpetual Inventory System

Mar 30, 2025

-

The Balance In Discount On Bonds Payable

Mar 30, 2025

-

Choose The Best Lewis Structure For Icl5

Mar 30, 2025

Related Post

Thank you for visiting our website which covers about A Customer Complains That Paying Her Bills Online Is Complicated . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.