The Balance In Discount On Bonds Payable

Holbox

Mar 30, 2025 · 6 min read

Table of Contents

- The Balance In Discount On Bonds Payable

- Table of Contents

- The Delicate Balance: Understanding and Managing Discounts on Bonds Payable

- What are Bonds Payable?

- Understanding Discounts on Bonds Payable

- Causes of Discounts on Bonds Payable

- Accounting for Discounts on Bonds Payable

- 1. Straight-Line Amortization

- 2. Effective Interest Amortization

- Impact of Discounts on Financial Statements

- Managing Discounts on Bonds Payable

- The Importance of Accurate Amortization

- Long-Term Implications and Strategic Considerations

- Conclusion: Striking the Right Balance

- Latest Posts

- Latest Posts

- Related Post

The Delicate Balance: Understanding and Managing Discounts on Bonds Payable

Bonds payable are a crucial long-term financing tool for many businesses, offering a way to raise significant capital. However, understanding the nuances of bond issuance, especially the impact of discounts, is critical for maintaining accurate financial reporting and effective financial management. This comprehensive guide delves deep into the complexities of discounts on bonds payable, exploring their causes, accounting implications, and strategies for effective management.

What are Bonds Payable?

Before diving into discounts, let's establish a foundational understanding of bonds payable. Essentially, a bond is a formal debt instrument issued by a corporation (or government entity) to borrow money from investors. These investors become bondholders, lending the company a specified amount for a predetermined period, receiving regular interest payments (coupon payments) and the principal amount at maturity.

The terms of the bond, including the face value (par value), coupon rate, maturity date, and call provisions (if any), are all detailed in the bond indenture – the legal contract governing the bond.

Understanding Discounts on Bonds Payable

A discount on bonds payable arises when a company issues bonds at a price below their face value. This happens when the market interest rate (yield to maturity) is higher than the stated coupon rate offered by the bond. Investors demand a higher return to compensate for the risk associated with the bond, leading them to pay less for it upfront.

Think of it this way: Imagine you're selling a $1,000 bond with a 5% coupon rate, meaning you'll pay $50 annually. However, comparable bonds in the market are offering a 7% yield. Investors will only buy your bond for less than $1,000 to achieve the equivalent 7% return. The difference between the face value and the issuance price is the discount.

Causes of Discounts on Bonds Payable

Several factors contribute to the occurrence of discounts on bonds payable:

-

Higher Market Interest Rates: This is the most prevalent reason. If prevailing interest rates rise after a company sets its coupon rate, the bond becomes less attractive, resulting in a lower issuance price.

-

Credit Risk: Investors perceive a higher risk of default (the company failing to repay the bond). This risk translates to a lower price for the bond to compensate for the potential loss.

-

Bond Features: Unfavorable features like restrictive covenants or call provisions (allowing early redemption by the issuer) can make a bond less appealing, leading to a discount.

-

Economic Conditions: During economic downturns, investors are more risk-averse, demanding higher yields and driving down bond prices.

-

Company's Financial Health: If a company's financial standing is perceived as weak, investors will demand a higher return, leading to a discount.

Accounting for Discounts on Bonds Payable

The discount on bonds payable is not simply an expense; it's an amortization that gets gradually recognized over the bond's life. This means the discount is systematically written off over time, increasing the interest expense reported each period. There are two primary methods for amortizing the discount:

1. Straight-Line Amortization

This method is simpler but less accurate. It allocates an equal portion of the discount to each interest period. The formula is:

Annual Amortization = Total Discount / Number of Years to Maturity

While straightforward, this method doesn't reflect the changing time value of money and can lead to slight inaccuracies in the interest expense reported.

2. Effective Interest Amortization

This method is the more accurate and generally preferred approach (often required under GAAP). It calculates interest expense by multiplying the carrying value of the bond (the face value minus the unamortized discount) by the effective interest rate. The difference between the interest expense calculated using the effective interest rate and the coupon payment represents the amortization of the discount for that period.

Interest Expense = Carrying Value × Effective Interest Rate

Amortization of Discount = Interest Expense - Coupon Payment

The effective interest rate is the market rate at the time of issuance. This method aligns with the time value of money, providing a more precise reflection of the interest cost over the bond's life.

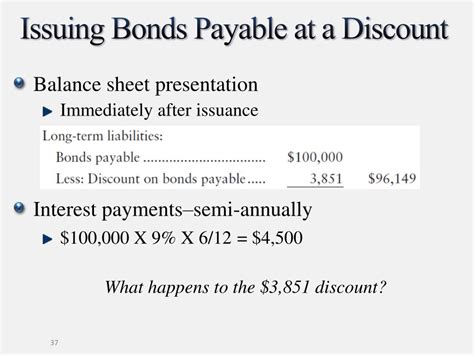

Impact of Discounts on Financial Statements

Discounts on bonds payable affect several key financial statement line items:

-

Balance Sheet: The carrying value of the bonds payable (face value less unamortized discount) is reported as a liability. The unamortized discount is presented as a contra-liability account, reducing the reported value of the bonds payable.

-

Income Statement: The interest expense reported each period reflects the coupon payment plus the amortization of the discount. This increases the total interest expense recognized over the life of the bond compared to what would have been recognized if the bonds were issued at par.

-

Cash Flow Statement: Coupon payments are reported as cash outflows under financing activities.

Managing Discounts on Bonds Payable

Effective management of discounts requires proactive strategies:

-

Careful Consideration of Coupon Rate: Setting a coupon rate that aligns with prevailing market interest rates minimizes the risk of a significant discount. Thorough market research is crucial.

-

Strong Financial Health: Maintaining a strong financial position reduces the perceived risk of default, making bonds more attractive to investors.

-

Transparency and Communication: Open communication with investors about the company's financial performance can build confidence and reduce the likelihood of a discount.

-

Effective Debt Management: Implementing a well-structured debt management strategy helps to minimize interest costs and maintain a healthy capital structure.

-

Regular Monitoring and Analysis: Continuously monitor interest rate trends and the company's financial health to anticipate potential challenges and make necessary adjustments.

The Importance of Accurate Amortization

The accurate amortization of discounts is crucial for several reasons:

-

Compliance: Accurate amortization ensures compliance with generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS).

-

Financial Reporting: Accurate reporting provides stakeholders with a true picture of the company's financial position and performance. Misstated interest expense can distort key financial ratios.

-

Tax Implications: Interest expense is deductible, and accurate amortization ensures the correct tax deduction is claimed.

-

Financial Planning: Accurate amortization enables better financial planning and forecasting by providing a reliable estimate of future interest expense.

Long-Term Implications and Strategic Considerations

Discounts on bonds payable are not simply accounting entries; they carry significant long-term implications for a company's financial health and strategic positioning. A substantial discount can signal underlying problems like poor creditworthiness or market perception. Conversely, successfully managing a bond issuance, even if slightly discounted, demonstrates a company's ability to access capital markets favorably.

The long-term effects extend to investor relations. Consistent performance and transparency in financial reporting help maintain investor confidence, potentially leading to more favorable financing terms in future issuances.

Companies need to view bond issuance and discount management as a continuous process intertwined with their overall financial strategy. Regular review of the bond portfolio, analysis of market conditions, and proactive adjustments to financial policies contribute to maintaining a sustainable and healthy capital structure. Moreover, understanding the impact of discounts on key financial metrics like debt-to-equity ratio and interest coverage ratio is essential for informed decision-making.

Conclusion: Striking the Right Balance

The balance in discount on bonds payable represents a delicate equilibrium between raising capital cost-effectively and ensuring financial stability. By comprehending the causes of discounts, applying accurate accounting methods, and employing proactive management strategies, companies can effectively navigate this aspect of corporate finance and ensure long-term financial success. Understanding the implications for financial statements and long-term planning is paramount. This comprehensive approach allows businesses to harness the power of bonds payable while minimizing the potential negative impacts of discounts. Careful planning, effective management, and consistent monitoring are vital to navigating this crucial aspect of corporate finance successfully.

Latest Posts

Latest Posts

-

Locking Out Tagging Out Refers To

Apr 01, 2025

-

When Society Requires That Firms Reduce Pollution There Is

Apr 01, 2025

-

Generally Accepted Accounting Principles Gaap Wants Information To Have

Apr 01, 2025

-

Which Of These Statements Is True

Apr 01, 2025

-

An Increase In Product Price Will Cause

Apr 01, 2025

Related Post

Thank you for visiting our website which covers about The Balance In Discount On Bonds Payable . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.